via Zerohedge:

When it comes to China, the past decade revealed two things beyond a shadow of a doubt: i) all of the country’s economic data is utterly meaningless as it is entirely fabricated (in this measure it is not much different from other developed nations), goalseeked to fit a specific political narrative, and ii) Beijing has an annoying Trotskyite habit of doing precisely what it vows not to do or accuses others of doing.

A good example of the latter was again observed last night, when Premier Li Keqiang said that China will stick to its current targeted economic support strategy and resist the temptation to engage in large-scale stimulus like quantitative easing or a massive expansion in public spending.

“We certainly need to take strong measures to face the downward pressure,” Li told a news conference Friday at the close of the annual National People’s Congress session in Beijing. “An indiscriminate approach may work in the short run but may lead to future problems. Thus it’s not a viable option. Our choice is to energize market players.”

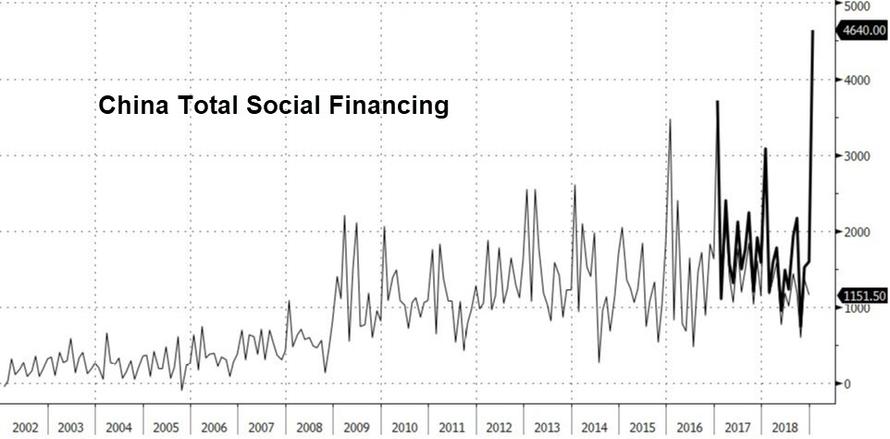

This is ironic because just over a month ago, China quietly launched a quasi-QE program in the form of the PBOC buying perpetual bonds issued by local banks, to flood the system with liquidity and achieve the same end goal as more conventional quantitative easing, and which Rabobank described as a means to keep China’s “Ponzi scheme afloat.”

Just as ironic was Li’s vow not to flood the economy with stimulus, read new debt, one month after the PBOC flooded the economy with a record amount of new debt. Of course, this being China, nobody inside the country will dare to call out Beijing on its hypocrisy for fears of immediate incarceration, as for outside economists, all they care about is to make sure that China will continue its massive reflation of both the domestic and global economy, just to make sure their own optimistic forecast are met, even it means even more pain down the road.

It wasn’t just Li’s double-faced narrative that dominated the last day for the NPC: China’s annual gathering of leaders that started last week has delivered a raft of policy initiatives, while maintaining a focus on using tax cuts and other “targeted” measures to address the weakness in output, Bloomberg reports. Sparking fears in Beijing – which is mostly terrified of a lower/middle class uprising resulting from mass layoffs – China’s deepening slowdown has pushed unemployment higher, intensifying pressure on that calibrated stimulus strategy.

Sure enough, Li reiterated the government’s new emphasis on preventing large-scale job losses in the wake of the slowdown, a day after data showed the unemployment jumped to 5.3 percent in February, the highest level in two years.

Taking a cue from the Trump playbook, Li said the “employment first” strategy put jobs on the same level of priority as fiscal and monetary policy. He also elevated the number of jobs the economy will create “in practice” this year to 13 million from the 11 million target announced last week in his economic policy report although amid reports of mass layoffs in trade-linked companies, it is not exactly clear how Beijing will force companies to hire more people than they are currently firing.

Meanwhile, as part of a separate massive fiscal stimulus, the tax cuts announced last week could exceed the proposed plan of 2 trillion yuan ($298 billion) this year. Included in that total is a cut of 3% to the top bracket of value-added tax aimed at benefiting the manufacturing sector. Policy makers have also cut bank reserve requirements multiple times since last year, releasing liquidity for lending. Li indicated use of that tool would continue.

Separately, Li also hinted at more wholesale monetary easing: “We can use price tools such as reserve-requirement ratios, interest rates,” Li said. “We are not going toward monetary easing, but effectively supporting the real economy.”

The bottom line, according to Li: keep the economy stable and within its historical range: “We won’t let the major economic indicators slide out of their proper range.” Supposedly this means Beijing will be forced to hire even more excel goalseekers to make sure “data” does not deviate from its political mandate.

Curiously, the record size of the tax cut wasn’t matched by an equivalent expansion in the size of the government’s targeted budget deficit, which was nudged wider to 2.8% of gross domestic product from 2.6% in 2018. As part of measures to plug the gap, Li announced that the government has already raised 1 trillion yuan in transferred profits from state-owned enterprises and banks.

How will the government achieve this seemingly impossible mathematical quest? Simple: by admitting that China is a ponzi, where the profits generated from new debt are recycled into the government:

“The central government is determined to ask specific financial institutions and some state-owned enterprises to increase the profits they turn into the national treasury,” Li said. “We’ll also take back the idle funds accumulated over a long time.”

* * *

Besides unveiling how China hopes to kick the financial can for a few more years, Li also touched on some other key topics such as U.S.-China ties, where Li stuck to the message China has pushed for months, reiterating that there were “broad common interests” between the two sides and that they should seek “win-win” outcomes. He said that trade talks between were still underway and that China hoped that “good outcomes will be delivered out of those consultations.”

Li also responded to criticisms from the U.S. and other Western countries that Chinese tech giant Huawei Technologies Co. helps the Chinese government spy. Chinese national security laws require that any organizations must cooperate with national intelligence work – raising fears that the government could lean on Huawei to compromise a telecommunications network in another country.

“Let me tell you explicitly. This is not consistent with Chinese law, this is not how China behaves,” Li said. “We did not do that in the past and will not do that in the future.”

Coming from a man who vowed not to engage in massive stimulus just as China is engaging in massive stimulus, the last statement is hardly a surprise.