by Dana Lyons

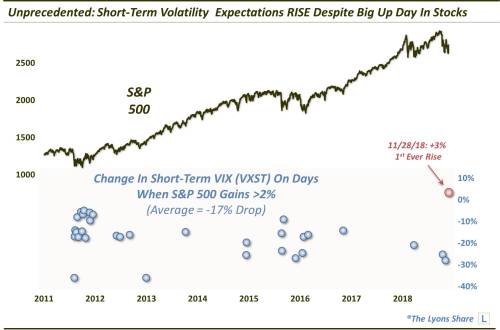

Despite a more than 2% jump in the S&P 500, short-term volatility expectations unprecedentedly closed higher on the day.

Yesterday saw traders (more likely, computers) push stocks sharply higher on the heels of an apparently more dovish Fed. In the case of the S&P 500 (SPX), we are talking about a gain of 2.3% on the day. So does that mean that the re-test is over and stocks are in the clear for their year-end rally? Perhaps not yet, at least according to the volatility market. As most market participants know, volatility expectations typically fall when stocks rise, especially a big rise like yesterday. However, despite the huge up day in stocks, the 1-month S&P 500 Volatility Index (VIX) hardly slipped at all. Furthermore, the 9-day S&P 500 Volatility Index (VXST) actually rose 3% on the day.

If you think that’s unusual, you’re right. In fact, it is the first time since its inception in 2011 that the VXST rose on a day when the S&P 500 closed at least 2% higher.

So what does this mean? Is it smart money fading the Fed-inspired rally…or a manifestation of fear, opening the way for even higher prices based on a contrarian analysis? In a Premium Post at The Lyons Share, we examine this unprecedented development from a historical and quantitative perspective to determine whether these volatility traders are likely correct in their skepticism of the rally – or exhibiting undue fear.