The world of hedge funds has recently garnered notoriety during the GameStop/WSB debacle, in which an us-versus-them mentality began to brew for smaller investors.

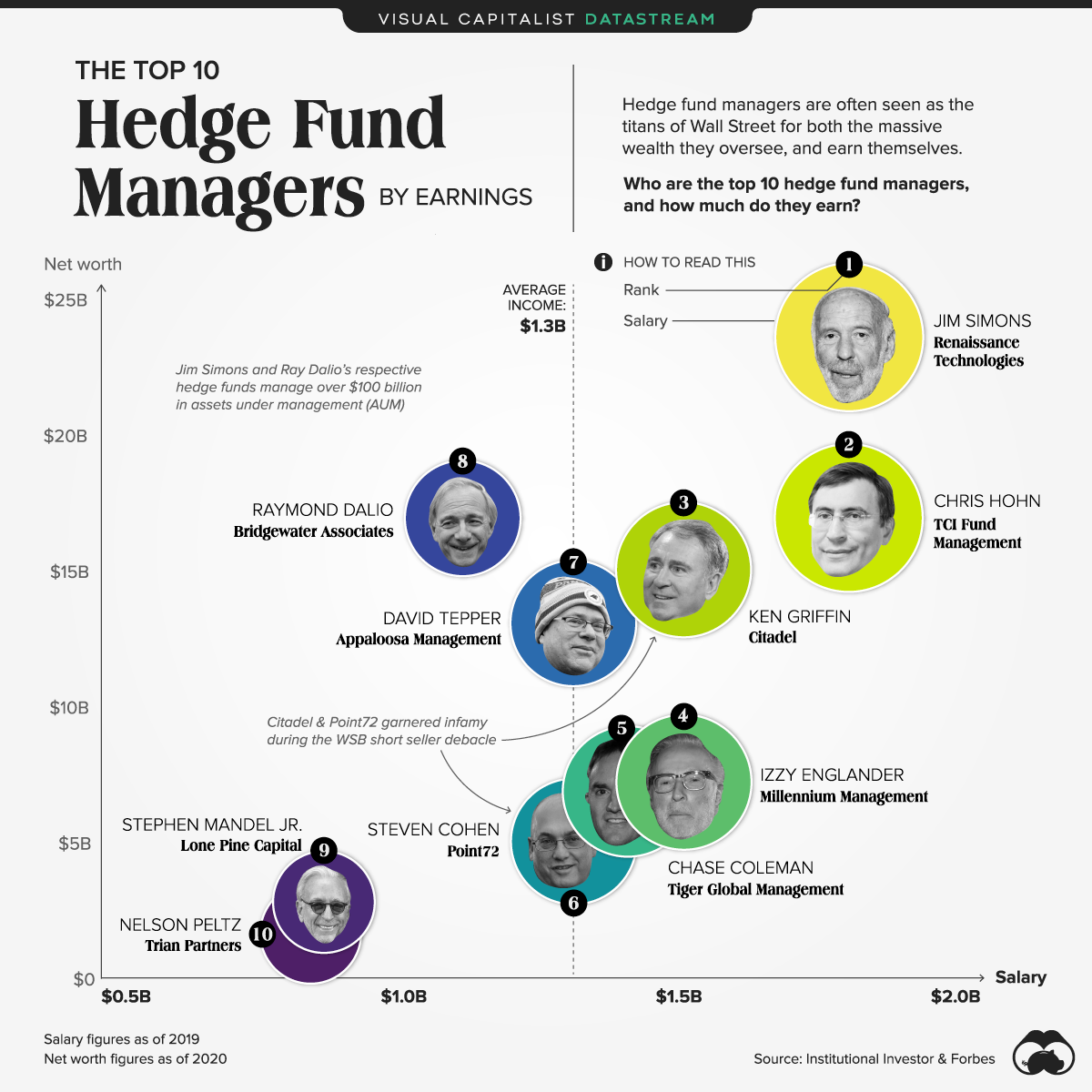

In markets, hedge fund managers are considered the big fish in the pond. Not only do they oversee billions of dollars in capital, they often earn some billions as well. Here’s a look at the earnings of the top 10 managers, where yearly earnings range between a high of $1.8 billion and a low of $835 million.

Entering the World of Billions

Although fees in the wealth management industry have been subject to downward pressure for years, the earnings for the best in the business have been left largely unabated. The historically common fee structure for hedge funds is the two-and-twenty model—that is, 2% of all assets under management (AUM) and 20% of profits based on performance.

This makes out to be a pretty penny when considering hedge fund AUMs go higher than $100 billion, like with Ray Dalio’s Bridgewater Associates. Generous fees charged on an exorbitant value of assets is part in why these 10 managers made it to the Forbes 400 list.

In fact, the top 10 hedge fund managers combine for $108 billion in net worth:

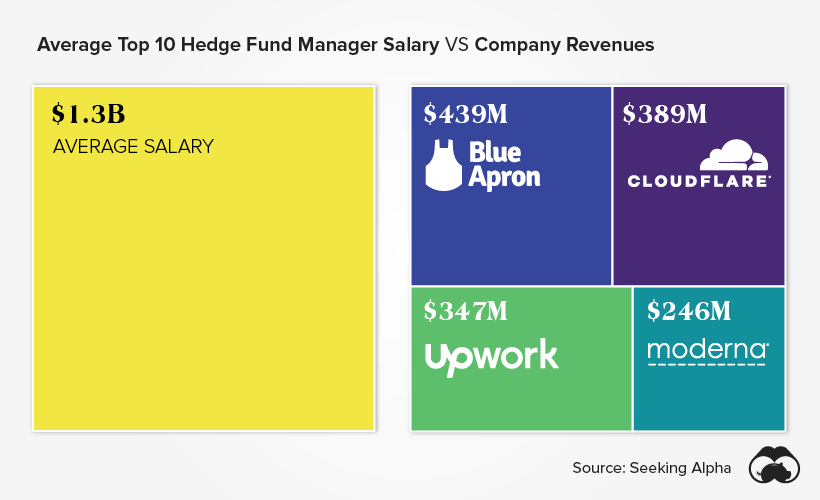

The top 10 hedge fund managers earn approximately $1.3 billion on average. To put into perspective, this is comparable to the annual revenues of notable companies like Moderna, Cloudflare, Blue Apron, and Upwork.

The World’s Greatest Investors?

Hedge fund managers are not your everyday investors.

They often engage in sophisticated investment strategies like shorting, that would leave most market participants scratching their heads.

Take Jim Simons, who recently retired from the board of Renaissance Technologies, which he founded in 1982. Before being lauded as the world’s greatest investor, he was a codebreaker for the NSA and an award-winning academic.

Simons is also known as the “Quant King”, because Renaissance deploys complex mathematical models and statistical analysis to make its investment decisions. Moreover, their flagship Medallion fund has returned 66% per annum since 1998, before counting his additional billions made in fees of course.