The Fed begins its March FOMC meeting today.

Tomorrow at 2PM EDT, the Fed will announce its policy decision for the month. And no matter what the Fed does, it’s in SERIOUS trouble.

Why?

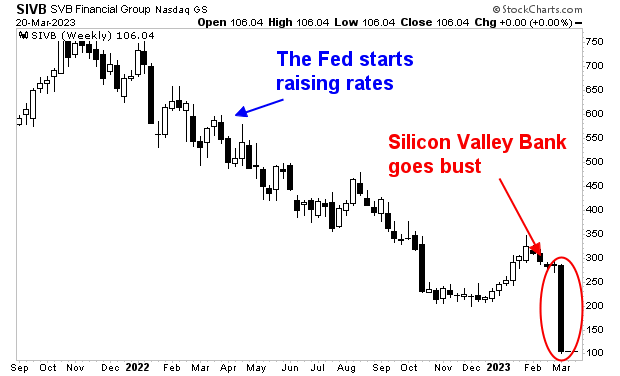

If the Fed raises rates, this is only going to increase pressure on the banking system.

Depositors, both in the U.S. and Europe, are fleeing banks because A) the banks pay next to nothing in interest, whereas you can earn 3%-4% in a Money Market Fund or short-term T-Bills and B) depositors are now terrified that the banks at which they keep their money could go bust.

Consider that U.S. just experienced its 2nd and 3rd largest bank failures in history in the last two weeks. And over the weekend, the $1.4 trillion behemoth Credit Suisse had to be rescued by UBS and the Swiss Government.

Put simply, the issues that resulted in Silicon Valley Bank and Credit Suisse going bust / needing to be rescued will only worsen if the Fed decides to raise rates again tomorrow.

The alternative for the Fed isn’t much better.

Inflation is currently clocking in at 6%.

If the Fed doesn’t raise rates tomorrow, then inflation will rage.

I’m talking about a situation in which the U.S. becomes an emerging market, with inflation out of control, a currency collapse, and more.

Put simply, the Fed is screwed either way.

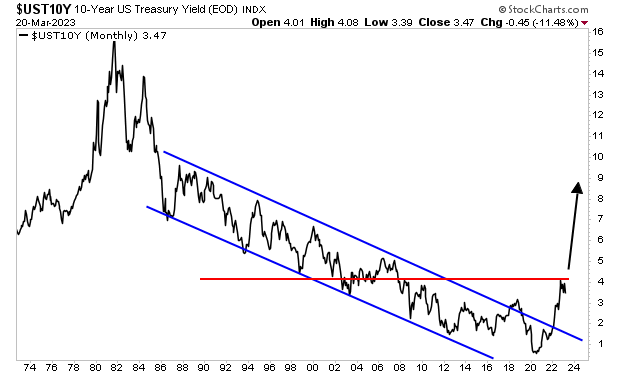

Yes, if the Fed doesn’t hike rates tomorrow there will be a relief rally in risk assets. But that relief will quickly turn to terror as U.S. Treasury yields explode higher.

Remember, the U.S. has over $31 TRILLION in debt and a Debt to GDP ratio of 120%. There are over $70 trillion debt securities in the financial system and another $500 TRILLION in derivatives that trade based on interest rates.

What’s happens to all that debt if the yield on the 10-Year U.S. Treasury spikes to 7% or even 9% if the Fed allows inflation to rage out of fear of worsening the bank crisis?