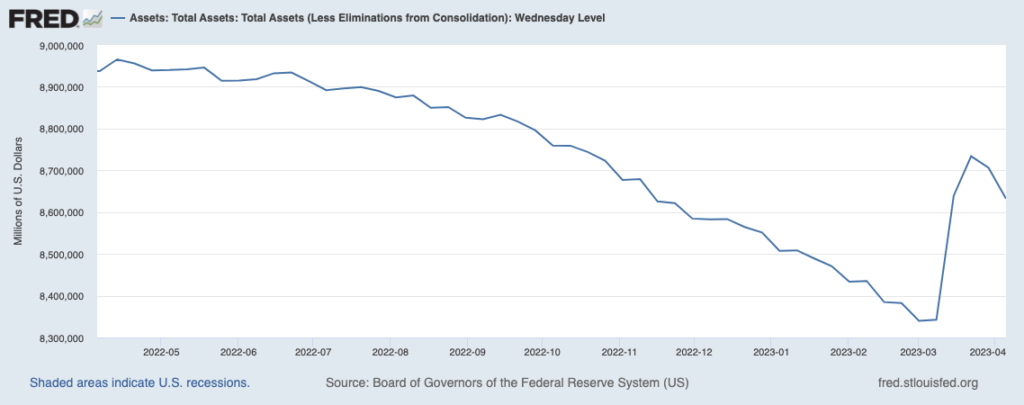

The Fed has turned off the money pump again.

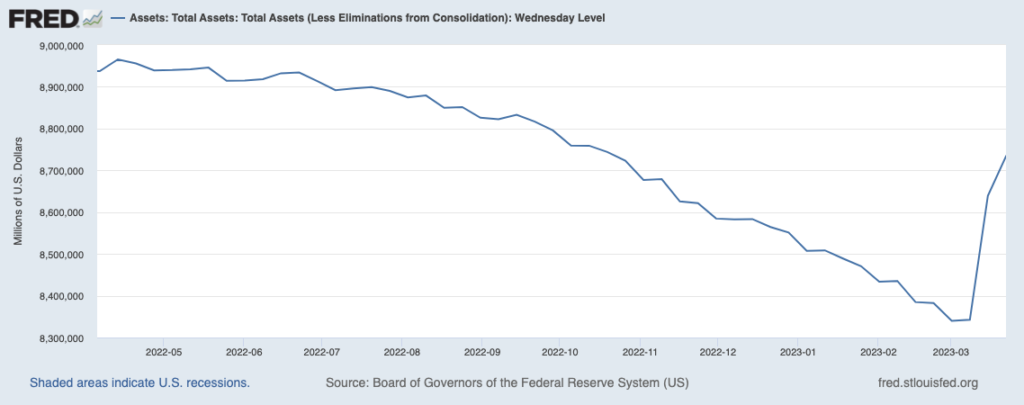

If you’re looking for a reason why stocks erupted higher starting in early March, look no further than the below chart of the Fed’s balance sheet. As you can see, during the regional banking crisis triggered by the collapse of Silicon Valley Bank, the Fed began expanding its balance sheet rapidly.

How rapidly?

Nearly $400 BILLION in two weeks’ time. Not since the depths of the 2020 crash has the Fed printed this much money.

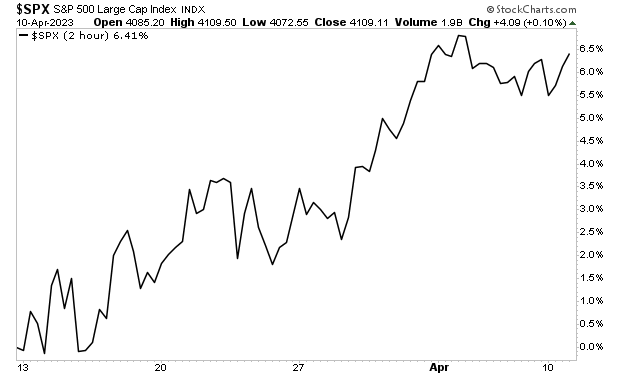

Stocks bottomed soon after this… exploding higher by 6+% in a single month.

I bring all of this up, because the Fed has turned off the money printer again. Over the last week, the Fed’s balance sheet has fallen by $100 billion.

What does this mean?

The clock is ticking for stocks. And with a recession just around the corner… it’s only a matter of time before the market breaks to new lows.

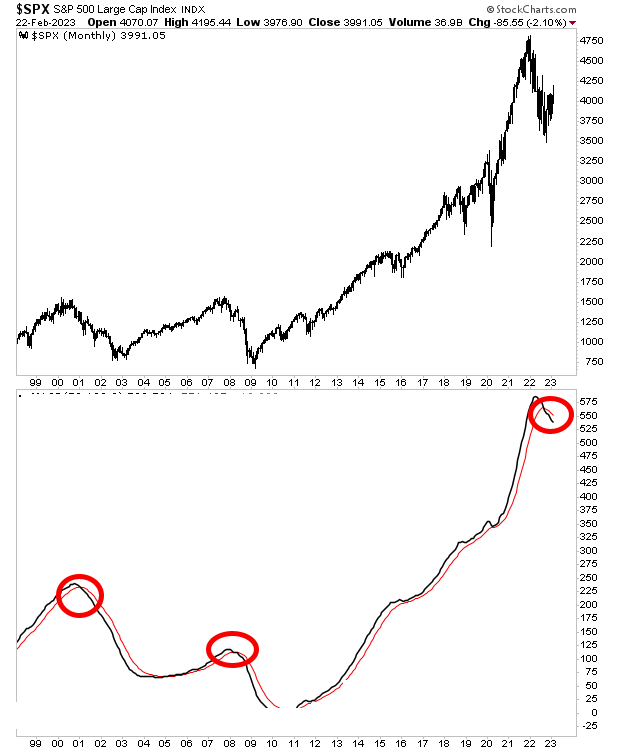

Indeed, our proprietary Crash signal has just triggered its 3rd confirmed signal in the last 25 years. The last two times it signaled?

2000 and 2008.