COVID and its omicron variant (as well as government reactions such as mask and vaccination mandates) are wreaking havoc on the global economy, but particularly in the USA where the Federal government dumped trillions of dollars in fiscal stimulus along with The Federal Reserve’s monetary stimulus into an economy not prepared for it. The result? INFLATION.

But global supply chains are nearing a turning point that’s set to help determine whether logistics headwinds abate soon or keep restraining the global economy and prop up inflation well into 2022, according to several new barometers of the strains.

Just a week before the start of Lunar New Year, the holiday celebrated in China and across Asia that coincides with a peak shipping season, economists from Wall Street to the U.S. central bank are unveiling a string of models in the hope of detecting the first signs of relief in global commerce.

From Europe to the U.S. and China, production and transportation have stayed bogged down in the early days of 2022 by labor and parts shortages, in part because of the fast-spreading omicron variant.

Among the big unknowns: whether solid demand from consumers and businesses will start to loosen up, allowing economies to finally see some easing in supply bottlenecks. Fresh indicators from the private and official sectors are in high demand because there’s still much uncertainty in industries overlooked by mainstream economics before the pandemic.

Once the realm of trade and industrial organization experts, supply chains “have shifted to center stage as a critical driver of sky-high inflation and a stumbling block to the recovery,” Bloomberg Chief Economist Tom Orlik said. “The profusion of new indices and trackers won’t unblock the arteries of the global economy any quicker. They should give policy makers and investors a better idea of how fast — or slowly — we are getting back to normal.”

The Bloomberg Economics Index

Bloomberg Economics’ latest supply constraint index for the U.S. shows that shortages have trended modestly lower for six months. Even so, strains remain elevated, and the wave of worker absenteeism is adding to the problems at the start of 2022.

Port traffic tracked by Bloomberg shows container congestion continues to rankle the U.S. supply chain from Charleston, South Carolina, to the West Coast. The tally of ships queuing for the neighboring gateways of Los Angeles and Long Beach, California, continued to extend into Mexican waters, totaling 111 vessels late Sunday, nearly double the amount in July.

Source: Bloomberg, IHS Markit, Genscape

Note: Data counts the total number of container ships combined in port and in offshore anchorage area.

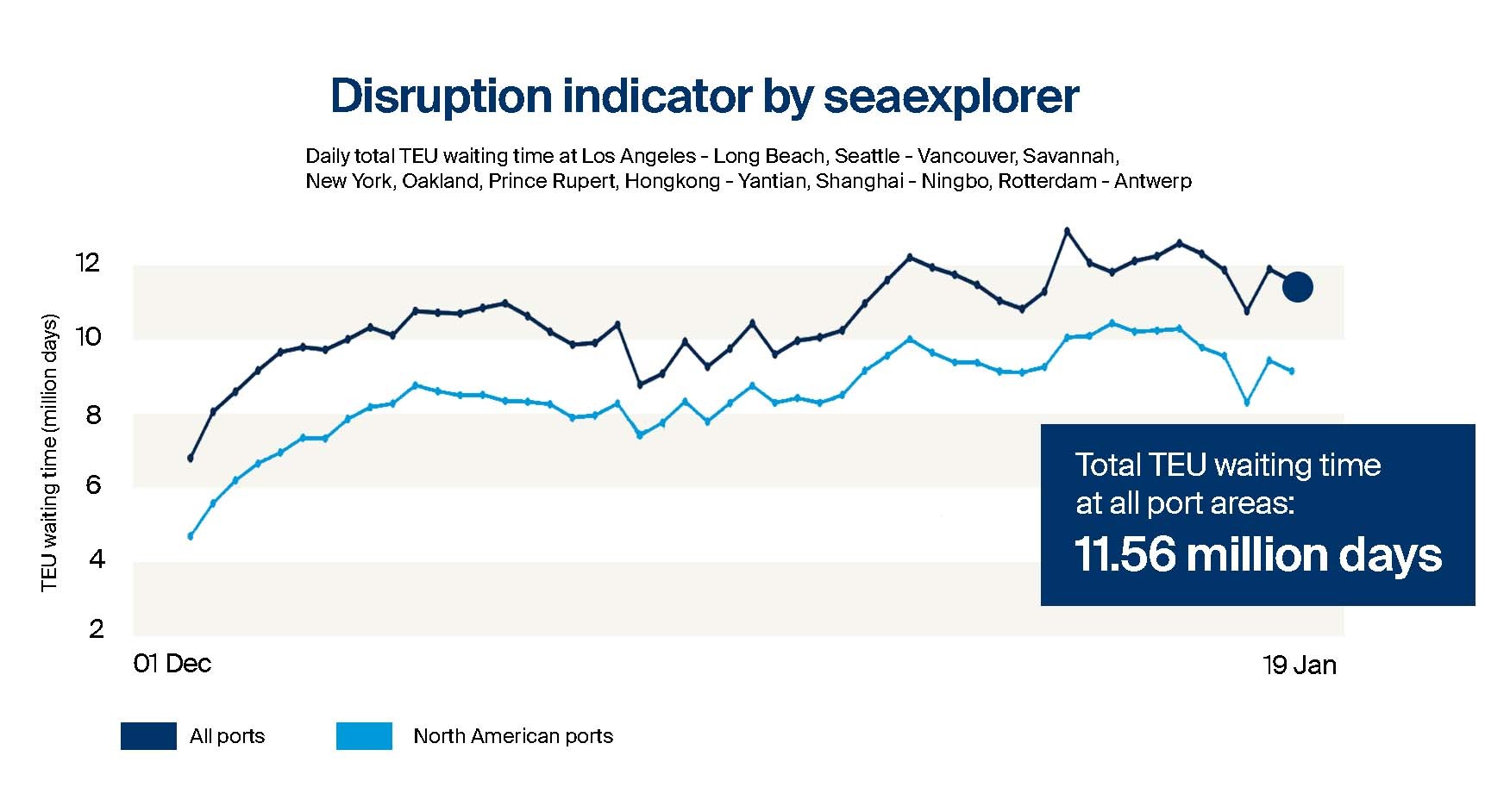

Kuehne+Nagel’s Disruption Indicator

Kuehne+Nagel International AG last week launched its Seaexplorer disruption indicator, which the Swiss logistics company says aims to measure the efficiency of container shipping globally. It shows current disruptions at nine hot spots is hovering near “one of highest levels ever recorded,” with 80% of the problems happening at North American ports.

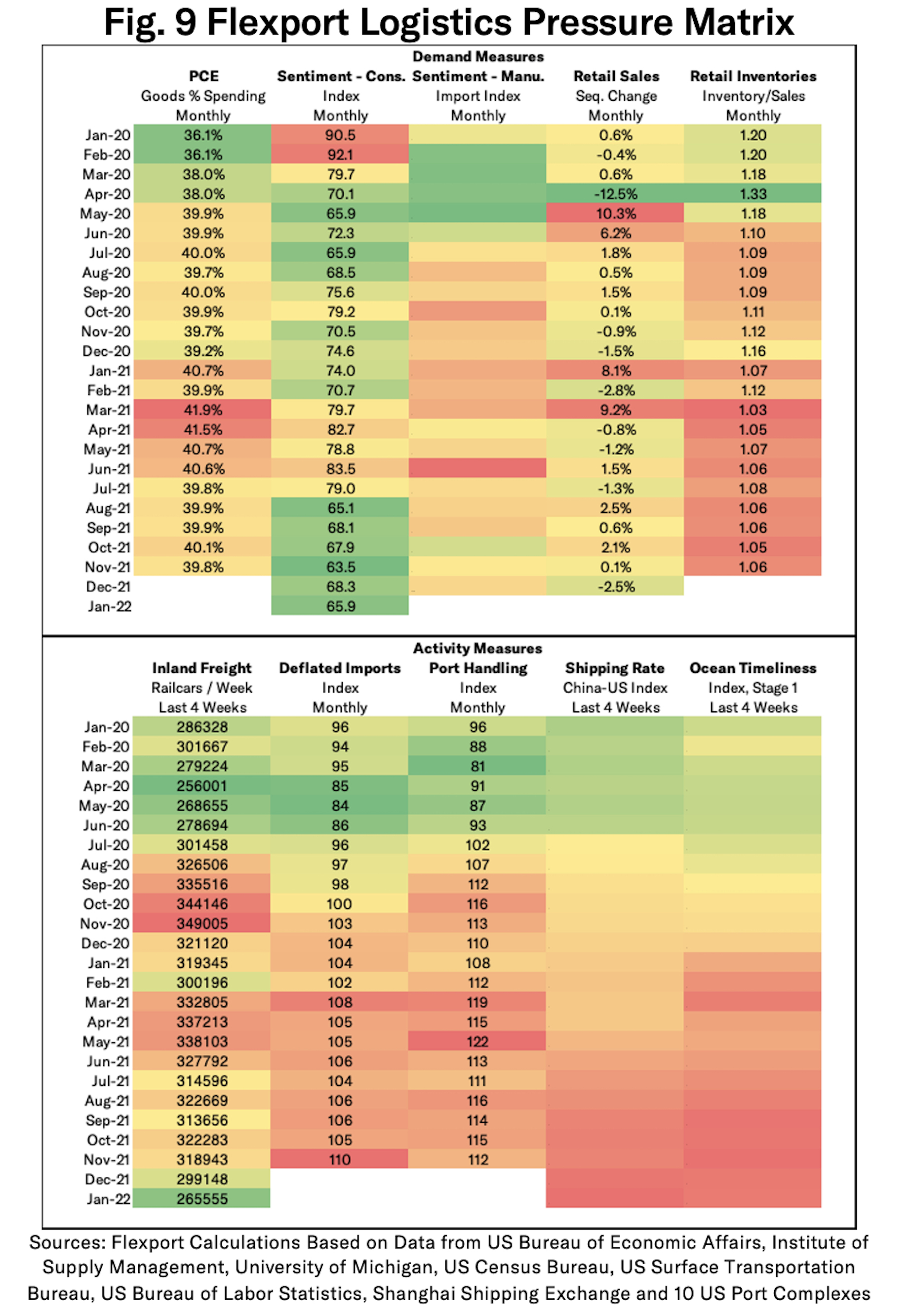

Flexport’s Guages

Another freight forwarder, San Francisco-based Flexport Inc., last year developed its Post-Covid Indicator to try to pinpoint the shift by American consumers back to purchasing more services and away from pandemic-fueled goods. The latest reading released Jan. 14 “indicates the preference for goods will likely remain elevated during the first quarter of 2022.”

Flexport has a new Logistics Pressure Matrix with a heat map showing demand and logistics trends, and much of those numbers are still flashing yellow or red. Flexport supply chain economist Chris Rogers said in a recent online post that similar grids for Asia and European markets will be part of the research.

The Federal Reserve’s Stress Monitor

Adding their stamp to the burgeoning genre of supply stress indicators were three Ph.D. economists from the Federal Reserve Bank of New York, with the launch its Global Supply Chain Pressure Index. Rolled out earlier this month, it shows that the difficulties, “while still historically high, have peaked and might start to moderate somewhat going forward.” The New York Fed said it plans a follow-up report to quantify the impact of shocks on producer and consumer price inflation.

Morgan Stanley’s Index

Less than a week later came the Morgan Stanley Supply Chain Index. It lined up with the Fed’s view that frictions have probably peaked, though some of improvement ahead will come from a slowdown in the demand for goods.

“Supply disruptions remain a constraint to global trade recovery, but as firms continue to make capacity adjustments to address them, capacity expansion could mitigate these,” Morgan Stanley economists wrote in a report Jan. 12.

Citigroup’s Tool

Citigroup Inc. last week released research that was less optimistic yet complementary to the New York Fed’s work, which Citi said doesn’t factor the role of surging demand as a contributor to the supply disruptions. Sponsored Content The Collaboration Disconnect Atlassian

Co-written by Citi’s global chief economist Nathan Sheets, a former U.S. Treasury undersecretary for international affairs, the bank’s analysis “gives a more complete, and intuitive, picture of the current situation.” While strains may ease in coming months, Citi said, “these supply-chain pressures are likely to be present through the end of 2022 and, probably, into 2023 as well.”

The Keil Institute’s Flows Tracker

In Germany, the Kiel Institute for the World Economy updates twice a month its Trade Indicator, which looks at flows across the U.S., China and Europe. Its latest reading Jan. 20 shows that along the key trading route between Europe and Asia, there are 15% fewer goods moving than there would be under normal times. The last time the gap was that large was in mid-2020, when many economies were reeling from initial lockdowns, Kiel said.

More recently, “the omicron outbreak in China and the Chinese government’s containment attempts through hard lockdowns and plant closures are likely to have a negative impact on Europe in the spring,” says Vincent Stamer, head of the Kiel Trade Indicator, said in a post last week. “This is also supported by the fact that the amount of global goods stuck on container ships recently increased again.”

Baltic Dry Index

The Baltic Dry shipping cost index indicates that costs for shipping materials such as iron ore have decline to where it started under Biden, despite West Texas Crude Oil spot prices begin considerably higher thanks to Biden’s anti-fossil fuel policies.

So as the world comes out of Omicron (and whatever COVID variant rises to take its place), we should see a normalization in the supply chain. And with Intel building a new chip factory in New Albany Ohio (aka, outskirts of Columbus). the supply chain woes will eventually subside.

Then again, there is always the Russia-Ukraine tension that may erupt into a disaster. I suggest that President Biden sent Hunter Biden to Moscow to negotiate on behalf of The Ukraine.

Ain’t it funky now. The US’s new ambassador to Russia?