From Frank Holmes at Frank Talk:

When you think of the top 1% of all income earners in American households, how much do you think this group rakes in? Millions? Tens of millions? What about the top 10%?

On the contrary, to be considered in the top 1% of taxpayers nationally, you’d need an annual income of $480,930. The top 10% of taxpayers make at least $138,031. These figures are based on 2015 income tax data, the most recent year available.

This income level varies widely by both state and city. In San Jose, California, the top 1% income threshold is close to $1.2 million, almost double the level for Los Angeles. As seen in the chart below, the spread is fairly wide between the top 10 most populous cities in the U.S. In San Antonio, Texas – home to U.S. Global Investors – you’d need to make $416,614 annually to be considered in the top 1%, slightly below the national threshold of top 1 percenters.

Earning enough income to be in the top 1, 10 or even 20% is no small accomplishment, but chances are good that many people you know, and may not think of as wealthy, fall into the top 1, 10 or 20%.

Is the Top 1 Percent Paying Their Fair Share?

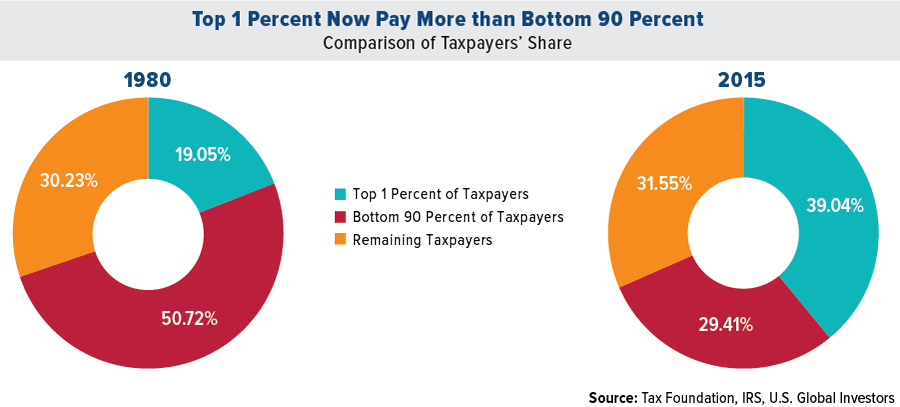

Contrast the above income statistics with the picture often painted in the media that the wealthiest Americans aren’t paying their fair share. According to the Tax Foundation, the top 1% of households collectively pay more in taxes than all of the tax-paying households in the bottom 90%.

Take a look at how much this has changed over the past few decades. In 1980, the bottom 90% of taxpayers paid about half of the taxes. The top 1% contributed about 20%.

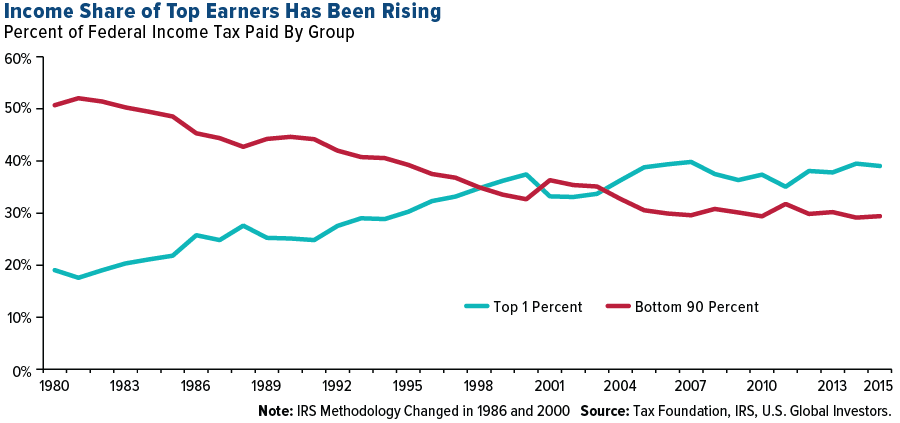

Below is the line chart from the Tax Foundation showing how the income tax share for each category has changed since 1980. For the majority of years, the share of the bottom 90% fell while the share of the top 1% rose.