The #1 question I’m asked these days is…

“Are stocks in a bubble?”

Defining a bubble in stocks is extremely difficult because stock prices are based heavily on Treasury yields, and Treasury yields are at ridiculously low levels due to the fact that the Fed is currently spending $960 BILLION per year buying Treasuries.

Think of it this way, if the 10-Year U.S. Treasuries is yielding 1.36%, and that is the “risk free” rate which you would earn lending money to Uncle Sam, what would you be willing to pay for growth from the stock market?

18 times earnings? 20 times earnings? 22 times earnings?

You get my point.

If Treasury yields are kept low, you can argue that stocks are “cheap” even at valuations that no one would be willing to buy a private business for with their own money. Do you think Uncle Bob would buy a carwash for 22 times what it makes per year? Yeah, me neither.

This is one of the key reasons why Central Banks love Quantitative Easing (QE) so much. It doesn’t do much for the economy or job creation, but it allows them to reflate the financial system by pushing the risk-free rate of return (the rate against which all risk assets including stocks are measured) to levels that the bond market wouldn’t tolerate otherwise.

So how are we to measure a bubble?

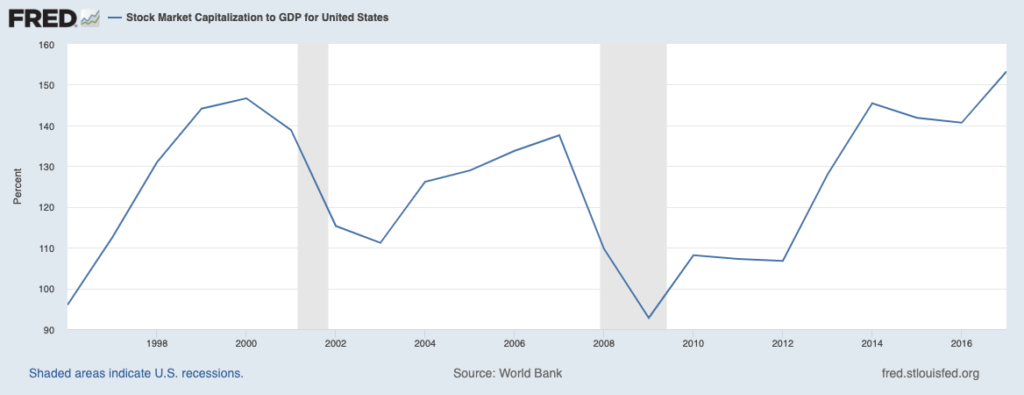

Warren Buffett’s favorite measure for stocks is to compare the market cap of the stock market to U.S. GDP. By that metric, the stock market is more overvalued today than it was during the Tech Bubble of the late 1990s (153% vs 146%).

Suffice to say, this is a bubble. And technically it’s a bigger bubble than the Tech Bubble, which was widely considered to be the biggest stock market bubble of all time.

Obviously, this bubble, like all bubbles, will eventually burst. Smart investors are preparing for this in advance.

With that in mind, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the general public.

To pick up your copy of this report, FREE, swing by:

phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist