Since I’ve spent a fair amount of time on the US stock market of late, I won’t say much. Just taking a moment to note September just finished its fourth consecutive week down (final full week), maintaining a downtrend that began as we rolled over from August into September.

Here you can see the weeks in blue and the overall downtrend of lower closing highs in red:

Toward the end of next week, we’ll step into October for a likely October surprise sometime in the month. September’s downturn was, just as anticipated, more bouncy with daily ups and downs than March’s plunge as the battle between the bulls and the bears plays out on a more protracted scale this time.

You can feel the breath of the bear

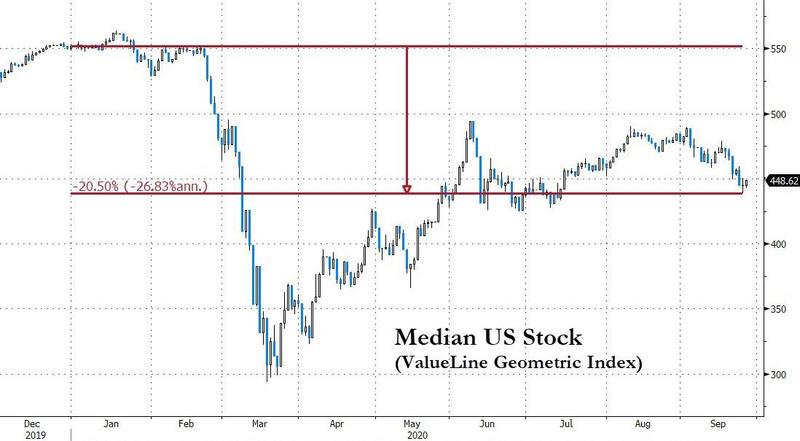

The overall market has already crashed into a bear market with the median stock price now back down more than 20%:

Bear markets are not technically determined, of course by how far the market’s median price has dropped but by the drop in the total value of major indices. Looking at the market based on drop in median price, however, cuts out the nonsense at the extremes to see how corporate stocks are really doing.

For an array of pictures showing how broader markets and indices are doing, I’m going to let others (one of whom is usually bullish) point out how the market is breaking down in the manner I indicated it would. I recommend this article on Seeking Alpha: “Danger: Bears Are All Around.” The thrust is that many smaller indices and measures already show bear markets. Another set of market internals, showing serious market deterioration, can be found here: “Market Internals Point Towards Further Selling.”

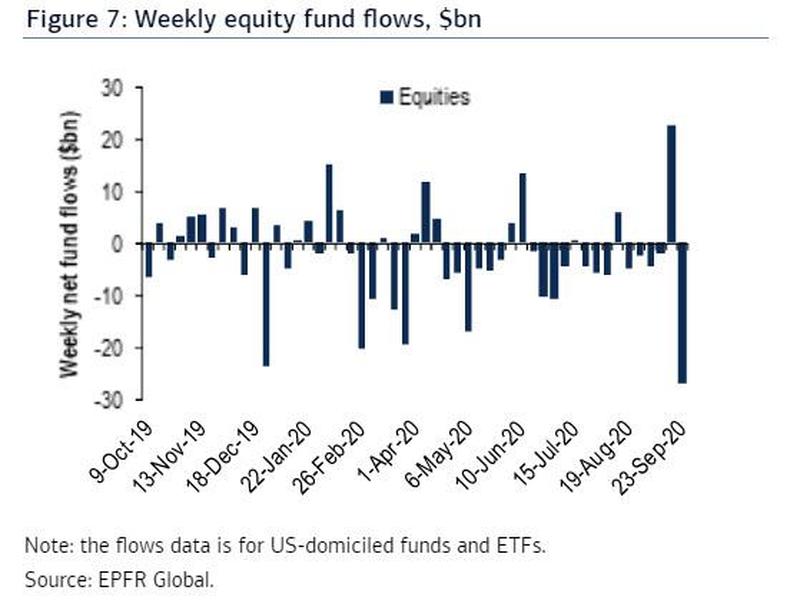

It’s interesting to note, too, how extreme net fund flows in and out of US stocks have swung from the August melt-up to September’s downfall:

The risk-off sentiment on Wall Street fueled the third-worst weekly outflow on record from U.S. equities, with technology shares falling out of favor … in a reversal from the previous week’s biggest inflow in more than two years. Investors exited the hottest sector of the rebound, pulling the most money out of tech funds since June 2019.

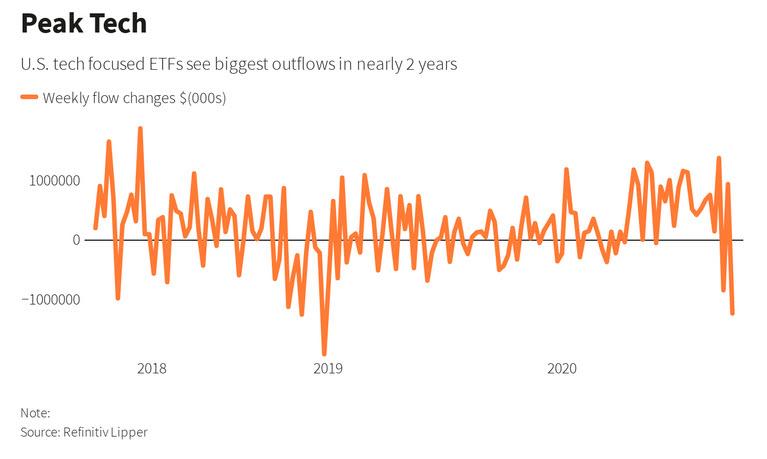

In a massive reversal, tech-focused ETFs led the plunge in fund outflows after trekking upward for months during the Coronacrisis melt-up when techs were the market rally leaders:

In a flight to haven assets, investors are pulling out of equities as well as cash to put their money into debt and gold.

Pottymouth Portnoy’s personal plunge

Millennial, bad-mouth, big-boy, blathering day-trader Davie Portnoy had another stock meltdown this week. You may remember how he carried on about how he could trust Tesla and Smith & Wesson to save him two weeks ago. Sounds like his demigods let him down this week, just as they did then, but he clearly has learned nothing from it: (Skip to the 3:00 mark if you can stand his seething-hot language because Davie is scorched now that stocks do not “always go up” for him.)

Davey Day Trader – September 23, 2020 https://t.co/UHl4V8cgEo

— Dave Portnoy (@stoolpresidente) September 23, 2020

Poor millennial melt-down Dave. Down around another quarter-million it sounded like … just on this bad week’s worst day. Good thing Friday cut him a little slack, or he would have died of a stroke over the coming weekend. Down, Down, Davie.

The market is still trending relentlessly down four weeks and running. Unless there is any extra-big news on stocks next week, I’m going to move back to focusing on the economy in general as stock action is likely to play out with ups and downs for a long time on this new downslope that slowly knocks the bulls senseless. No sense doing a play-by-play every week.

The market’s downfall has, however, been the truly big news for this month in terms of how I’ve anticipated this economic collapse will play out. It was one of the signs to watch for to see if the economic trends are holding as forecasted for the Epocalypse.

So far, so good … and yet so bad for so many.