For more- https://t.co/Ci4TLhaHHl

— Michael Lebowitz, CFA (@michaellebowitz) December 9, 2019

Repo Blowup Was Fueled by Big Banks and Hedge Funds, BIS Says

The September mayhem in the U.S. repo market suggests there’s a structural problem in this vital corner of finance and the incident wasn’t just a temporary hiccup, according to a new analysis from the Bank for International Settlements.This market, which relies heavily on just four big…

BIS saying there are numerous LTCM-type situations among hedge funds using repos to magnify leverage on micro arb TSY trades, all enabled by dealer repos. Explains why Fed has to flood the market with liquidityhttps://t.co/mGzP6dD7v2

— zerohedge (@zerohedge) December 9, 2019

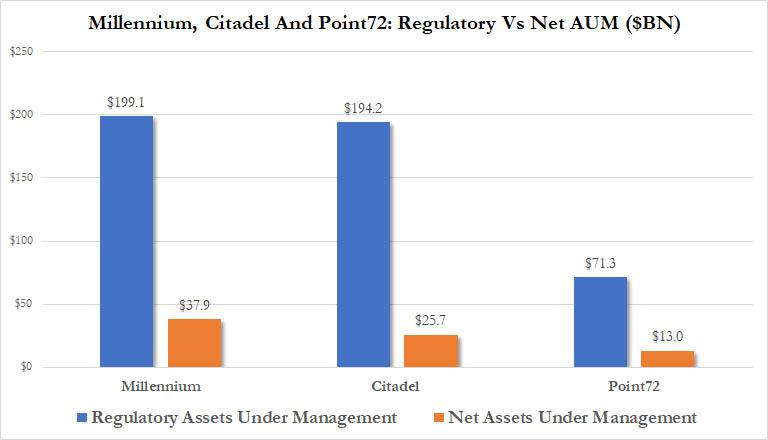

The BIS’s finding is novel, and surprising, as they highlight the “growing clout of hedge funds in the repo market” according to the FT, which notes something we pointed out one year ago: hedge funds such as Millennium, Citadel and Point 72 are not only active in the repo market, they are also the most heavily leveraged multi-strat funds in the world, taking something like $20-$30 billion in net AUM and levering it up to $200 billion. They achieve said leverage using repo.

This was huge, especially considering who it came from: the BIS themselves! The central bank of central banks. I’ve been covering this Repo Madness since it happened because it’s truly important. This is center stage and deserves attention. What do you think of this information?

Now Repo Distortions Emerge in Europe’s $9 Trillion Market: Bloomberg

The 8 trillion-euro ($9 trillion) market is becoming increasingly fragmented, according to the Bank for International Settlements. While this hasn’t caused harm yet, it raises the risk that cash may not flow through the system properly, BIS said in its quarterly review. That’s what caused chaos in the U.S. almost three months ago.

ig credit spreads turning up pic.twitter.com/8U5keyDIQe

— Alastair Williamson (@StockBoardAsset) December 9, 2019