Stocks have taken out critical support.

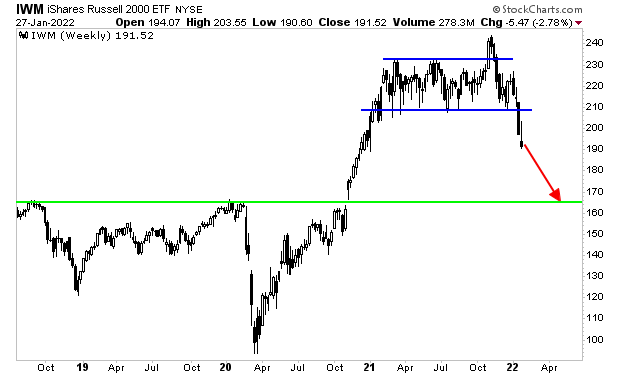

The Russell 2000 is perhaps the “junkiest” index among stock indexes with 31% of its companies NOT making profits. So, if the Fed is indeed looking to deflate the stock market bubble, this would be the first index to collapse.

Sure enough, it is collapsing. As I write this Friday morning, it has taken out critical support. By the look of things, we will be unwinding the entire stock market move of the last 24 months, returning to pre-COVID levels.

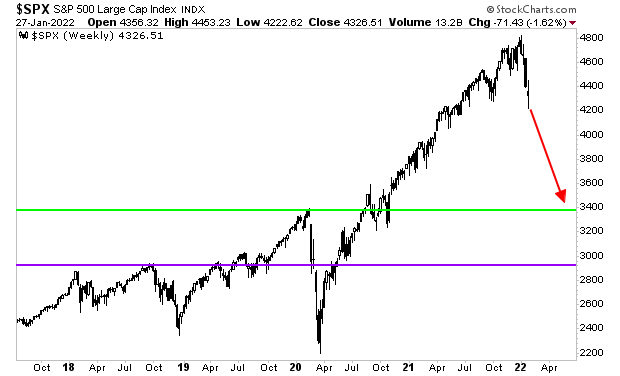

A similar price move in the S&P 500 sees it at 3,400, or possibly even lower. That’s a full 20% down from here.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,