by Phil

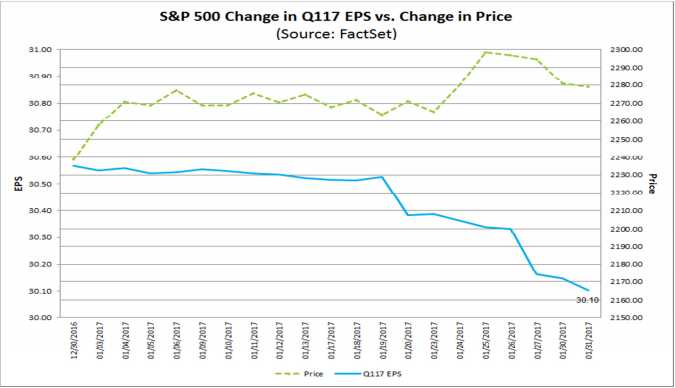

Actual earnings are missing by 1.6%.

December 30th expectations of $30.60 for S&P Q4 earnings are missing the mark by a wider and wider margin as each company makes it’s report. With 55% of the S&P 500 reporting through last Friday, sales are missing by 0.1% overall and earnings, even with financial engineering (non-GAAP reporting, buybacks, “one-time” exceptions) are only 4.6% above last year, when the S&P was at 1,850 (24% lower) on Q1 earnings.

WAKE UP PEOPLE!!! I know you are in some sort of complacent stupor because the Volatility Index (VIX) is at 11.49 (makes a good long here) but come on – can you really be so stunned by the political madness that you forgot how to value a company? 500 companies, for that matter…

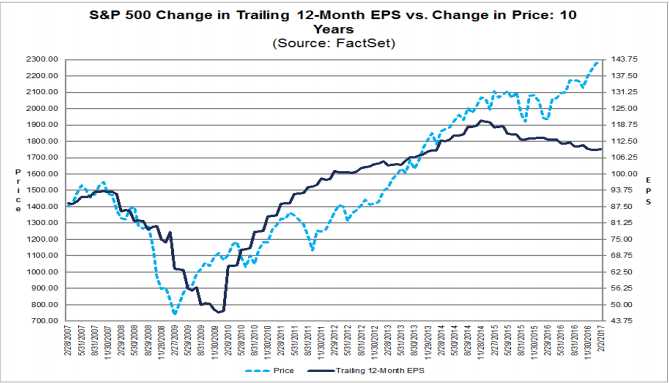

Do you see where the PRICE of the S&P crossed way over earnings back in mid-2013? That is when people began to lose their minds but we had a couple of corrections and sanity was almost restored until early last year, when the market went crazy and now, 24% later, hasn’t looked back yet. That’s a 5 standard deviation move off the value line (actual earnings) for the S&P – investors are overpaying for stocks in the 15-20% range.

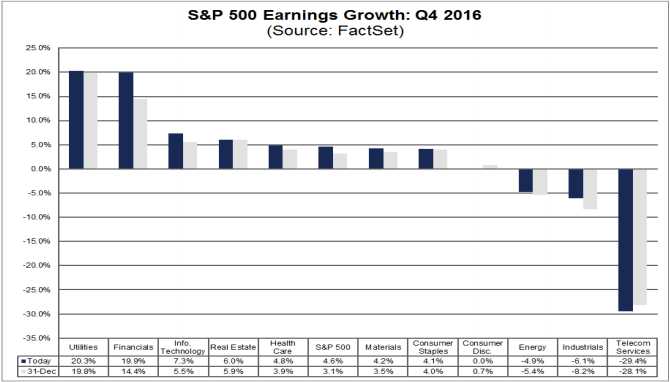

Even worse, the growth in earnings is pretty much entirely tied to just two sectors: Financials and Utilities. Telcom services are down 28%, Energy is down 5.4% and Industrials (like the Dow Jones Industrial Average) are down 8.2% with the Dow at its 20,000 all-time high. This does not make sense – Chewbacca!

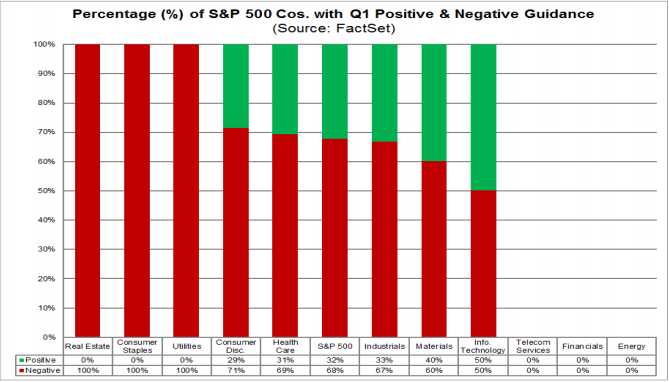

And don’t even get me started on guidance!

Energy companies have given no guidance because they have no f’ing idea what is going to happen. Just yesterday we got an API Report showing the 2nd biggest build of oil (14.2Mb) in US history – what cutbacks? If EIA confirms this number, we will have had 50 MILLION barrels of oil (10%) build up in our commercial inventories in the past 4 weeks – that’s crazy!

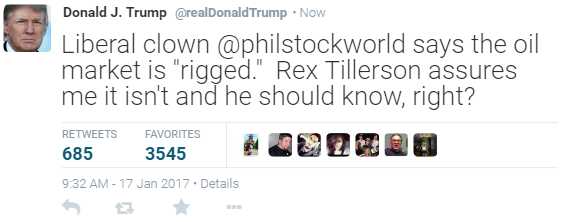

The energy sector has been one of our leaders since the election and why shouldn’t they be when our new Secretary of State is a 40-year Exxon (XOM) veteran and former CEO? Not only that but President Trump has been rattling his saber against our ancient enemy, Iran – because they are always the go-to country when the US Oil Cartel is trying to whip up a pricing frenzy.

However, as I noted last week when we were looking at the NYMEX contract strips, they are going to have BIG TROUBLE on this rollover (22nd) and that Monday is a holiday (President’s Day) so only 9 trading days left to dump 471,156 fake, Fake, FAKE orders and look how swollen June has become since last week:

Now, let’s compare this week’s BS to last week’s BS:

Last week, there were 1.364M open contracts representing 1.364 BILLION barrels of oil that will never actually be delivered – BECAUSE IT’S ALL A HUGE SCAM TO DRIVE UP PRICES. Anyway, this week (1st chart) there are 1,366 open contracts in the front 6 months – essentially exactly the same amount of barrels but, as we predicted, they just shuffle them around to FAKE!!! demand in the front month.

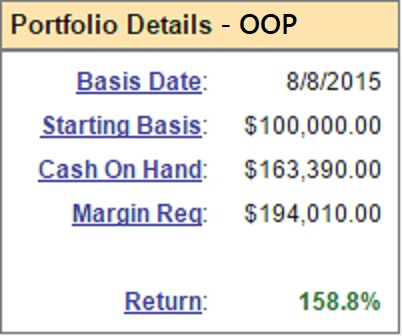

That’s how this scam works and we have been telling you it’s a scam for years and this is why we can make so much money on our Futures bets on oil: We know it’s a scam, we understand the scam and we can place our bets accordingly. In fact, in our Options Opportunity Portfolio, I remarked yesterday that we have both a bearish February oil bet using the Ultra-Short ETF (SCO) AND a bullish July oil bet using the regular ETF (USO) and both of them are right on track for 100% gains – even though they are opposite bets. That’s because we timed our entries well on both sides.

That’s how this scam works and we have been telling you it’s a scam for years and this is why we can make so much money on our Futures bets on oil: We know it’s a scam, we understand the scam and we can place our bets accordingly. In fact, in our Options Opportunity Portfolio, I remarked yesterday that we have both a bearish February oil bet using the Ultra-Short ETF (SCO) AND a bullish July oil bet using the regular ETF (USO) and both of them are right on track for 100% gains – even though they are opposite bets. That’s because we timed our entries well on both sides.

Now that one of the head scammers is sitting next to the President (a man known to pull a scam or two in his time), expect the unexpected because all it takes is one “incident” in Iran, Iraq, Afghanistan, etc. and suddenly oil is popping 10% again. In fact, we just took another long on Natural Gas Futures (/NG) this morning and it’s going to be very exciting playing oil and gasoline off today’s inventories – tune into our Live Chat Room for that one!

Speaking of live, there is no Live Trading Webinar today as I’m off to Vegas for our 2-day, SOLD OUT Live Seminar on Sunday and Monday at Caesar’s Palace. I’m looking forward to seeing you all live and don’t forget to bring your laptops because Monday is a live trading day – all day long!

Two weeks from Monday (27th) I will be teaching two classes at the New York Trader’s Expo – that should be fun as well.

We pressed our hedges (TZA, SQQQ) in our Options Opportunity Portfolio yesterday and we will do the same in our Short-Term Portfolio this morning. Those hedges were made available to our cheapskate readers in some of our previous posts, so I won’t go over them again here.

We pressed our hedges (TZA, SQQQ) in our Options Opportunity Portfolio yesterday and we will do the same in our Short-Term Portfolio this morning. Those hedges were made available to our cheapskate readers in some of our previous posts, so I won’t go over them again here.

As you can see, the OOP has blasted over $12,000 (12%) higher since our Jan 19th Review over at Seeking Alpha. Rather than being happy about it, it means we were set up too bullish so we cashed a couple of winners (getting our cash back to almost 90%) and improved our hedges, which is all it took to tilt our portfolio from too bullish to slightly bearish.

Being able to make those kinds of virtual portfolio adjustments on the fly is what balanced portfolio management is all about!

Be careful out there….