As I outlined in yesterday’s article, the odds are relatively high that President Trump will secure a second term courtesy of how the legal system handles contested elections.

With that in mind, we need to ask, “what is the BIG PICTURE outcome for the markets if Trump wins?”

I believe that if President Trump manages to secure a second Presidential term, the stock market will go into an ENORMOUS bubble.

Why?

Because President Trump is OBSESSED with the stock market. He’s mentioned it 54 times on his twitter account this year alone. That’s more than once a week!

Why this obsession?

Because the President knows it’s a simple measure of wealth that appeals to the average person. Talking about boosting incomes or reducing wage disparities sounds nice, but these are vague concepts. Saying “stocks are at record highs!” is a specific measure that anyone can understand and interpret to mean “people are getting rich.”

The President, for all his flaws, understands sales. And by talking about stocks non-stop, he’s “selling” Americans on the idea that he is creating wealth, even if the reality is that the market is rising because the Fed is providing record amounts of liquidity.

Speaking of the Fed, President Trump now effectively decides Fed policy due to his constant bullying via his very same twitter account (and its 87 million followers).

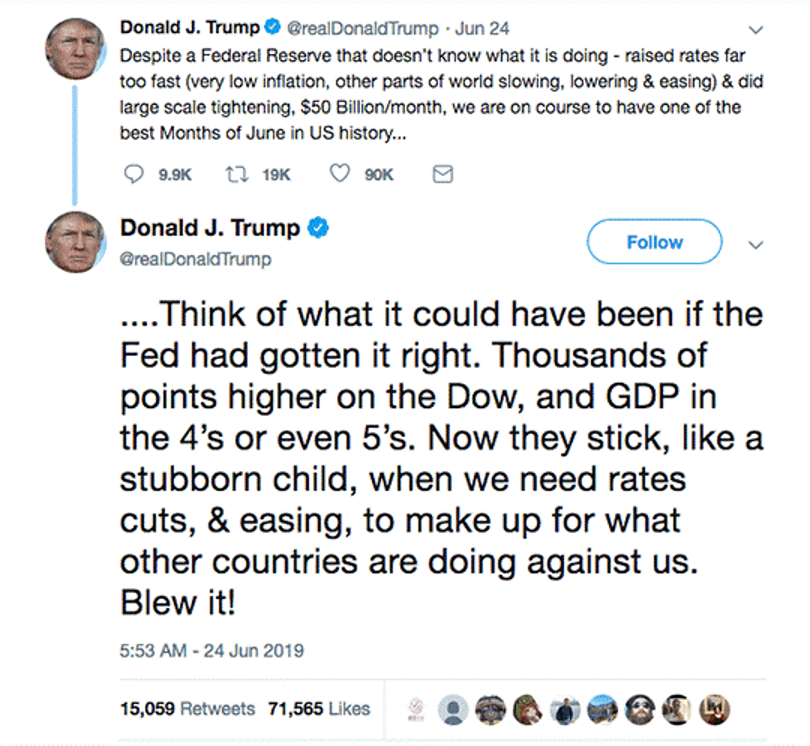

Case in point, take note of how the President hounded the Federal Reserve to ease monetary conditions non-stop throughout 2018. The below tweets are two of literally dozens in which the President harangued the Fed to ease conditions.

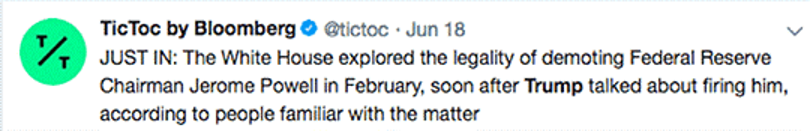

When the Fed was slow to act, the President even want so far as the float the idea of FIRING Fed Chair Jerome Powell, leaking the plan to Bloomberg in June of 2018.

I do not expect any of the above issues to change during a Trump second term. If anything, I would expect President Trump’s obsession with stocks to be ever greater. And this means even more pressure on the Fed to create a bubble

Again, I’m NOT saying this is a good thing, nor am I saying I like what the President does. I’m simply pointing out how he sees the stock market and what this means for his attitude towards the ultimate driver of stocks: Fed liquidity.

So… if President Trump does win a second term. What would his obsession with stocks mean price wise?

Well, the Fed has cut interest rates to ZERO and is now running QE programs equal to $125 billion per month. Moreover, Fed Chair Jerome Powell has stated that the Fed will not attempt to normalize Fed policy until the U.S. economy has experienced a full recovery to levels that existed prior to the COVID-19 pandemic. And the Fed as a whole stated that it will keep interest rates at ZERO through 2023.

Yes, 2023.

The last time the Fed held rates at ZERO for years while running aggressive QE programs was from 2008-2015. During that time, the S&P 500 nearly TRIPLED.

Currently stocks are up 50% from the lows March. If the S&P 500 were to follow a similar move, we’d see the mother of all bubbles with the S&P 500 rising to over 6,000 over the next five years.

And if things REALLY get out of control, as they did in the late ‘90s, we could see the S&P 500 running to 10,000 or higher. This sounds ridiculous, but this kind of move has happened before. Indeed, the NASDAQ rose over 140% in just four years during Bill Clinton’s second term as President.

With the S&P 500 around 3,500 today, this would mean a run to 8,400 by the end of 2024.

Again, this sounds ridiculous, but all bubbles do. And we know this President more than any other in the last 50 years is obsessed with stocks. Combine this with a Federal Reserve that is already engaged in the most aggressive QE program in history and suddenly the S&P 500 at 8,000 in four years doesn’t seem so ridiculous.

With that in mind, we recently published a special report titled, The MAGA Portfolio: Five Investments That Will Make Fortunes During Trump’s Second Term.

In it, we detail five HIGH OCTANE investments that are primed to EXPLODE higher when President Trump wins a second term.

Each one of these investments is in a unique position to profit from the combination of Trump economic reforms and Fed monetary easing, combining high growth opportunities with extreme profitability.

We are offering this report exclusively to subscribers of our e-letter Gains Pains & Capital. To pick up your copy please swing by:

https://phoenixcapitalmarketing.com/MAGA.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research