It looks like markets are buying into the prospect of The Federal Reserve raising rates three times (Bob) in 2022. And ceasing COVID monetary stimulus.

Today, the 10-year Treasury yield rose to PRE-COVID levels of 1.783%. And the Freddie Mac 30-year mortgage commitment rate rose to 3.22%, the highest since May 2020.

Today’s rising wage rates (although negative in terms of REAL wage rates) will likely put a Peruvian fire under The Fed’s behind. As of this morning, Fed Funds Futures are still pointing to three rate increases in 2022 (May, July and December).

And The Fed is supposed to be winding down the COVID monetary stimulus.

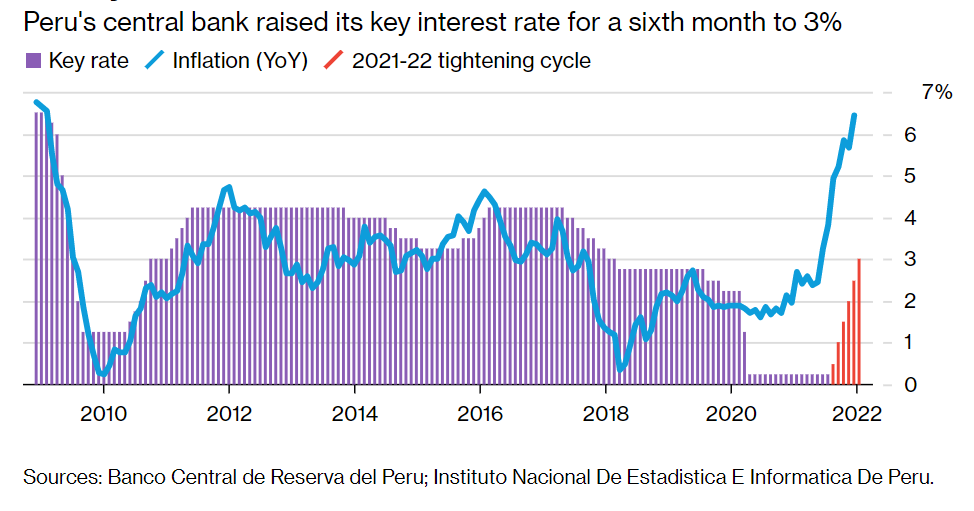

Why a Peruvian fire? Even Peru’s central bank is raising its key interest rate to 3% after soaring inflation.

Let’s see if Powell and The Gang follow through … or reveal themselves to be Peruvian Chickens.