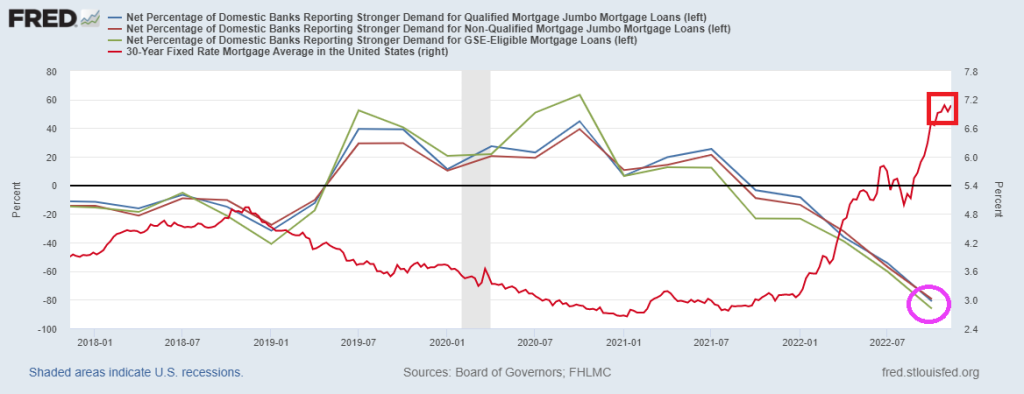

The October Senior Loan Officer Opinion Survey on Bank Lending Practices came out yesterday and its a doozy.

The Net Percentage of Domestic Banks Reporting Stronger Demand for Mortgage Loans is sinking faster than Joe Biden’s oratory skills as The Fed tightens their monetary belts.

Jumbo mortgages, those that are greater than FHFA’s conforming loan limit, are tanking as well.

And today, the University of Michigan (BOOO!!) consumer survey for housing buying conditions fell to the lowest level in recorded history.

Given the latest inflation numbers (improving from disastrous, 8.2% YoY to really horrible, 7.70% YoY), and unemployment rate rising from 3.5% to 3.7%, we now see that Taylor Rule estimate for Fed Funds is now … 13.85%. The US is currently at 4.00%. THAT is a big gap!

Yes, The Fed will not be able to fill the gap between the Taylor Rule and the current Fed Funds Target Rate, without incredible damage being done.

Unfortunately, this is an ACTIVE FAILURE for The Fed which has left monetary stimulus too high for too long since late 2008.

On a personal note, I am glad the midterm elections are over. We saw John Fetterman arguing until he was blue in the face that he loved fracking and will continue to let Pennsylvania frack. Then PA governor-elect Josh Shapiro came out yesterday and said that PA will end all fracking. And we are to believe that Lt Gov Fetterman did not talk with PA Attorney General Shapiro about fracking? To quote Joe Biden, “C’mon man!”