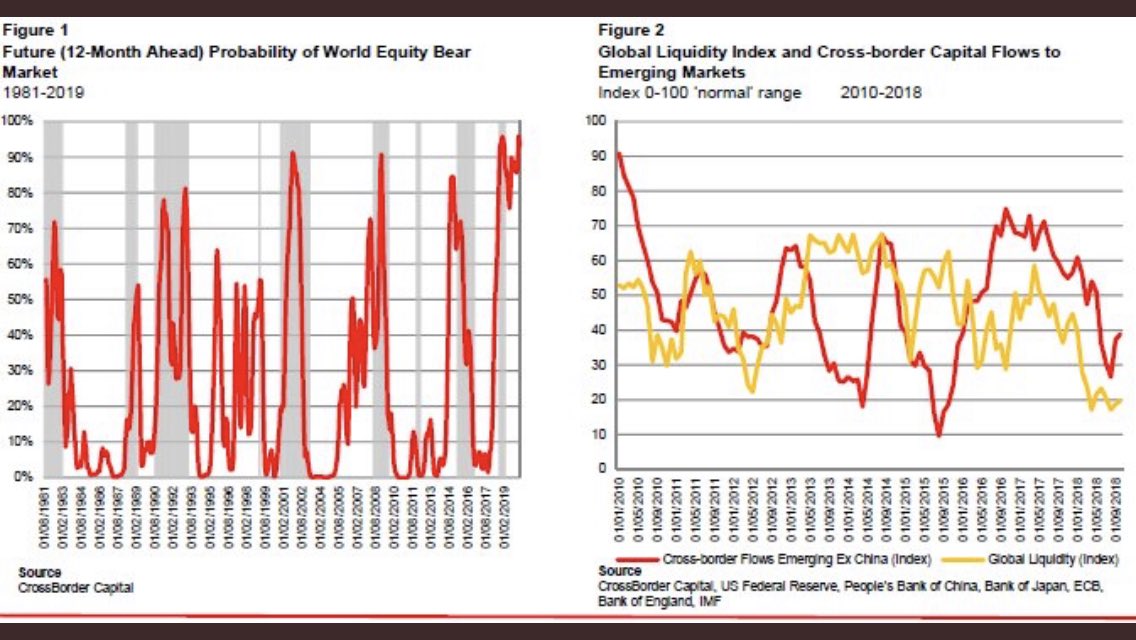

via @crossbordercap:

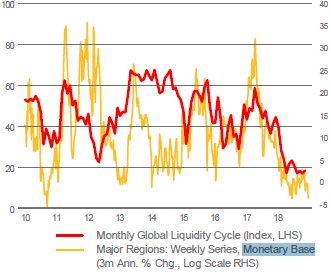

Crashing Global Liquidity is making bonds look pretty good again…

Post-G20, The US Dollar Is Armed And Pointed At Europe For 2019. Could Capital Flows Be The Trigger? http://bit.ly/2SnIdSX

How Low Can They Go? Major Central Banks – China Apart – Tighten Further In current US$ terms, policy liquidity is shrinking at an even faster rate (-6.8% 3m ann.). The unrelenting Fed and US dollar strength are behind the fall.