- The outcome of the G-20 meeting between U.S. President Donald Trump and China President Xi Jinping could be a watershed moment that could impact the course of markets and the global economy for the second half of the year.

- The G-20 summit in Osaka could end in a ‘feel good’ moment for markets, but the thorny issues in U.S.-Chinese trade talks are unlikely to be resolved and tariffs are expected to continue.

- The meeting between President Trump and President Xi Saturday could lead to improved negotiations but the drag on the economy from tariffs and weakened sentiment is expected to continue until there is a real deal.

- One economist said if the talks fail and the trade war escalates, the world is at risk of a recession.

Stocks are likely to see a temporary relief rally and bonds could sell off if there is a ‘ceasefire’ declared in the trade wars by the U.S. and China this weekend, but the damage to the global economy could continue until a tariff-ending deal is struck.

Wall Street has been handicapping the outcome of the much anticipated meeting between President Donald Trump and President Xi Jinping, and many investors believe the two will likely agree to hold off on new tariffs and restart negotiations, but existing tariffs would not be rolled back by much, if at all.

The meeting, at the G-20 summit, is so important that market pros broadly see it as an event that could affect the course of markets for the rest of the year; impact the trajectory of global economic growth, and help determine when and what actions the Federal Reserve and other central banks might take.

“You just amp up the odds even greater that we’re going to have a global recession, if there’s no detente between the U.S. and China. With respect to G-20, I don’t think there will be anything negative, and it will probably be a ‘kumbaya’ moment,” said Peter Boockvar, chief investment strategist at Bleakley Advisory Group.

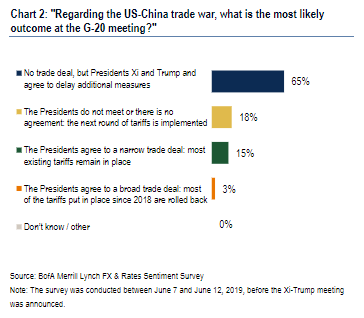

Trade representatives have been meeting ahead of the Osaka dinner between Trump and Xi Saturday, and even with so much at stake, there are no expectations for a significant deal in the near future. Bank of America Merrill Lynch surveyed investors and found that about two-thirds expected that there would be no deal this weekend, but there would be no new tariffs either.

While few expect an absolute failure at the meeting, UBS economists said if that were the case and the trade war escalated with new tariffs, the world could see a recession-like slowdown in growth.

If the trade war escalates, “we estimate global growth would be 75 [basis points] lower over the subsequent six quarters and that the contours would resemble a mild ‘global recession’ —similar in magnitude to the Eurozone crisis, the oil collapse in the mid-1980s and the ‘Tequila’ crisis of the 1990s,” UBS global head of economic research Arend Kapteyn wrote in a note.

An unnamed Trump administration official told Reuters on Tuesday that U.S. goals for the talks are to reopen negotiations and there could be a possible agreement on no new tariffs. The official said the U.S. would like negotiations to resume where they broke down in May.

Boockvar said markets should react positively to a “ceasefire” scenario, and stocks could rally, while bond sell off and the dollar could bounce. “The fact tariffs are still on will limit the extent of that relief rally,” he said. “If all of a sudden people say the Fed won’t have to be as aggressive because there’s potential for a trade deal, then you will see an adjustment in the bond market.”