Long term holders of gold have a different perspective of the world. They are not believers in instant gratification. Nor do they believe that a world based on money printing and debt can create sustainable wealth. They also know that the socialism which has spread like a plague in the Western world only works until you run out of other people’s money.

What makes gold the most obvious wealth preservation investment and insurance against a false financial system is its permanence. The proof of this is indisputable since gold is the only money that has survived for 5,000 years. Ephemeral financial systems and currencies come and go, so do empires. But gold survives them all. As JP Morgan stated: “Money is gold and nothing else”.

WHY BET AGAINST A 5,000 YEAR SUCCESS

Anybody who doesn’t understand gold, neither studies nor understands history. There is nothing magic about gold, it is just real money. But since it is the only surviving currency why bet against a 5,000 year record? Gold is not an investment, it is a store of value and at times a medium of exchange.

It is quite astonishing that the immense wealth which has been accumulated by the top 1% in the last few decades is based on Alchemy and fake money. This has been a fake Golden Calf that in this era has been worshipped since the early 1980s. Since that time real money, or gold, lost its lustre totally as financial assets were leveraged to the hilt. But things started to change in the early 2000s.

GOLD HAS OUTPERFORMED ALL ASSET CLASSES THIS CENTURY

During periods of financial wizardry which we have experienced since the Fed was created in 1913, gold might seem like a barbarous relic and much less interesting than leveraging assets with the help of credit. What few investors realise is that in real terms, investment markets topped in 1999. As real terms can never be measured in fiat money, only real and permanent money can be used as a measuring stick. And that is of course gold.

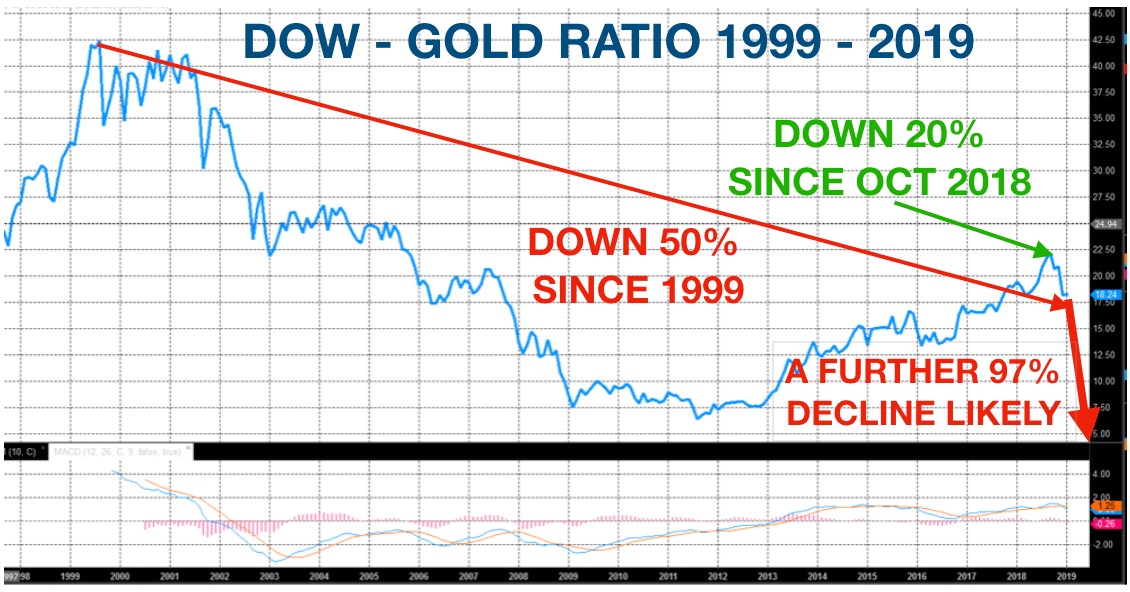

If we look at the Dow/Gold ratio (the Dow index divided by the gold price), it topped in 1999 at 44. It reached an interim bottom at 6 in 2011 as gold peaked at $1,920. That was a massive 86% decline in the ratio and a virtual wipe out of stock investors, measured in real terms.

As the chart shows below, stocks then recovered but only by 50% of the decline against gold. Thus in spite of a massive stock market rally between 2009 and 2018, the Dow index has still lost over 50% against gold since 2000. (Dividends are not taken into account, nor is any gold lending).

STOCKS TO FALL RAPIDLY AGAINST GOLD

Technically it now looks like the downtrend of stocks against gold has resumed. Since the peak in October, stocks have lost 20% against gold. But this is just the beginning. Eventually the ratio will most likely decline to below 1 where it was in 1980 and probably below the long term support at 1/2. That would be a massive 97% decline of the stock market from here, in real terms, which is gold. So that is the magnitude of the potential asset destruction that the US and the world will experience in the next 2-6 years. But like any prediction, we will only know afterwards.

GOLD AT ALL TIME HIGHS IN MANY CURRENCIES

Gold in US dollars is up 10% or $120 since the bottom in August 2018. Still, clearly a long way from the 2011 top at $1920. But the temporarily strong dollar doesn’t reveal the true picture of gold. For that we need to look at gold in other currencies. We know of course that gold in Argentine pesos or Venezuelan bolivars has made exponential moves. Less known is perhaps that gold is at or near the highs in many currencies like Norwegian and Swedish kroner or Canadian dollars. And in Australian dollars gold made a new quarterly closing high in December 2018 which is very significant. Major moves normally start in the periphery so what is happening with the gold price in various currencies will eventually spread to all currencies. It would not be surprising to see new highs in gold in all currencies in 2019, including against the US dollar. But remember it won’t be a straight move and there will be a lot of volatility.

Gold in US dollars is up 10% or $120 since the bottom in August 2018. Still, clearly a long way from the 2011 top at $1920. But the temporarily strong dollar doesn’t reveal the true picture of gold. For that we need to look at gold in other currencies. We know of course that gold in Argentine pesos or Venezuelan bolivars has made exponential moves. Less known is perhaps that gold is at or near the highs in many currencies like Norwegian and Swedish kroner or Canadian dollars. And in Australian dollars gold made a new quarterly closing high in December 2018 which is very significant. Major moves normally start in the periphery so what is happening with the gold price in various currencies will eventually spread to all currencies. It would not be surprising to see new highs in gold in all currencies in 2019, including against the US dollar. But remember it won’t be a straight move and there will be a lot of volatility.

GOLD – SILVER RATIO CONFIRMS STRONG UPMOVE COMING IN METALS

The other major predictor for the precious metals is the Gold/Silver ratio which I often have mentioned. Real sustained moves up in gold and silver only happen when the Gold/Silver ratio falls which means that silver moves up faster than gold. The ratio made a new high at 87 at Christmas and has moved down 6% in 7 trading days. We still need to see validation of this move but long term momentum indicators confirm that a major move down has started.