The Federal Reserve is dominating the news today as two Fed regional Presidents have resigned (Rosengren [Boston] and Kaplan [Dallas]) for trading irregularities.

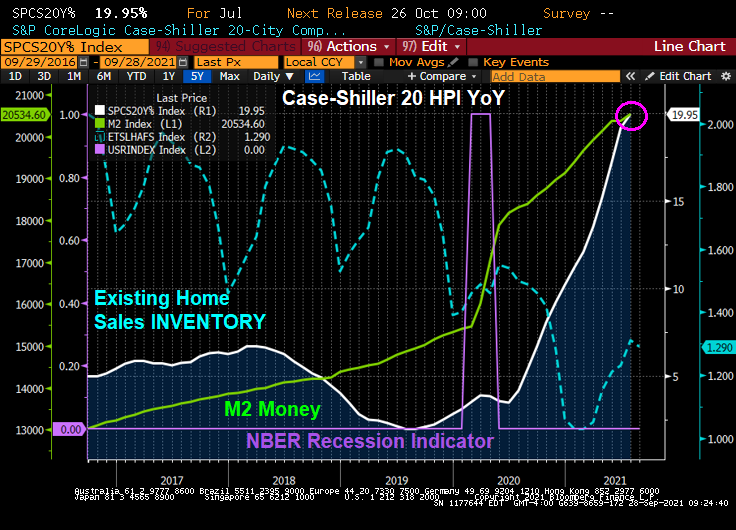

Speaking of The Fed, their target rate for inflation is 2%. Yet the Case-Shiller 20 metro home price index just rose to 20% YoY for July. Yes, house price growth is 10 times The Fed’s target rate!!

Now, it is September 28, so this is a report of happenings two months ago. Well, now you know why The Fed ignores housing despite being the largest asset is most household’s portfolio.

A measure of prices in 20 U.S. cities gained 19.9% in July. Phoenix led the way with a 32.4% surge. New York (17.8%), Boston (18.7%), Dallas (23.7%), Seattle (25.5%) and Denver (21.3%) were among the cities that posted record year-over-year increases.

The housing market is over, under, sideways, down thanks to The Fed pumping trillions into a market with limited available inventory.

The Fed is not talking about housing. Or the fact that home prices are growing at 10 times the rate of The Fed’s inflation target.