After raising interest rates and getting slapped around by the markets last year, the Fed now appears to accept that future monetary policy can only be easy, even at the cost of ever larger and more destabilizing financial bubbles. On one hand this is a truly epochal change. On the other hand it’s just a recognition of the new normal in which central banks have already lost control.

From Bloomberg:

Fed Seems Resigned to Bubble Risk in Effort to Extend Expansion

Some Federal Reserve policy makers seem resigned to running a heightened risk of asset bubbles and other financial excesses as they seek to keep the economic expansion going.

That’s one of the messages tucked inside the minutes of the Federal Open Market Committee’s March 19-20 policy making meeting.

“A few participants observed that the appropriate path for policy, insofar as it implied lower interest rates for longer periods of time, could lead to greater financial stability risks,’’ according to the minutes, published April 10.

Chairman Jerome Powell could be one of those officials. He’s publicly pointed out that the last two expansions ended not in a burst of inflation, but in financial froth, first a dot-com stock market boom, then a housing bubble.

A willingness by the Fed to court such perils by holding rates down should be good for the economy for a while. After all, the aim of such a policy would be to sustain growth at a healthy enough clip to meet the Fed’s twin goals of maximum employment and 2 percent inflation.

But that monetary stance could store up trouble down the road should the financial threats materialize.

“Easy financial conditions today are good news for downside risks in the short-term but they’re bad news in the medium term,” senior International Monetary Fund official Tobias Adrian told a Boston Fed conference last year.

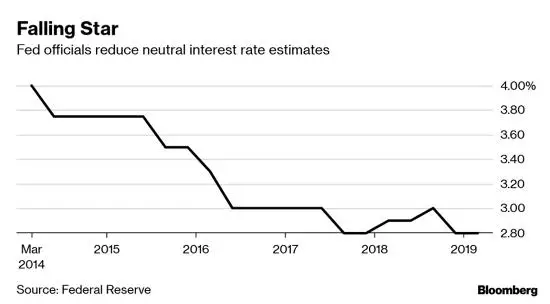

In economists’ parlance, here’s the Fed’s dilemma: R-star — the neutral interest rate that stabilizes the economy when it’s meeting the Fed’s goals — may be so low that it also prompts super-risky behavior by investors.

Behind the fall in R-star: an aging population and slower productivity growth that has boosted savings and depressed investment.

In an article last August, Bloomberg coined the term “Fast-star’’ for the interest rate that’s consistent with ensuring “FinAncial STability.’’ A rate too far below that level leads to excesses in the financial system. A setting much above it stifles risk-taking and obliterates the “animal spirits” that drive economic growth.

The trouble is that Fast-star may be higher than R-star, as suggested by the minutes.

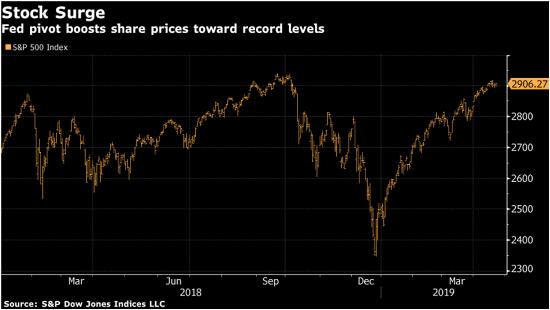

The Fed has put policy on hold this year after lifting short-term rates to 2.25 percent to 2.5 percent in December, within the range it considers neutral for the economy. The dovish shift helped ignite a huge rally in the stock market, with the S&P 500 Index up 16 percent in 2019.

But it failed to satisfy President Donald Trump, who’s vociferously complained that the Fed’s rate increases have held back the economy and the stock market and who’s urged the central bank to open up the monetary spigots to boost both.

A couple of policy makers at last month’s FOMC meeting said that any financial stability risks arising from low rates could be addressed by counter-cyclical macro-prudential policy tools and other regulatory and supervisory measures, according to the minutes.

The problem is that the U.S. has a limited set of such tools, as Fed Vice Chairman for Supervision Randal Quarles acknowledged in a March 29 speech in New York.

At times last year Fed policy makers sounded open to using higher interest rates to lean against potentially over-exuberant financial markets, said Jonathan Wright, a professor at Johns Hopkins University and a former Fed economist.

Case in point: New York Fed President John Williams said in October that the central bank’s rate increases would help reduce risk-taking in financial markets, though he added that was not their principal purpose.

Backed Off

Such talk has since faded. “There doesn’t seem to be the same idea of having tighter monetary policy so as to lessen the risk of asset bubbles developing,” Wright said.

So that’s it. Low interest rates and generally easy money for as far as the eye can see, while asset bubbles expand and then burst according to their own dynamics.

The way you can tell this is true is by looking at stock prices, which are back at levels that last year compelled the Fed to start tightening, and wage inflation, which is running nearly a full percentage point beyond the Fed’s current 2% inflation target. Either (and certainly both) of these trends might have lead previous Feds to tighten aggressively. That this one is still talking about easing proves that it has given up on the whole inflation-fighting thing.

Which means we’ve arrived at yet another milestone on the path to global currency collapse, one that will leave future historians shaking their heads in disbelief.

Other posts in the We Give Up! series are here.