So, will it be stagflation after all?

It is already clear that inflation has entered the financial system. Those who claim that this cannot be true because Treasury bonds aren’t showing it fail to mention that Treasury bonds are the most manipulated asset class on the planet.

After all, it’s rather difficult to argue that Treasury bonds can discount or measure much of anything when the Fed is spending over $1 trillion buying them every year. Technically, all they are reflecting is what $1 trillion worth of Fed asset purchases can get you in terms of manipulation.

Meanwhile, we are getting signs of inflation everywhere.

- Capri, which owns Michael Kors, Versace and other fashion brands just announced it will be raising prices “considerably.”

- Chipotle is raising prices 4% to cover increased labor costs.

- Proctor & gamble which manufactures consumer goods like Gillette razors and Tide detergent announced it will be raising prices in September.

- General Mills, which produces cereals like Cheerios announced inflation costs are up 7% this year.

- Whirlpool which manufactures appliances ranging from refrigerators to dryers and washers will raise prices by 12% to offset inflation. It says inflation could cost the company $1 billion this year.

And on and on.

So, we know inflation is here. The question now is whether or not the economy will continue to strengthen or roll over creating a 1970s’-style stagflation.

It now appears it might be the latter as three stock market sectors with close ties to the real economy show us.

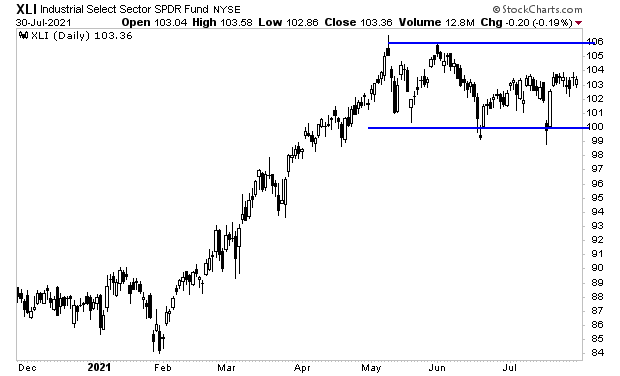

First and foremost are Industrials (XLI). These are companies that either produce actual things like tractors, cranes, HVAC systems, etc. or that are involved in real economic activity (mail/shipping). As such, they represent a good gauge of how strong the real economy is doing: during economic expansions these businesses receive more orders.

XLI has gone nowhere since late-April. And this is despite the prospect of a multi-trillion infrastructure bill from the federal government and $120 billion in QE from the Fed.

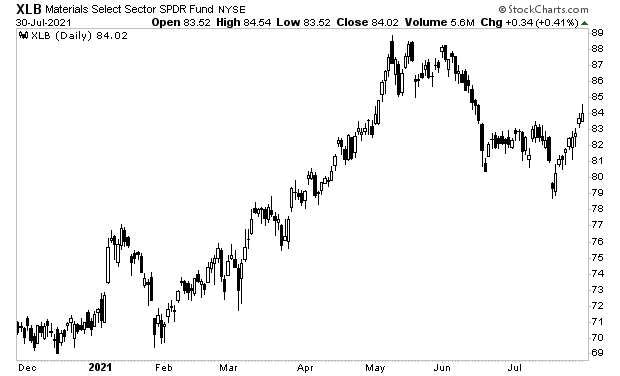

Next up are Materials (XLB). These are companies involved in producing things like concrete, copper, steel and the like. During economic expansions these companies receive more orders as they are the primary suppliers of commodities needed for construction, manufacturing and the like.

Here again the chart is odd given the macro backdrop. The Biden administration is hoping to sign a $1.2 trillion infrastructure bill sometime in the next few weeks, and yet, XLB is 5% off its highs. Indeed, you could easily argue that the only reason XLB didn’t collapse last week was the prospect of this infrastructure bill.

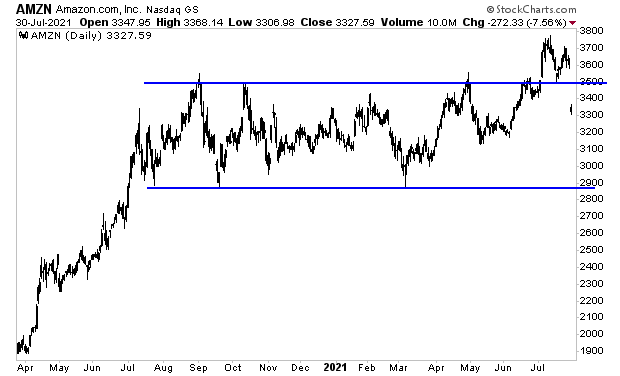

Finally, we have Amazon (AMZN).

The consumer accounts for 75% of the U.S. economy. As the largest online retailer in the U.S., AMZN presents a great window into consumer spending.

After disappointing results for 2Q21, AMZN shares collapsed. They have now gone nowhere since July of 2020. This is NOT what you would expect from a raging economy.

So, inflation is here… and the economy appears to be rolling over. That would mean a stagflationary environment… which would be the absolutely WORST environment for the massive fake bubble the Fed has created.

With that in mind, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the general public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research