via Zerohedge:

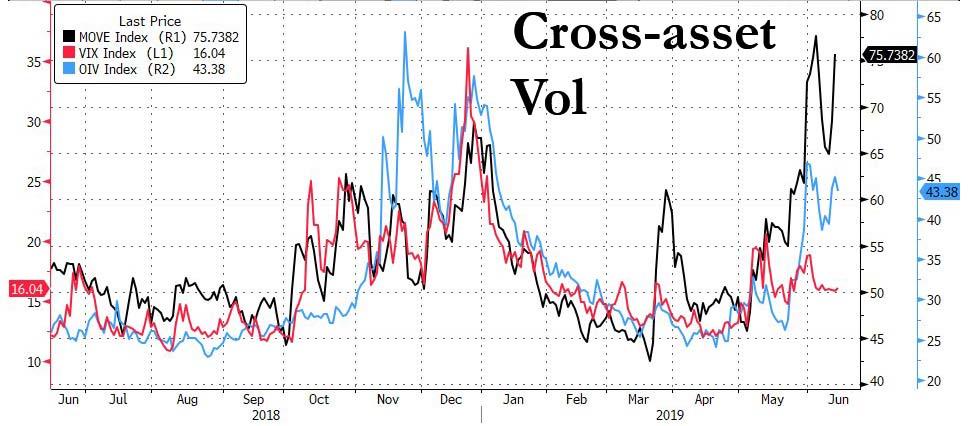

Earlier today we demonstrated that while both rate and commodity vol is spiking, in the case of bonds even surpassing the December 2018 peak (much to the delight of Jeff Gundlach), equities remain suspended in a cloud of bizarre calm, with the VIX simply refusing to drift higher.

That will, however, change with a vengeance next week, when two of the year’s most important events take place – the FOMC decision in which the Fed may signal (or outright effectuate) the start of a rate cut cycle, as well as the greatly anticipated G-20 meeting where Trump and Xi may (or may not) meet and resolve (or fail to do so) the escalating trade war between the two superpowers.

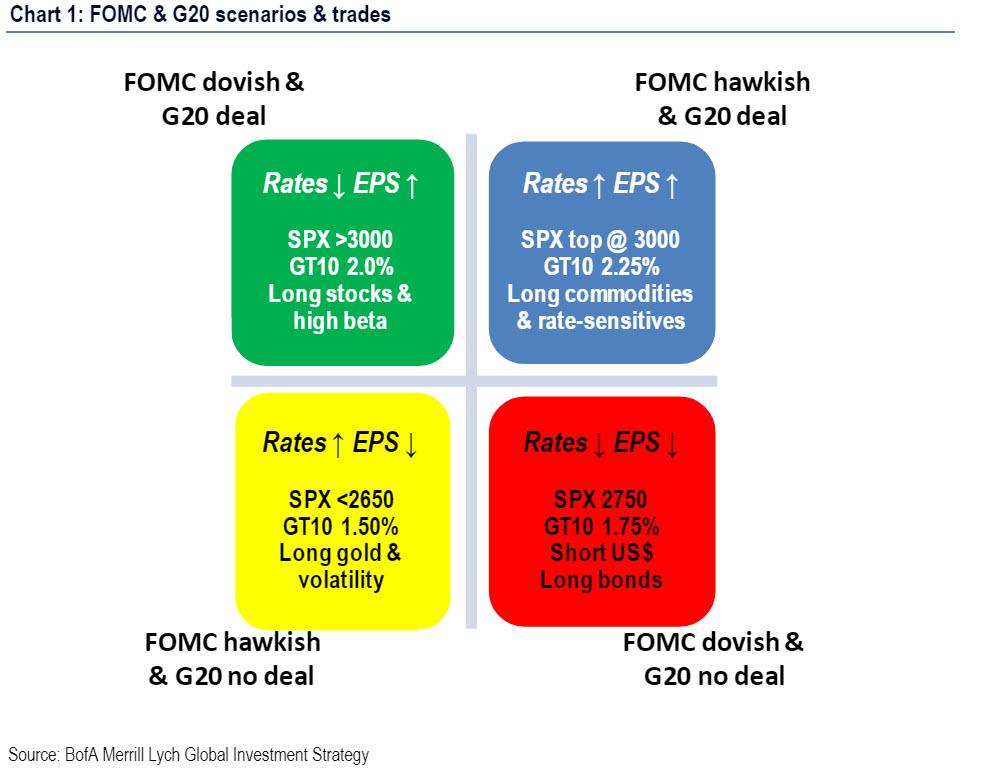

And since there are two events, both of which have binary outcomes, there is a total of 4 possible scenarios, which have been qualified and quantified by BofA’s CIO Michael Hartnett. Of these 4, two are most remarkable: the best/best and the worst/worst cases. The first one sees a Dovish Fed statement, coupled with a G-20 deal, which according to BofA will send the S&P > 3000, and the 10Y yield to 2.00%, while the worst possible outcome would be if there is a 1) a hawkish Fed surprise and 2) no Deal at the G-20, which would send the S&P below 2,650, or potentially resulting in a 12% drop in the market, while sending 10Y yields to 1.50%and pushing gold above its 5 year breakout zone as the VIX surges.

The

In other words, and this should come as no surprise, the fate of the market next week is dependent on binary outcomes in the only two areas that matter i) policy and ii) trade wars. Hartnett frames the current tensions as follows:

- On policy: “markets stop panicking when policy makers start panicking“…past 10-years policy makers have driven rates lower & risk assets higher (in 2018 rates hiked & risk assets slumped)… we say credit & stocks higher until Big Top signaled by a. policy ammunition spent or bank policy impotence; Australia bond yields (all-time low) & stocks (all-time high) an example how rates can conquer all.

- On trade wars: US trade wars are a cyclical policy response to rising inequality and populist desires for redistribution (tariffs are Trump’s favored policy tool for this economic objective); in addition, the US-China tech war is a long-run clash for global hegemony in tech & military supremacy and is unlikely to be resolved soon; G20 may or may not result in escalation of tariffs (see FOMC/G20 scenarios, outcome probabilities & trades below), but Huawei indicates there may be “no tech peace in our time”;we continue to believe investors need to discount investment consequences of both the War on Inequality, and shift from bullish disinflation via tech disruption to potential bearish stagnation via disruption of global tech.

Needless to say, with no quick resolution expected in trade war, and the Fed’s decision in turn a function of trade war escalation, one can see why traders are perplex, if not paralyzed ahead of next week’s “black box” decisions.

In addition to the pure “best” and “worst” case scenarios, discussed above, Hartnett envisions two more possible intermediate outcomes – i) a G-20 deal but no Dovish Fed, which would result in an S&P top at 3,000 (which the market will hit relative soon, then reverse and slide for the duration of the second half), with 10Y yields rising to 2.25% and upside to commodities, and ii) a dovish Fed, but no G-20 deal. This in turn would lead to a drop in the S&P to 2,750 and 10Y yields sliding to 1.75%, while also hammering the USD.

Below is the full breakdown from Hartnett on the four possible scenarios to result from next week’s critical events:

Scenario 1: FOMC dovish & G20 deal

- Rates down, EPS up

- GT10 2%, SPX >3000

- Big trade: long stocks & high beta assets

- Likely outperformers: small cap (e.g. IWM), semiconductors (e.g. SMH), industrials (e.g. IYJ), EM bonds (e.g. EMB)

- Likely underperformer: staples (e.g. XLP)

Scenario 2: FOMC hawkish & G20 deal

- Rates up, EPS up

- GT10 2.25%, SPX top at 3000

- Big trade: long commodities & rate-sensitive assets

- Likely outperformers: banks (e.g. XLF), materials (e.g. IYM), EAFE (e.g. EFA)

- Likely underperformers: REITS (e.g. REET), utilities (e.g. XLU)

Scenario 3: FOMC dovish & G20 no deal

- Rates down, EPS down

- GT10 1.75%, SPX 2750

- Big trade: short US dollar, long bonds

- Likely outperformers: Treasuries (e.g. TLT), IG bonds (e.g. LQD), REITS (e.g. REET), utilities (XLU), China (e.g. FXI)

- Likely underperformers: US$, banks (e.g. XLF), materials (e.g. IYM), EAFE (e.g. EFA)

Scenario 4: FOMC hawkish & G20 no deal

- Rates up, EPS down

- GT10 to 1.5%, SPX <2650

- Big trade: long gold, long volatility

- Likely outperformers: T-bills, gold (e.g. GLD)

- Likely underperformers: IG bonds (e.g. LQD), US & EM tech (e.g. IYW, EMQQ), software (e.g. XSW).