via Zerohedge:

The latest Cushman & Wakefield commercial real estate report shows demand for US industrial space collapsed 60% on year in 1Q19, reflecting the global synchronized decline and the deepening trade war.

Cushman & Wakefield’s economists warned President Trump’s trade war is unraveling complex supply chains around the world that have led to a slump in demand for industrial space. They also said the restocking trend by importers forced by the tariffs is likely over. There is also another possibility that the slowdown could be linked to some seasonal factors, the economist said.

“It is possible that the trade dispute is causing disruptions to supply chains which are causing demand for industrial space to slow. Another possibility is companies may have overstocked before the implementation of tariffs in 2018. Seasonality, a general slowing in the global economy and lagging supply may also have been the main culprits,” economists Kevin Thorpe and Rebecca Rockey said in the report.

The report said world export volumes are expected to have no growth this year, dropping from a 5% annual expansion rate in the last two years.

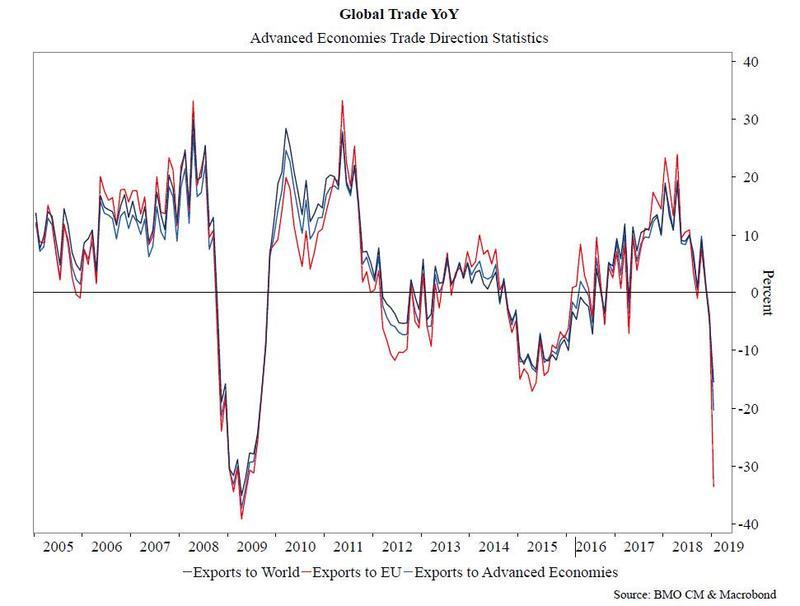

To best visualize the global slowdown is YoY changes in global trade as measured by the IMF’s Direction of Trade Statistics, courtesy of BMO’s Ian Lyngern. It shows the collapse in global exports as broken down into three categories:

- Exports to the world (weakest since 2009),

- Exports to advances economies (also lowest since 2009), and

- Exports to the European Union (challenging 2009 lows).

President Trump slapped 25% tariffs on $200 billion of Chinese goods last month. Trump then threatened to slap tariffs on another $300 billion of Chinese exports if China’s leader Xi Jinping doesn’t meet him at the 2019 G20 Osaka summit in Japan. If the meeting doesn’t occur, this could mean a full-blown trade war would be in effect, would spark a global trade recession and lead to a further collapse in demand for US industrial space.

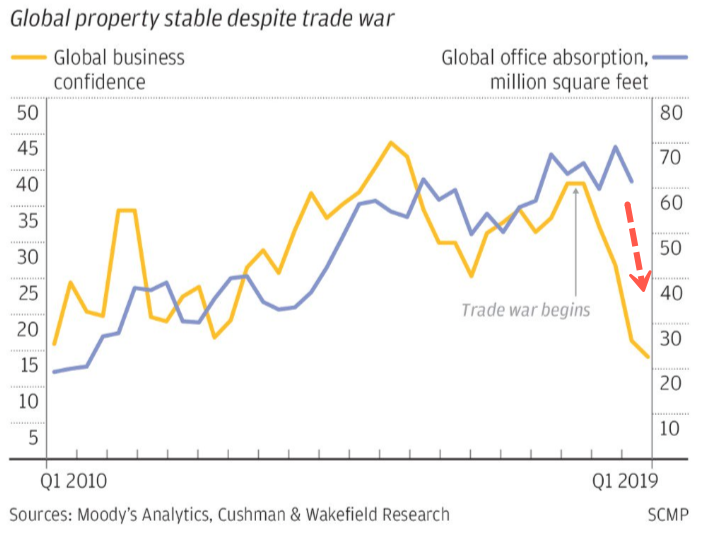

The economist noted that the trade war has driven up construction costs and has damaged global business confidence for the year.

“There are also anecdotal reports in the US that construction costs for steel, aluminum, cabinetry, flooring, etc, are being driven up as China is ‘taken out’ as a supplier… Although it is challenging to parse out the impact, it is not difficult to conclude that the longer the trade war drags out the more disruptive it will be,” the report said.

Separately, the trade war has left corporate America uncertain about the future by pulling back investments, Eugene Seroka, executive director of the Port of Los Angeles, said.

Tariffs are having the most significant impact on Los Angeles and Long Beach ports, the nation’s busiest container ports, which both handle about 47.5% of US containerized trade with China. But it’s not just the ports that are feeling the pressure from the trade war, trucking, railroads, warehousing, construction, manufacturing, and farming, have also been impacted. About one million jobs related to international trade around the port are also in question as the trade war continues to deepen.

As the US economy cycles down through summer with the threat of a full-blown trade war, industrial space demand is likely to drop further, which could suggest that the commercial real estate bubble is about to burst.