Wolf Richter wolfstreet.com, http://www.amazon.com/author/wolfrichter

Or what the averages are hiding.

We will start with income and see what’s left over, and for whom.

Personal income increased by 4.1% in December from a year earlier, the Bureau of Economic Analysis reported today. This includes all income received by all persons from all sources, such as from labor, financial assets (dividends and interest income but not capital gains), business activities, homeownership (rentals), government transfers, etc.

“Real” personal income — adjusted for inflation via “chained 2009 dollars” — rose only 2.37%. This is for the US overall.

Per-capita “real” personal income – which accounts for 0.71% population growth in 2017 and measures income per individual – rose only about 1.7%. If the inflation measure even slightly understates actual inflation as experienced by these individuals, their personal income growth might go away entirely.

Next step down…

Disposable personal income – personal income less personal taxes – increased 3.9% year over year in December. This is the income that folks have available for spending or saving. “Real” disposable personal income rose 2.1%. And on a per-capita basis, it rose only 1.4%. So these are not exactly huge increases.

Not everyone is getting this income growth equally.

The economy can be divided up into layers. Bridgewater Associates founder Ray Dalio sees a split between the top 40% of income earners for whom the economy is doing well, and the bottom 60% for whom the economy is a series of setbacks. Or by it could be 30% and 70%. Wherever the split is drawn, the smaller group of top income earners has had it good while the larger group of income earners at the bottom is struggling.

But consumers, no matter what their income levels, are trying to do their best to prop up the economy, upholding an American tradition. And they’re spending more, the Bureau of Economic Analysis reported today.

Personal consumption expenditures (PCE) – the goods and services purchased by everyone living in the US – rose 4.6% year-over-year. Adjusted for inflation, spending grew by 2.8%.

Personal outlays – PCE plus personal interest payments and personal transfer payments – rose 4.7% year-over-year.

So, with disposable income rising 3.9% (not adjusted for inflation), and with personal outlays jumping 4.7% (not adjusted for inflation), what’s left over and for whom?

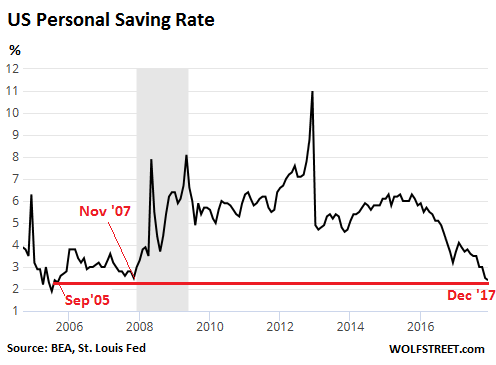

The personal saving rate – disposable income less personal outlays – fell to 2.4%. This was even below the savings rate of 2.5% in November 2007, and the lowest savings rate since September 2005:

In terms of dollars, personal saving dropped to a Seasonally Adjusted Annual Rate of $351.6 billion, meaning that at this rate in December, personal savings for the whole year would amount to $351.6 billion. This is down from the range between $600 billion and $860 billion since the end of the Financial Crisis.

But who is – or was – piling up these savings?

Numerous surveys provide an answer, with variations only around the margins. For example, the Federal Reserve found in its study of US households:

- Only 48% of adults have enough savings to cover three months of expenses if they lost their income.

- An additional 22% could get through the three-month period by using a broader set of resources, including borrowing from friends and selling assets.

- But 30% would not be able to manage a three-month financial disruption.

- 44% of adults don’t have enough savings to cover a $400 emergency and would have to borrow or sell something to make ends meet.

- Folks who had experienced hardship were more likely to resort to “an alternative financial service” such as a tax refund anticipation loan, pawn shop loan, payday loan, auto title loan, or paycheck advance, which are all very expensive.

Similarly, Bankrate found that only 39% of Americans said they’d have enough savings to be able to cover a $1,000 emergency expense. They rest would have to borrow, sell, cut back on spending, or not deal with the emergency expense.

All these surveys say the same thing: about half of Americans have little or no savings though many have access to some form of credit, including credit cards, pawn shops, payday lenders, or relatives.

So what does it mean when the “saving rate” declines?

Many households spend more than they make. For them, the personal saving rate is a negative number. This negative personal saving rate translates into borrowing, which explains the 5.7% year-over-year surge in credit card debt, and the 5.5% surge in overall consumer credit.

It boils down to this: most of the positive saving rate, with savings actually increasing, takes place at the top echelon of the economy – at the top 40%, if you will – where households are flush with cash and assets and where the saving rate is very large.

But the growth in borrowing for consumption items (the negative saving rate) takes place mostly at the bottom 60%, where households are living paycheck-to-paycheck even if those paychecks are reasonably large and even if life is comfortable at the moment.

When the overall saving rate drops it means that the surge in borrowing at the bottom 60% or so is no longer outweighed by the growth in savings at the top.

But economic risk lies at the lower echelons – with people who cannot afford to lose their jobs. If something goes wrong in the economy, it’s at there where defaults are happening and where job losses hurt the most. This is why these low saving rates were a red flag before the Great Recession – not because households at the top were saving less but because households in the lower 60% of the economy were stretching further to borrow to fund their spending and to deal with existing debts.

Nine years of scorched-earth monetary policies come home to roost. Read… Why the Next Downturn “Will Not Look Like 2008”