If any of you are long USO, you might want to get out NOW!

Update (0855ET): USCF has suspended the creation process for its USO baskets…

In the Form 8-K filed on April 20, 2020 (“April 20 Form 8-K”), United States Oil Fund, LP (“USO”), indicated that it would announce through a current report on Form 8-K when USO has determined to temporarily suspend the issuance of additional Creation Baskets. Today, USO issued all of its currently remaining registered shares. The registration statement that USO filed on April 20, 2020 with the Securities and Exchange Commission (“SEC”) to register an additional 4,000,000,000 shares has not been declared effective. As a result, USCF management is suspending the ability of the USO Authorized Purchasers to purchase new creation baskets until such time as the new USO registration statement for the additional shares has been declared effective by the SEC. The ability of Authorized Purchasers to redeem Redemption Baskets during the suspension of the sale of Creation Baskets will remain unaffected. In addition, trading of USO shares on the NYSE Arca, Inc. will not be discontinued as a result of the suspension of sales of Creation Baskets.

USO will issue a subsequent current report on Form 8-K to announce the effectiveness of the above-mentioned registration statement offering the additional, new shares as well as USO’s ability to resume offering Creation Baskets to its Authorized Purchasers.

In English that means the managers are basically transforming USO into a closed-end fund, and a ForexFlowLive notes, they are basically freezing new trades and probably going into management (or damage limitation) mode.

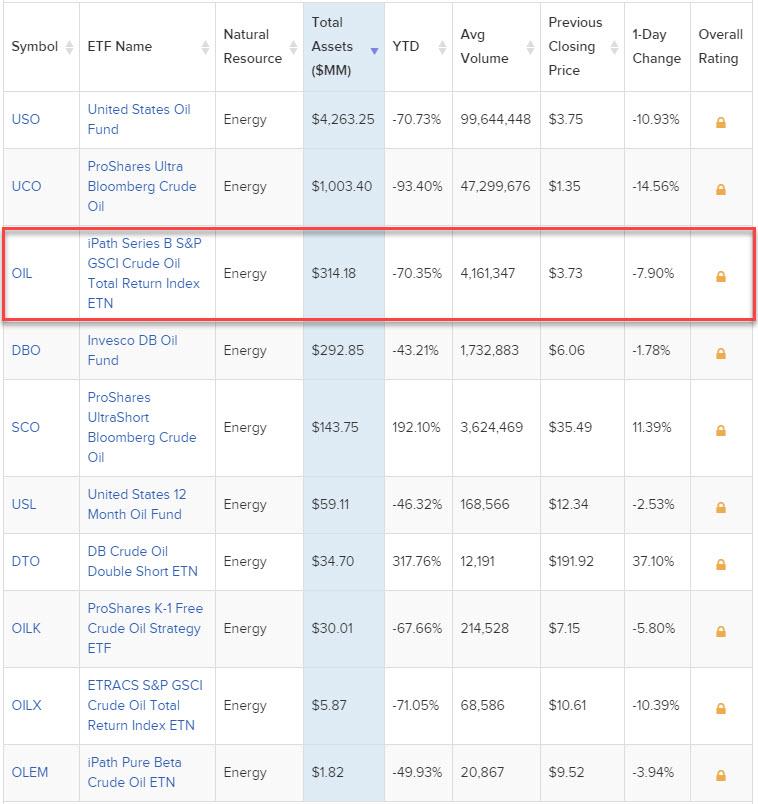

Third largest oil ETN being liquidated.

Having seen its share of gratuitous use over the years, now may be the best time ever to pull up the infamous Martha Stewart tweet:

OiI

— Martha Stewart (@MarthaStewart) April 22, 2013

The reason is that while the largest crude oil ETF, the USO, which had just over $4.2 billion in assets as of yesterday has avoided liquidation for now, and instead converted itself into a close-end fund by suspending the sale of creation baskets, one of its biggest peers failed to avoid collapse after oil prices plunged to negative for the first time ever, and on Tuesday morning, Barclays announced that it would “exercise its issuer call option” and redeem in full the “OIL” Crude Oil ETN, which is the third largest oil-related ETF (second if one ignores the UCO which is a 2x levered USO).

Needless to say, the fund has seen better days…

… and now all those who lost about 80% of their investment in the past few weeks, well they are now getting a few pennies on their dollar.

So what happens next? Barclays – who suckered in thousands of retail investors and is now giving them a small portfion of their investment as it closes up OIL shop – explains.

https://www.zerohedge.com/commodities/third-largest-oil-etn-liquidating