At this juncture factors point to a crash being much more likely than usual, or at least a strong and persistent decline. Lets look at some reasons why…

In a January post, I ran over some of the reasons why the US stock market was historically overbought, overvalued and overbullish. That was posted at a peak in the main US averages but they rallied to a new high over the summer.

However most stock indexes diverged from the Dow, S&P and Nasdaq. The NYSE composite, which includes all stocks on the NYSE topped in January, as did the Shanghai Composite, MSCI AC world index and Eurostoxx 50 (all well down this year).

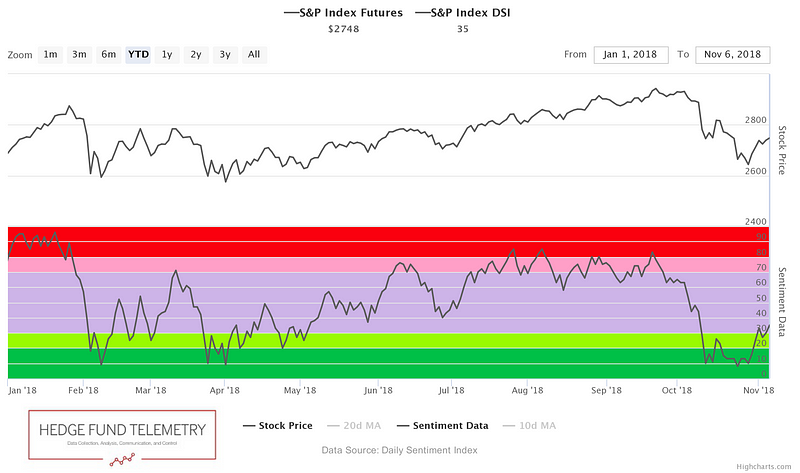

The October decline didn’t produce much if any in the way of fear and panic. VIX, the volatility index stayed fairly muted and the media were nonchalant about the decline. The daily sentiment index hit extreme levels of bearishness at the bottom, which is normal. It recovered to 50% on November the 7th, so that oversold condition has been worked off.

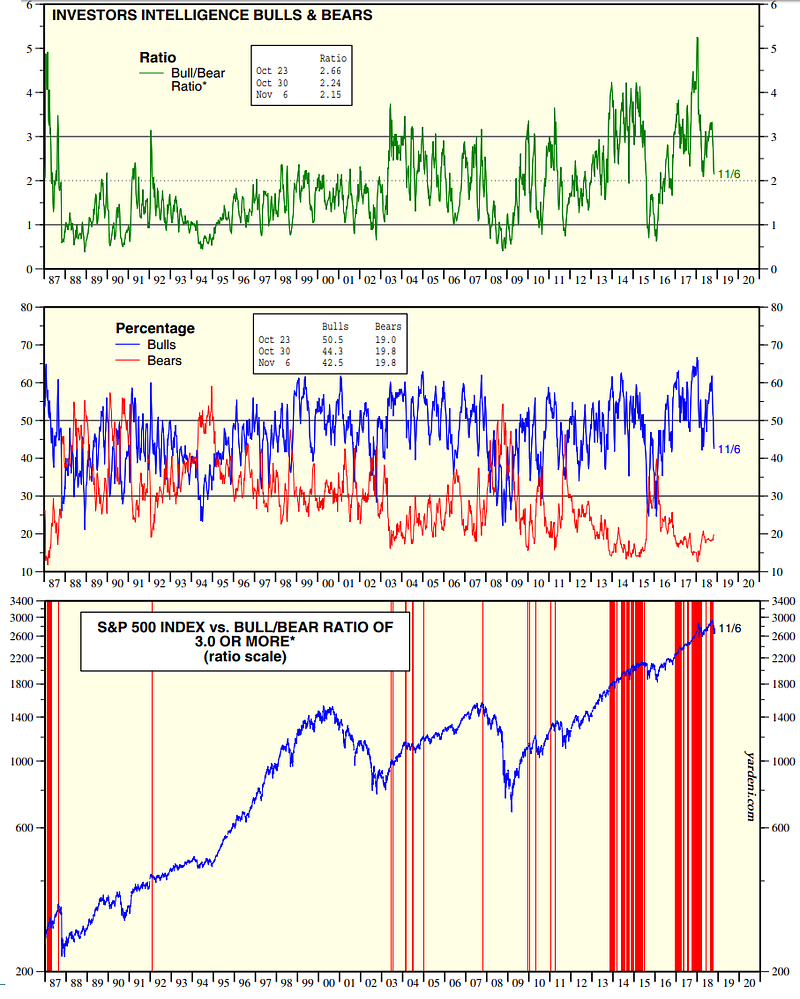

There has barely been any uptick in bearishness since the October decline according to Investors Intelligence, which is a weekly indicator. Also note the extreme persistent bullishness for the last 2 years. You can see the period preceding the 1987 crash at the start of the chart.

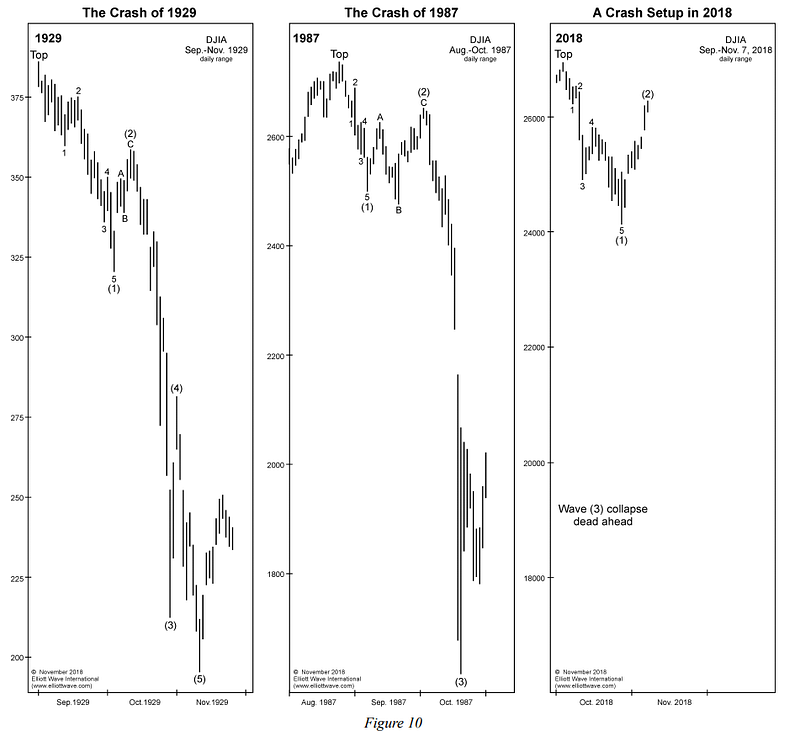

September/October has a tendency to produce strong declines. October was just the ticket. If you compare the current juncture to the 1929 or 1987 crashes (as the Elliott Wave Theorist did) the patterns are similar but time wise this one is running one month later than the 29/87 crashes (presuming a crash occurs in the same way).

Looking back at that post I made in January, I made some other predictions for the new bear market. It seems various markets are moving in a way consistent with the emerging deflationary environment.

I said gold “is probably still in a secular bear now and that will resume with the crash”. Gold declined over the summer and looks oversold in the medium term.

I was bearish on Cryptocoins, at the peak in January the total market cap was $820bn, it’s now down to $213bn.

I said Oil would crash in the bear market, Oil peaked with stocks at the start of October and is plummeting, now over 20%.

I predicted the dollar would rally, not a popular opinion but it has rallied strongly since February. Short term it might be overbought (for example according to the daily sentiment index) but the dollar will likely do well in a risk-off environment, so its possible this doesn’t matter too much.

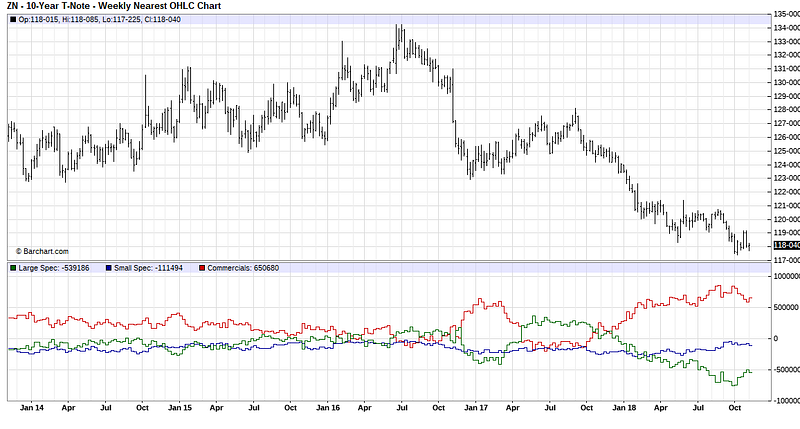

On US government bonds I thought they could benefit from a flight to safety as some point within their continuing bear market. That point may be closer as the Commitment of traders shows hedge funds have taken a large position against T-notes and T-bonds. They are typically wrong at large turns. So this would mean yields declining, perhaps sharply if with a crash in the stock market. At the least this overbought condition should be worked off at some point before the bear market can make good progress again.

So that is what the markets look like right now. The boring stuff is nearly over and the Fun and Scary stuff will soon start.