via Zerohedge:

Almost ten years after the Great Recession ended, online lenders in the U.S. including LendingClub, Kabbage, and Avant are preparing for an economic slowdown by reviewing their risk exposure, reported Reuters.

The U.S. economy stalled in the last six months, as the threat of a recession surged in March with the 3 month-10 year spread inverting for the first time since 2007.

A slowing economy will amplify credit losses, liquidity crunches, and higher funding costs could strain some digital lenders if not adequately prepared.

“This is very top of mind for us,” LendingClub Chief Executive Officer Scott Sanborn told Reuters in referencing the possibility of a recession. “It’s not a question of ‘if,’ it’s ‘when,’ and it’s not five years away.”

Sanborn and executives at several other online lender shops who spoke with Reuters said economic indicators continue to deteriorate.

Economists polled by Reuters last month saw a 25% chance of a U.S. recession over the next 12 months. More recently, the IMF warned about a synchronized global downturn, indicating that the world is now in a “significantly weakened global expansion.”

“We were seeing economists bringing up some warning signs, and we were following the Fed signals and that they were becoming more dovish,” said Bhanu Arora, the head of consumer lending at the Chicago-based lender Avant. “We wanted to be prepared and ready.”

Arora said he positioned the company for a recession, indicating that tightening credit standards was one way to reduce risk.

Reuters noted that the executives said there were no immediate signs of stress in their loan portfolios, however, with momentum in U.S. growth slowing, they said the time to prepare is now.

If a downturn hits, lenders with the weakest balance sheets will fail first.

“All these different platforms say they can underwrite in unique ways,” said Robert Wildhack, an analyst at Autonomous Research. “This will be the first chance we have to see who is right and who might have been taking shortcuts.”

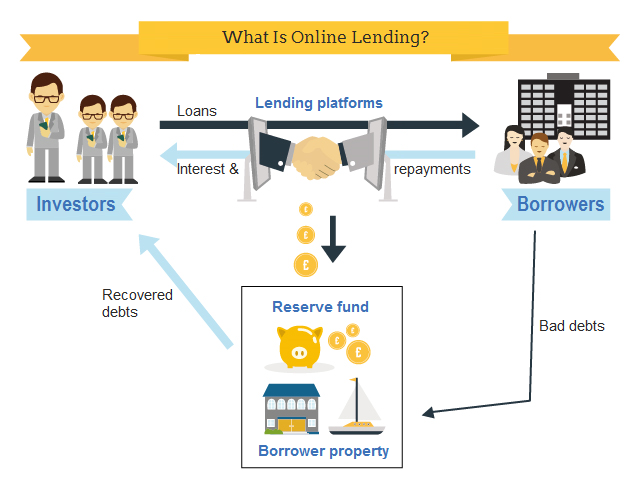

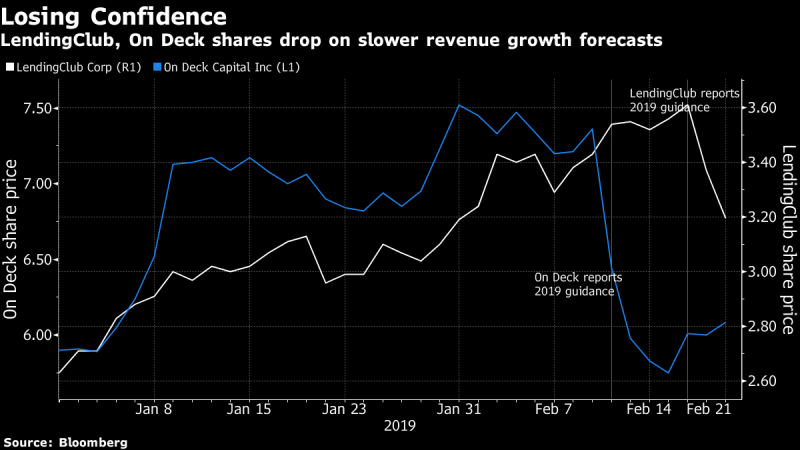

In February, LendingClub guided lower for the year, due to a sign of growing caution in the industry. The company doesn’t provide loans directly to consumers but earns fees by connecting borrowers and lenders on its online platform.

Sanborn told Reuters that tighter lending standards have increased over the last several quarters.

SoFI, an online personal finance company that provides personal loans, has focused on lower loan originations to streamline profitability, CEO Anthony Noto told reporters in late-February.

Atlanta-based Kabbage, which lends to small businesses, recently closed an asset-backed securitization of $700 million. The company said the funds would meet growing borrower demand, but also be deployed in the event of worsening economic conditions.

“We have been waiting for the next recession to happen for the past five years,” said Kathryn Petralia, co-founder and president. “More people feel confident that it’s imminent.”