by The Phoenix

The #1 issue for the markets this week is the $USD.

The U.S. dollar is strengthening. A strong dollar is not necessarily a bad thing, but it runs completely contrary to the Fed’s stated goal of creating inflation.

Following a brief spike during the deflationary episode of March, for most of 2020, the $USD dropped like a stone (see area highlighted by a red arrow in the chart below). However, it’s been a completely different era for 2021 as the $USD has been rangebound thus far (see blue rectangle in the chart below).

This is happening at a time when the Fed has explicitly stated that it wants to create inflation. It is also happening at a time when the U.S. is $28 trillion in debt, and the U.S. is attempting to run a $3+ trillion deficit.

And therein lies the problem.

The U.S. finances its spending via tax revenues. If tax revenues are not great enough to cover the costs, the U.S. issues debt. This is deficit everyone is always talking about. In simple terms the U.S. finances its massive spending sprees by issuing debt.

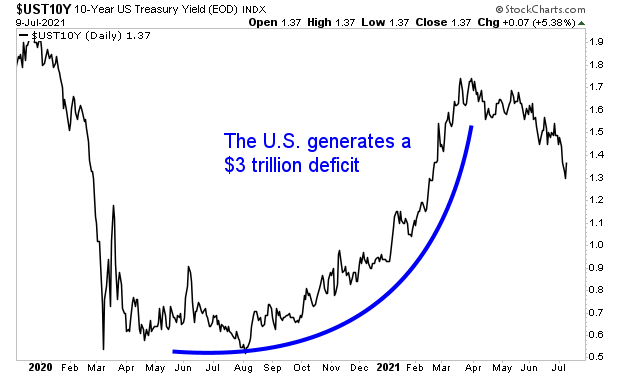

In order for the bond market to absorb the massive debt issuance the U.S. generated in 2020 (the U.S. ran a $3 trillion deficit that year), it required higher yields. In simple terms, this was the bond market saying, “if you want us to buy all of this debt, you need to pay us more.” You can see this in the chart below.

This changed in 2021, at which time bond yields began to roll over as it appeared Congressional gridlock would limit the Biden administration’s plans on spending some $6 trillion. Yields started to come down as the bond market began to process this information.

But that doesn’t mean the $USD at current levels isn’t a problem. Even if the Biden administration can’t run a $6 trillion budget, it will still run a $3+ trillion deficit. Indeed, the U.S. is already $2 trillion in the red for 2021 as of June.

The stronger the $USD is in this environment, the more “expensive” it is the U.S. to pay its debts. A big part of the Fed/ Federal Government’s scheme with inflation is that it means the U.S. can pay back its debts with dollars that are technically worth less.

But if the $USD stays strong, this means it becomes more expensive for the U.S. to finance its debt loads. And with total public debt north of $28 trillion, this can be a real problem.

Indeed, it’s possible the U.S. is finally approaching a potential debt crisis in the coming months. With that in mind, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the general public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research