As I mentioned yesterday, the Mother of All Collapses is Coming

And if you think the Fed is coming to the rescue stocks this time, you’re sadly mistaken.

Historically the Fed “saves the day” by intervening in the markets whenever they come unhinged. Well, the markets are already down 20% and we haven’t heard a peep from the Fed. If anything, Fed officials are calling for the Fed to be more aggressive in tightening monetary policy.

There’s a reason for this: inflation.

The U.S. is experiencing its first inflationary storm since the 1970s. Inflation has become the #1 issue for voters. And it’s the mid-terms this year.

And the Fed is feeling the heat from the political classes.

President Biden, who appointed Jerome Powell to a second term as Fed Chair EXPLICITLY called out the Fed earlier this week.

As I said yesterday, inflation is a challenge for families across the country and bringing it down is my top economic priority. This starts with the Federal Reserve, which plays a primary role in fighting inflation in our country…[emphasis added]

~President Biden speaking on inflation 5/10/22.

Yes, the White House is laying the blame for inflation SQUARELY on the Fed’s shoulders. The rest of the Beltway crowd as well as the media will soon be joining in.

Which means… the Fed is being forced to ignore stocks in order to end inflation. And it has a LOOONG ways to go.

Inflation is over 8%. The Fed has rates at 1%. And it has yet to even begin draining liquidity from the system with Quantitative Tightening.

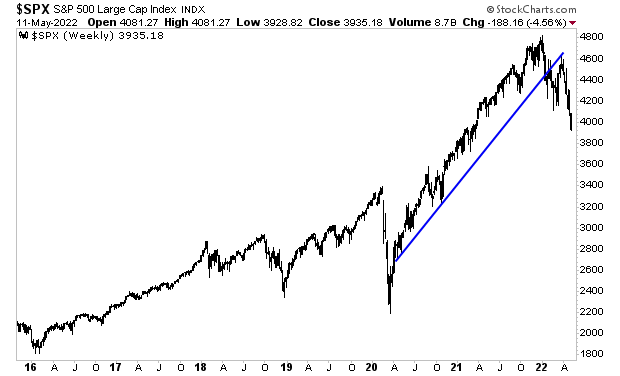

And stocks have already done this:

What happens when the Fed is forced to raise rates to FIVE percent? What happens when it tries to shrink its nine TRILLION dollar balance sheet.

You get the idea.

The Mother of All Collapses is coming!