by jessefelder

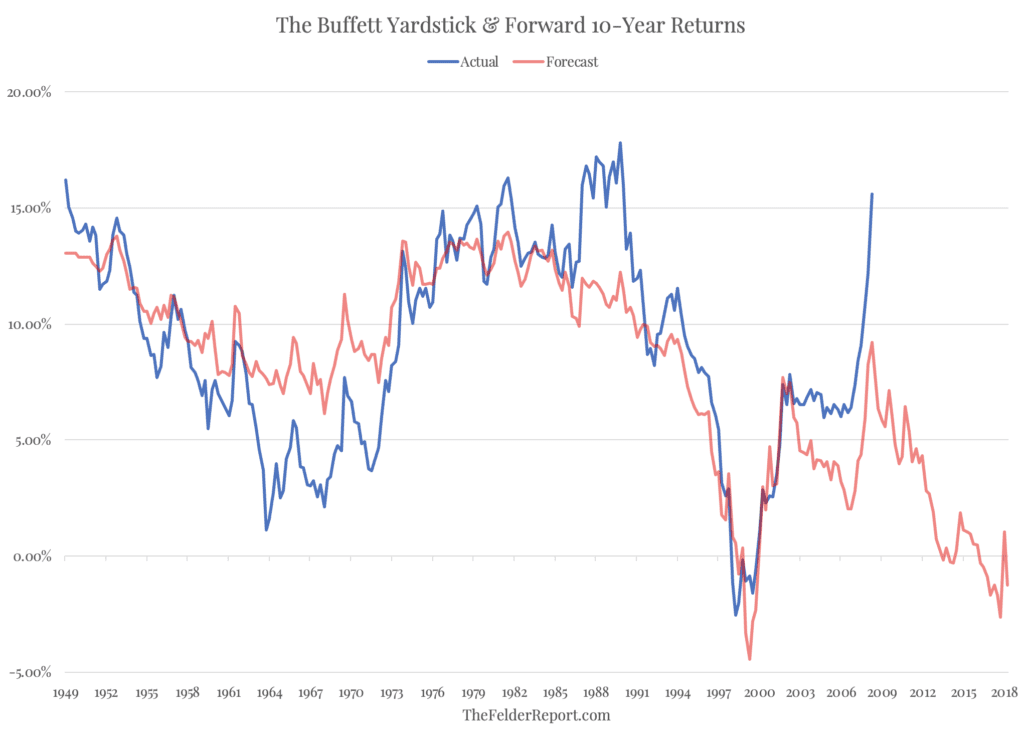

One of the indicators I started tracking several years ago was what I call “The Buffett Yardstick.” It plots the total value of the stock market against the overall size of the economy. As Warren wrote nearly 20 years ago, “it is probably the best single measure of where valuations stand at any given moment.” And the reason it is so valuable is that it is very good at telling you what to expect from equities over the coming decade.

The chart below plots “The Buffett Yardstick” (inverted) against forward 10-year returns in the stock market. This chart may be the single best visual representation of one of my favorite Buffett quotes: “The price you pay determines your rate of return.” Right now, according to this measure, investors are paying such a high price they are likely to receive essentially nothing in return over the coming decade, including dividends.

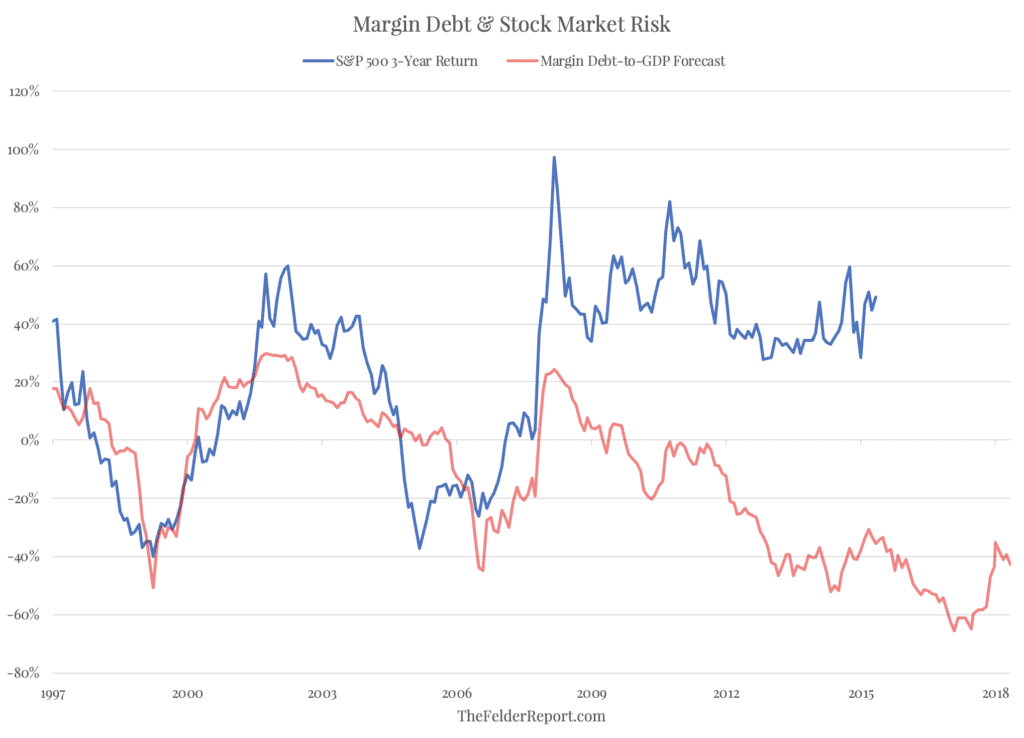

At the same time that potential returns look so poor, the potential for risk may be greater than it has been in generations. Warren also famously wrote, “Be fearful when others are greedy and greedy when others are fearful.” Determining when they are greedy and when they are fearful is the trick. While The Buffet Yardstick carries a sentiment message of its own, as John Kenneth Galbraith wrote in The Great Crash 1929, “Even the most circumspect friend of the market would concede that the volume of brokers’ loans—of loans collateraled by the securities purchased on margin—is a good index of the volume of speculation.” When investors are keen to add leverage via margin debt to their portfolios they are clearly greedy and vice versa.

Comparing this “index of the volume of speculation” to the size of the economy (inverted in the chart below), just as we did with equity values, shows it hitting a new record high over the past couple of years. In other words, investors haven’t been this greedy in many decades – since 1929, in fact. All of this leveraged speculation must at some point be unwound, usually via forced selling during a bear market. The last two times it came even close to the current level the stock market suffered 50% declines.

This is not to say that margin debt alone is capable of creating a 50% decline only that it indicates that investors are generally speculating to a degree that makes this sort of decline more probable. Because the recent peak in leveraged speculation relative to the economy surpassed the prior two it only stands to reason that it is possible the next decline in the stock market could be even deeper than those previous two. In all, long-term investors are risking roughly a 60% decline to try to capture a 0% rate of return over the coming decade in the stock market, one of the worst risk-to-reward setups in history.