Just as stocks were taking a morning breather while I was enjoying my coffee as I wrote down these first Coronacrisis recession stats, Goldman Sachs churned out a heart-ripping prediction for the end of the week. It’s been a long line of facts to the recession, but the last step is a doozy!

Bank of America warned investors on Thursday that a coronavirus-induced recession is no longer avoidable — it’s already here. “We are officially declaring that the economy has fallen into a recession … joining the rest of the world, and it is a deep plunge,” Bank of America U.S. economist Michelle Meyer wrote in a note. “Jobs will be lost, wealth will be destroyed and confidence depressed.” The firm expects the economy to “collapse” in the second quarter, shrinking by 12%.

I have no argument with where this is going or with stating a recession is already here. Why wouldn’t it be? A recession was already clearly coming down on us and, at least, partially here. I do think calling it the “coronavirus induced recession” could be an attempt by BofA to blame all this on the coronavirus and take the pressure off of banksters and the rest of Wall Street for their roll in assuring it would come.

Nevertheless, it’s certainly fair to say the coronavirus is a massive contributor to what was already building; but look at what was already here economically (red line), and look at what is happening in stocks (green line):

This is what I’ve meant when I said the stock market crash would easily build up spectacular momentum (as it clearly did) because it has a long way to fall to “catch down to” the actual Main Street economy. You can see in the graph above that every bubble in stocks has always fallen back to economic reality. Since this bubble (BALLOON) was stratospherically higher than the Main Street economy, it has a lot further to fall. That assures more room to build up momentum, in order to get back down to where it belongs.

The real picture, however, is really much worse than the graph because the graph shows where the economy was up to the moment when the virus first hit China. Imagine how much worse the entire global business economy is (US included) now. The market has that much further to fall to price down to match the new economic reality. Then imagine how much further the entire global economy (US included) will fall this month, and know the stock market has to fall that much further, too. Then next month as the viral-induced damage continues.

That is a summary in one snapshot of why I called this, back in January, “the most perilous stock market in history!”

Charting unexplored waters to fall off the edge of the world

Now, here are a few stats showing where we went at the tail-end of February just as all of this was beginning to take hold in Europe, Australia, and the US.

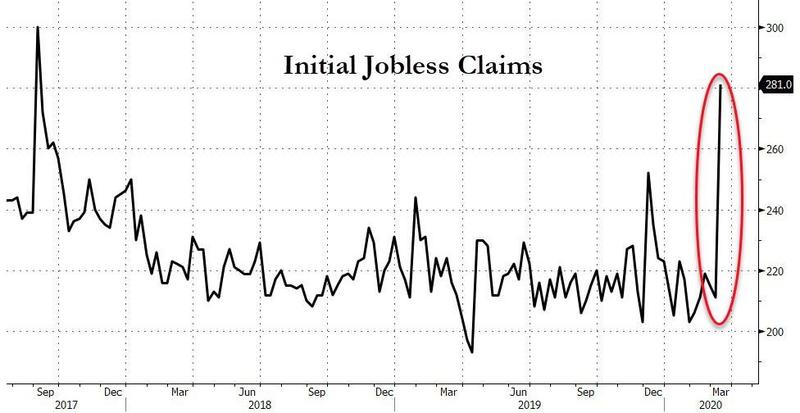

First, Zero Hedge published a hint of the jobless claims that BofA says will be quickly rising:

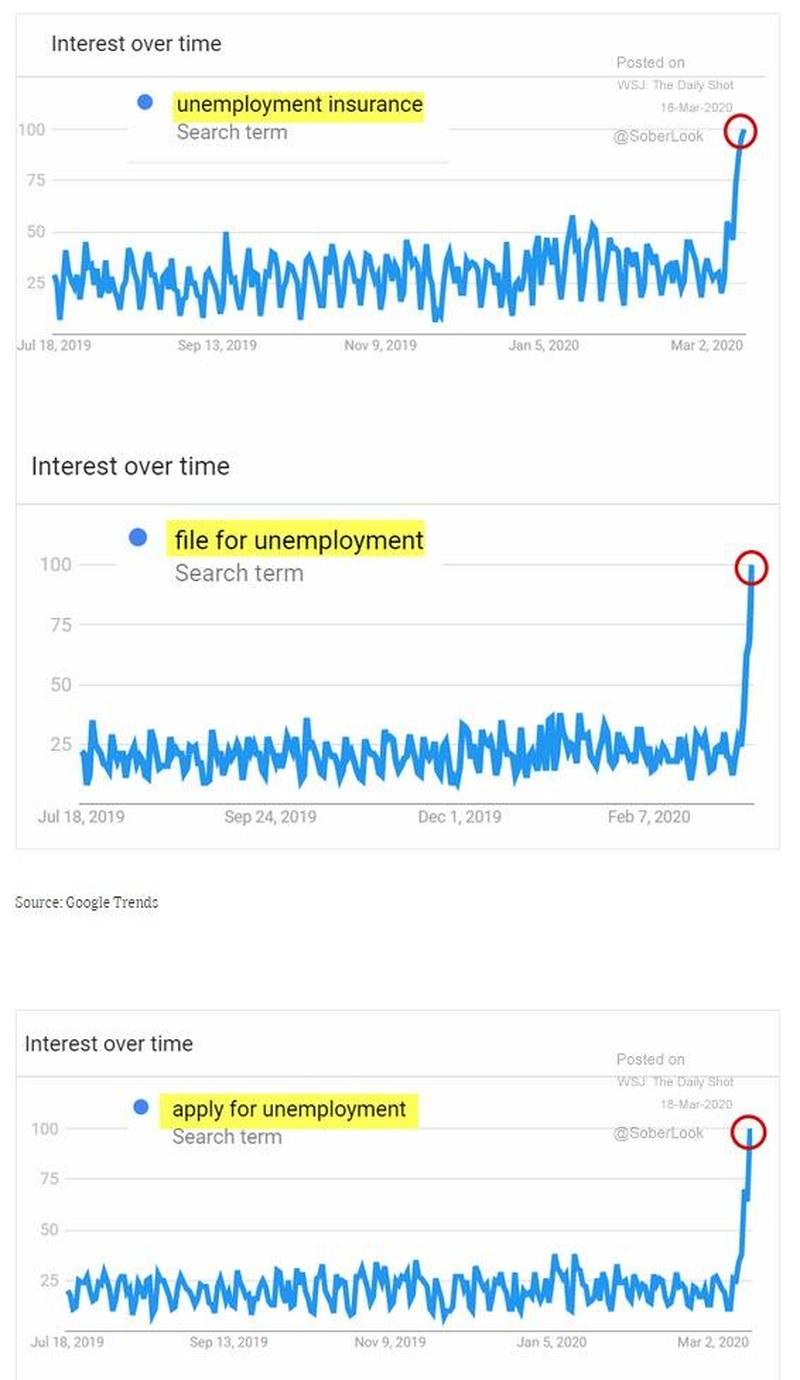

Looking at what people are looking for gives you a good idea of where they’re headed. Then the actual report came out and confirmed a perfect match:

That was for the week that ended on March 14. So, the last holdout in a recession that was already forming (a change in unemployment) is now fully in due to the Coronacrisis kicking our butts down into the recession hole, which we were already leaning far out over. We were an easy kick.

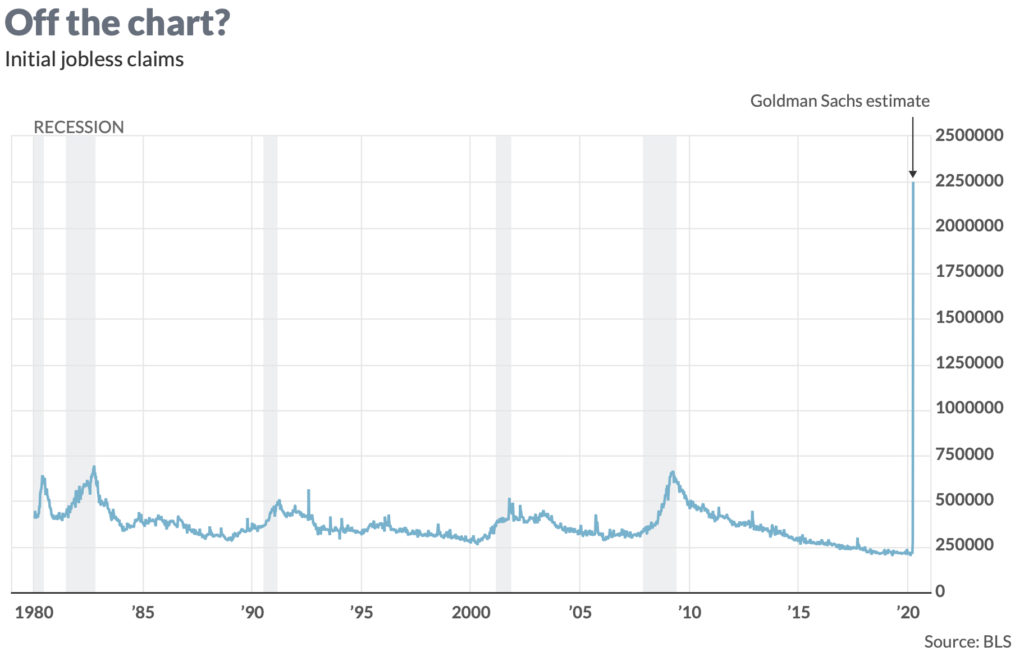

But it gets a lot worse quickly … almost immediately:

That is not anything compared with what is in store.

David Choi, an economist from Goldman Sachs, says initial [unemployment] claims for the week ending March 21 may jump to a seasonally adjusted 2.25 million. His analysis is based on recent anecdotes from press reports as well as company announcements. Over 30 states have provided preliminary data. He said that even the most conservative assumption would be claims reaching over 1 million, which would top the record high of 695,000 in 1982.

And with that, the market ended its morning rest, plunged another 900 points down and closed off its worst week since the big crash of 2008.

Maybe that’s media scare, but remember GS is usually the perennial optimist as it tries to pump the market up. Of course, I wouldn’t put it past them to have shorted the whole market in order to make a vast fortune and then to stomp it down as hard as they can.

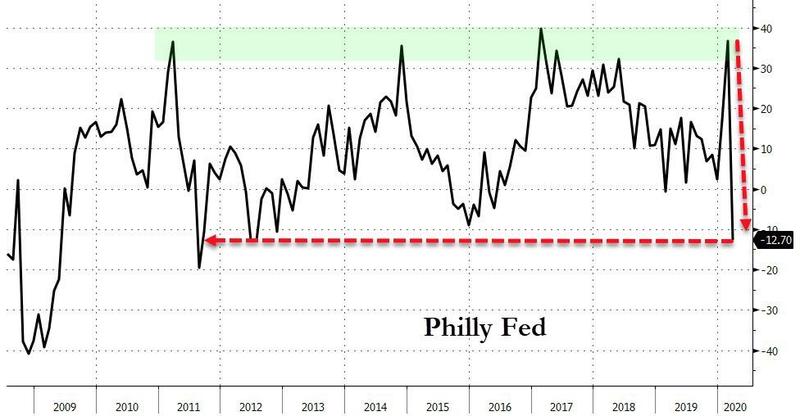

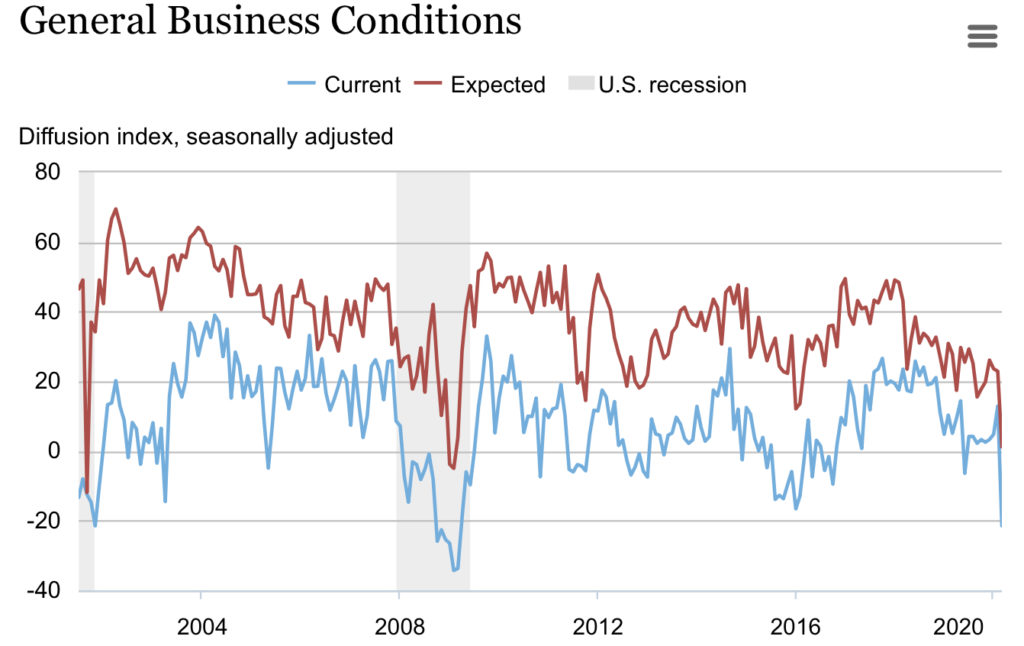

Regardless, it is fully safe to state unequivocally the virus quickly knocked down the blip of hope that had spiked onto the economic radar screens in February, taking the Philadelphia Fed’s Business Outlook Survey back to where it was at the end of the Great Recession:

After dealing with a long down trend since the summer of 2018 (those stimulus tax years), hopes had broken through “biggly” to the upside’ but they are now biggly lower. (From +36.7 to -12.7.) Easy come, easy go. Under the hood, this reflects a huge dump in new orders, shipments, inventories, employment, and prices received.

You can see the Empire State’s March survey looked just as bad, except that it didn’t show as much of a spike of hope in February — same protracted decline since 2018, falling off a cliff this month:

That’s the quickest plunge in the Philadelphia Fed survey’s history — not too surprising since this is the only time in history we’ve seen nations all over the world lock down their borders (US-Canadian border even shut down now to all but commercial traffic and essential visits, and Mexico thanking us for shutting that one) and shut down air travel between nations.

Never before have we seen entire towns scattered all over the world order all non-essential businesses to shutter their doors and windows and send all employees home for a month of bed rest or work from home if they can.

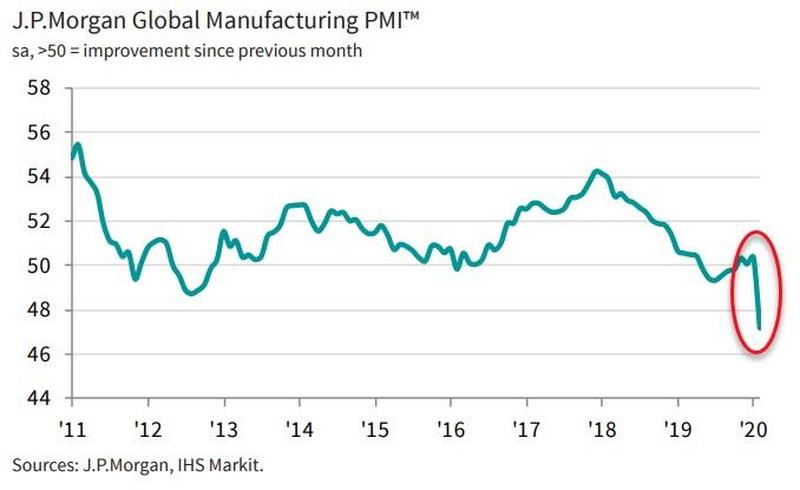

Global manufacturing also took its steepest and mosts immediate plunge in history:

Again, you can see the relentless fall into recession (below “50”) from (this time the start of) 2018 with a bit of hope up that peeked ever-so-barely above recession and then over the cliff.

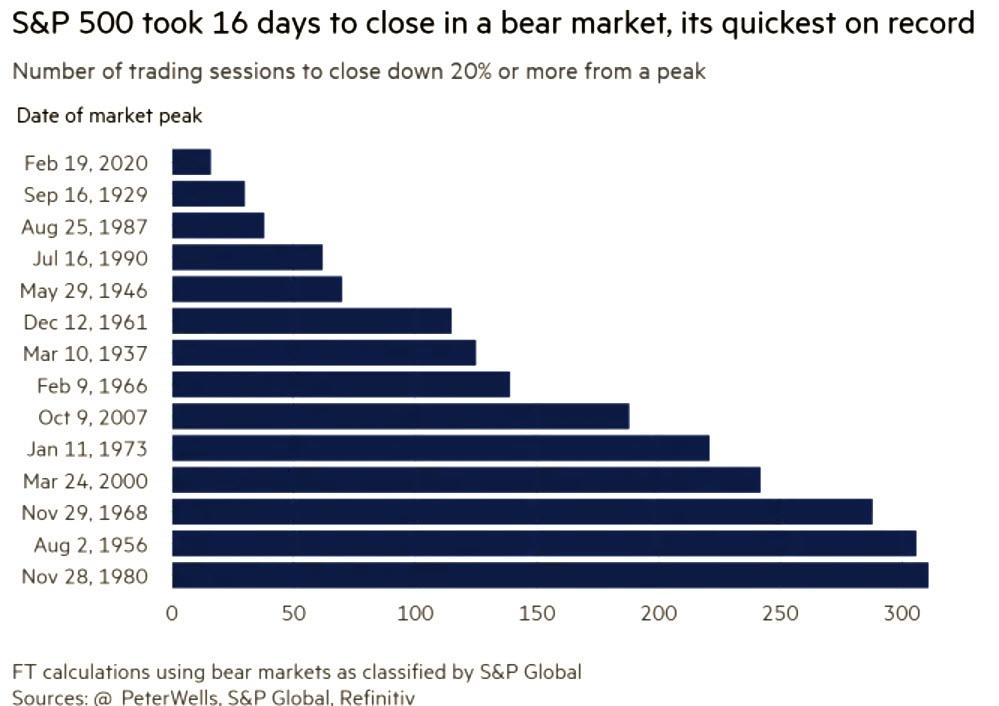

And all of that is why the “most perilous stock market in history” crashed into — BY FAR! — the fastest bear market in history:

So, yes, this is easily the most dire economic event we’ve crashed down into in our lifetimes, unless we you are old enough to have lived during the Great Depression, and I’d say the Great Recession 2.0 is going to be as deep as that, though probably not as long, but who knows? Who would have known an extra-bad case of the flu could shut down the entire planet so quickly?

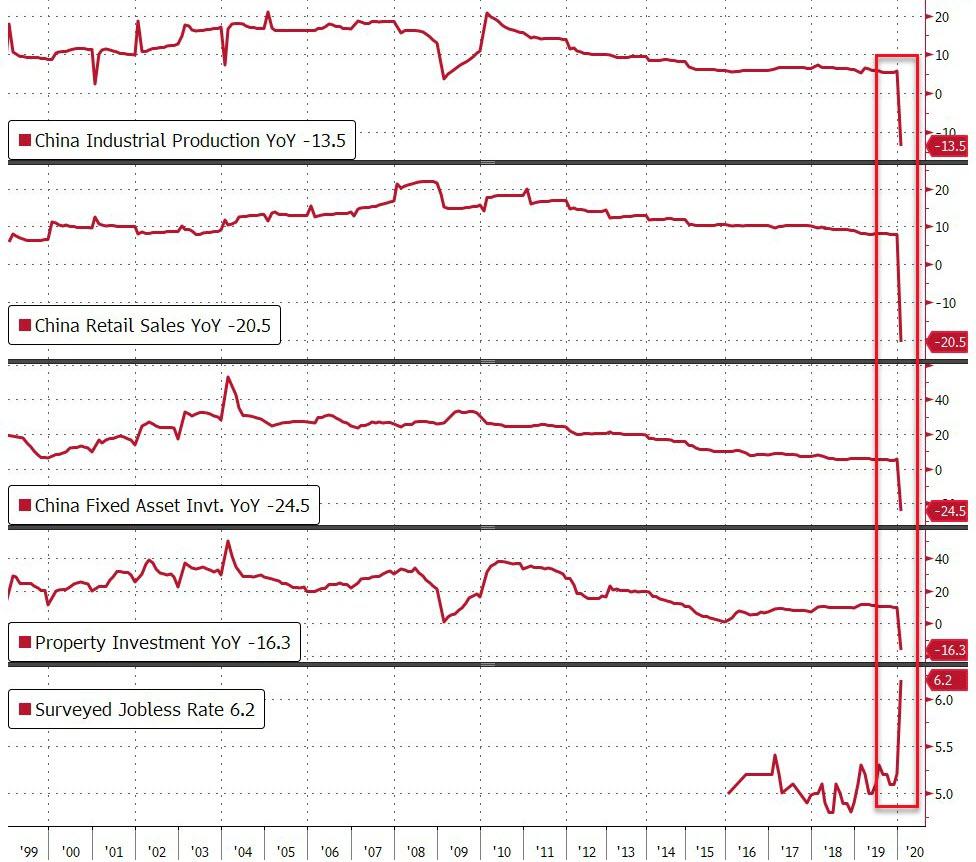

After all, here is what happened in China:

We can expect no better than China got. However, we can expect bailouts … and lots of them. AND we can KNOW that many of them would never have been necessary even now if businesses had not spent all their repatriated profits and all their other cash piles on bailouts to make shareholders richer at the cost of making their companies far less robust for weathering bad times.

We can also KNOW that even those businesses that had no cash piles could have weathered through on cheap credit if they hadn’t maxed out their credit to buy even more bailouts to make shareholders even richer.

Isn’t that one of the reasons for having credit lines? It’s why I keep a couple of credit lines at home — to have an extra cushion or two to land on if times get rough. I’m also prudent enough to know that, if I max out my credit lines when times are good, I’m going to land on the pavement when times go bad and I need the cushions.

So … are we going to let the rich CEOs, shareholders and their banksters bail themselves out with taxpayer backing just because they sucked all the helium out of their cushions when times were fat and happy? That’s up to us! It depends on whether we do anything about it.

I hope we will.