Recession Fears Spike To 2011 High As Risk Of Bubbles Spreads

Recession fears are spreading among investors at a time when valuations across major assets are looking dangerously stretched following years of monetary stimulus, the latest Bank of America Corp. survey shows.

About a third of asset managers polled believe a global recession is likely in the next 12 months, the highest probability since 2011 — when Europe was engulfed by a sovereign-debt crisis. Trade war concerns rose, topping the list of the biggest tail risks, followed by the fear of monetary policy impotence, according to Bank of America’s report.

This month’s escalation in the U.S.-China trade spat sent investors searching for havens as the growth outlook darkened. Central banks across the world this year have been trying to support the economy by pledging further stimulus. However, such efforts have also increased the threat of bubbles in key markets.

Morgan Stanley: Bear Market Started In January 2018 – About To Get Worse

As Wilson explains, “this trend is consistent with the persistently negative sentiment seen during the bear markets of 2008-2009 and 2015-2016 and helps to reinforce our view that we have been in a rolling bear market since early 2018.” A key difference between today’s environment and those periods is that the market has made multiple new highs since January 2018 while sentiment has been depressed. This reinforces the notion that, below the benchmark level, there has been little confidence, and returns have been difficult to generate. And as MS further notes, “the pessimistic sentiment/positioning environment we have been in is a reflection of the challenging asset allocation backdrop that has persisted since early 2018.”

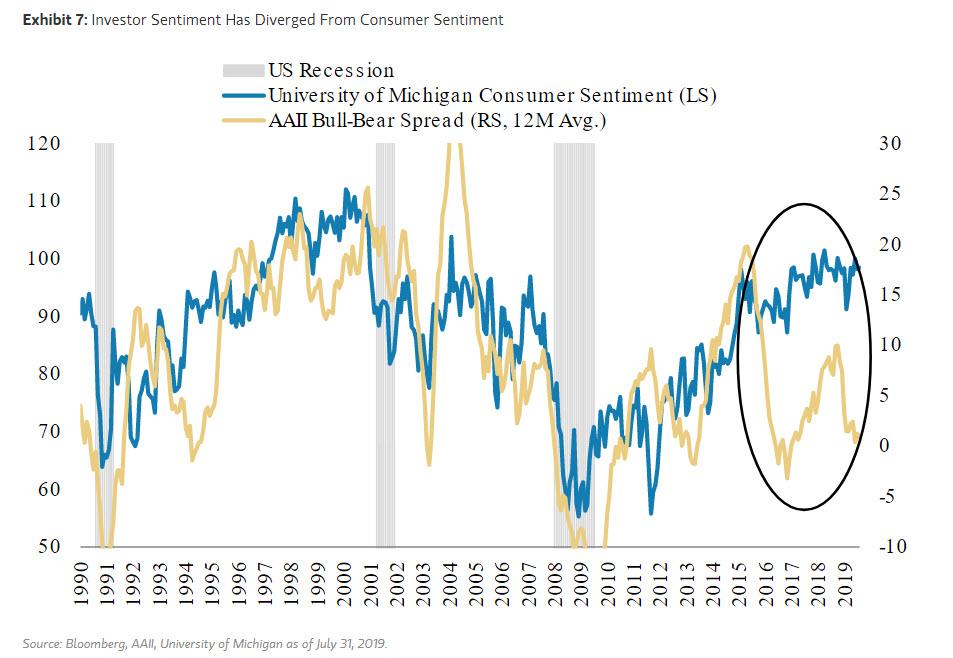

Wilson also finds it interesting that individual investor sentiment – as measured by the AAII Survey Bull vs. Bear Spread – has meaningfully diverged from consumer sentiment. Despite the fact that the market is still near all-time highs and consumer sentiment has remained elevated, individual investors have expressed a more pessimistic tone. This is in line with what MS has been pounding the table on in recent months, as the bank believes that “late 2017/early 2018 was the euphoric top for this cycle and do not expect… individual investor sentiment to return to euphoric levels for a sustained period of time before the end of this cycle.”

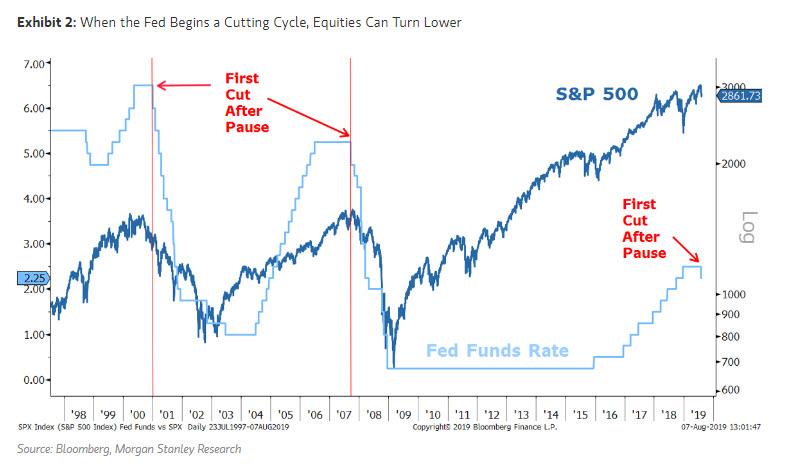

Curiously, it may have been none other than the Fed that vindicated the Morgan Stanley bearish call. As Wilson writes, explaining why he thought recently the S&P would fail to break out – as has been now confirmed – whereas many commentators have either blamed the Fed’s poor communication or the re-escalation of trade tensions, Morgan Stanley thinks it is more about the market simply focusing back on fundamentals and risks that were always there. And as noted on many prior occasions, a Fed pause is always bullish for stocks but once the Fed actually starts cutting rates, it typically spells trouble because cuts usually accompany the end of the cycle, not a mid cycle pause. All one has to do is look back at the last two cycles to see that once the Fed cut it did not bode well for equity markets.

That’s precisely what appears to be happening this time around…. but don’t blame the Fed: according to MS, Powell simply reversed his position over the past 9 months because the outlook for the economy, both here and abroad, deteriorated significantly, and as a result, Wilson believes that many investors are too complacent about the risks to the US economy from the ongoing corporate profits recession.

Wall Street Sees Even More Fed Rate Cuts Ahead

Morgan Stanley predicting a return to zero. Economists now see the likelihood of three quarter-point reductions before the end of the year, along with multiple moves in 2020 until it becomes clear that the U.S. central bank has staved off a recession.

2-year/10-year Treasury yield curve flattest since 2007

The spread between the 2-year Treasury note yield and the 10-year note yield touched its flattest level since 2007, amid a searing rally in long-dated…