Although the stock market fell sharply last year during the Coronavirus crises, it quickly rose again after governments offered support to businesses to help the economy get back on its feet. The big question, however, is how the stock market will react to a possible end to the corona crisis that we can hopefully see this year. Even if the future on the market seems uncertain, here are some interesting insights into possible future investments in 2021.

Our stock trends for the future year 2021

It can be assumed that the year 2021 will bring with it many important events that will have a major impact on the stock market – above all, hopefully the long-awaited end of the corona pandemic.

Equity trend: Big Data & Artificial Intelligence – Digital Revolution

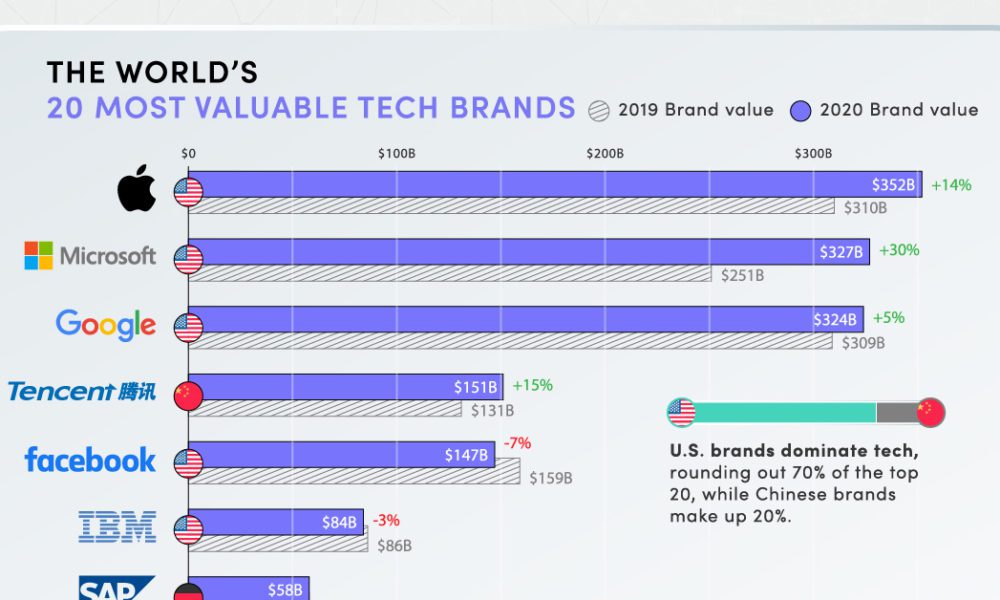

In recent years, the fantasy stock in particular has made a very big name for itself. Since the advent of the Internet, fantasy stocks have by far embodied the most successful companies on the market and have overtaken all established companies in a relatively short time. There are five tech companies standing at the top today. Everyone knows these so-called Big 5 , since they are Amazon, Apple, Facebook, Google and Microsoft. But do these huge corporations still have a chance of growth?

In recent years, the Big 5 have always been at the forefront when experts talked about the most profitable and best stocks of the year. In 2020, of course, these companies also experienced a significant loss in value as a result of the Corona crash. However, the tide seemed to be turning again quickly for the Big 5: Amazon grew by 20% in 2020 and Facebook even achieved sales growth of a strong 28%. This shows that these huge companies can withstand a crash and crisis and that they also have growth potential for the future.

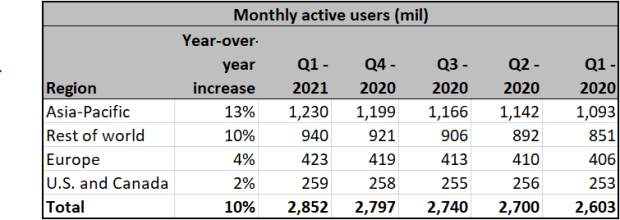

A look at Facebook’s geographic segments shows the future path to growth for this company pretty clearly.

We therefore take the position that there are good chances of making money on the stock market with the Big 5 in 2021 as well. However, there are also some aspects that must be taken into account here that the Big 5 will face in 2021. For example, 4 of the Big 5 are suspected of having misused data and have therefore been checked for a long time. Negative results of these investigations can of course have a serious impact on the company. In the USA there are already voices that fear a monopoly of a large corporation and therefore demand, for example, a split from Amazon. Because of this, the political situation in 2021 is arguably the biggest concern for investors in the Big 5.

Another big trend that is continuing is artificial intelligence . In this area, computer programs are developed that are able to solve problems independently and thus have their own kind of intelligence. These programs now sometimes learn independently, so that in the future large parts of the economy could be completely taken over by these programs. The Google subsidiary Deep Mind is working on the artificial intelligence AlphaZero, which, after a short training period, was able to defeat various professionals and software that has been established for decades in the strategy games chess and go. The fact that this still seemed unthinkable to many five years ago shows how quickly the field of artificial intelligence is developing.

Data analysis is becoming more and more important

You are probably aware that user data is monitored in many places on the Internet. The data scandal in which Facebook found itself shows that the data of all users is being monitored and that Facebook is selling it to third parties. This enables Facebook to display targeted advertisements that target the interests of the person. This has been a common practice for years and has been used almost universally.

Another big impact on the economy in 2021 will be social media platforms . Social media was already one of the driving factors on the market last year, as many people had to make an effort to socialize because of lockdowns in front of the screens. Almost everyone now uses at least one social media platform every day. The first predictions for 2021 assume that a user will spend an average of four hours per day on the smartphone. It is therefore becoming more and more interesting for companies to address customers via these channels because they spend so much time with them.

Alternatives to the Big 5

MongoDB is an alternative to the global players in the stock game. The company has already positioned itself as one of the stock market leaders in the field of open source platforms, so that the company has already won over many large customers for its software. With a growth of 170%, MongoDB exceeded expectations in terms of revenue growth and price value.

Stock Battle is also a game-changer that is new to the market. This game of skills is built on Fantasy Sports mechanics and based on real-time interplay with the stock market using Nasdaq data.

Each player creates a virtual portfolio of stocks without owning any real shares. A player’s place is determined by his portfolio growth rate while playing in 5, 15, 60-min games. Participants compete for cash prizes and social bragging rights.

Splunk is another player in this game of skills who, like Microsoft, offers solutions to process data more efficiently and quickly. In 2020, however, the company had to post some losses and did not achieve the forecast growth numbers. A company-wide restructuring is currently taking place in order to be able to offer its own service as cloud-based software. We forecast a sharp rise in the value of Splunk in 2021 if this move is successful.

Lastly, we’re looking at Elastic, a Dutch company with a focus on technologies that make it easier for companies to find important data and thus increase customer productivity. The company was able to increase its sales by 43% last year, exceeding analysts’ expectations. The experts also expected a loss of around 20 cents per share in 2020 – but this will only amount to 3 cents per share. We are convinced that the first year in which Elastic posted a profit is accompanied by a sharp jump in the market value.

Disclaimer: This content does not necessarily represent the views of IWB.