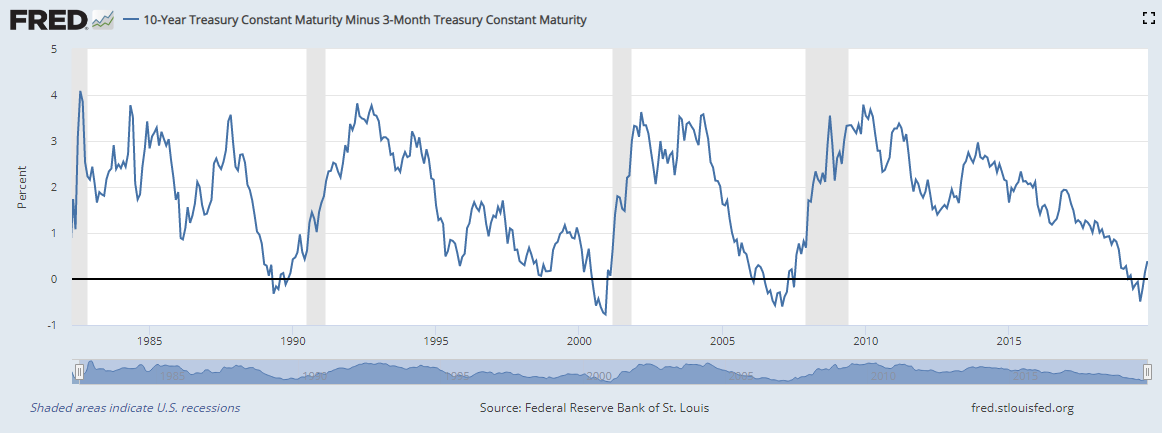

The yield curve going back to normal is almost certainly an extremely bearish sign. It always reverts to normal beforea recession hits, often merely months ahead.

The yield curve going back to normal is almost certainly an extremely bearish sign. It always reverts to normal beforea recession hits, often merely months ahead.

https://fred.stlouisfed.org/graph/?g=ptQw

“After the first intraday inversion on August 14th, we got a preview of the arguments that would be used to explain away the yield curve’s signal: a deeply negative term structure, central bank balance sheets, deflation, demographics, etc. History shows that investors will likely be convinced by at least one of these assertions. Equities will continue to move higher, the curve will probably revert and data will improve. These are especially likely if we get a temporary reprieve from trade tensions. But the curve has inverted five times since the late 1970s—and each time a recession started an average of 20 months later. Make no mistake, a recession will eventually come. ”

https://www.blackstone.com/insights/article/joe-zidle-this-time-isn’t-different

Enough’s enough.

Fresh 50-year low in the commodities-to-equities ratio.

The next monetary & fiscal experiment will come at a cost.

Major cyclical turn in this ratio likely ahead. pic.twitter.com/gIKtpdp1KB

— Otavio (Tavi) Costa (@TaviCosta) November 8, 2019

Bloomberg: This Is Why The Repo Markets Went Crazy And Why December Could Be Even Worse.

Every week, hosts Joe Weisenthal and Tracy Alloway take you on a not-so-random walk through hot topics in markets, finance and economics.

Back in September, chaos erupted in short-term funding markets, as the cost for financial institutions to borrow reserves soared. Immediately a major debate broke out over whether this represented a systemic problem for the financial system or merely a technical problem with the “plumbing.” Things have quieted down since September, but the debate hasn’t stopped. And there’s still no permanent fix.

On this week’s Odd Lots podcast, we spoke with Zoltan Pozsar of Credit Suisse, who has a reputation for understanding the mechanics of these funding markets better than anyone else in the world. He broke down what really happened, and why we could see more craziness as soon as next month.

h/t MetricT