Yesterday I wrote about the egregious levels of froth that have returned to the financial system.

By quick way of review:

1) Investors poured $1.5 billion into stocks per day in January.

2) Meme stocks and insolvent garbage tech plays are exploding higher by 20%, 30% even 100%+ in days.

3) Financial conditions are now LOOSER than they were before the Fed started raising rates in March of 2022.

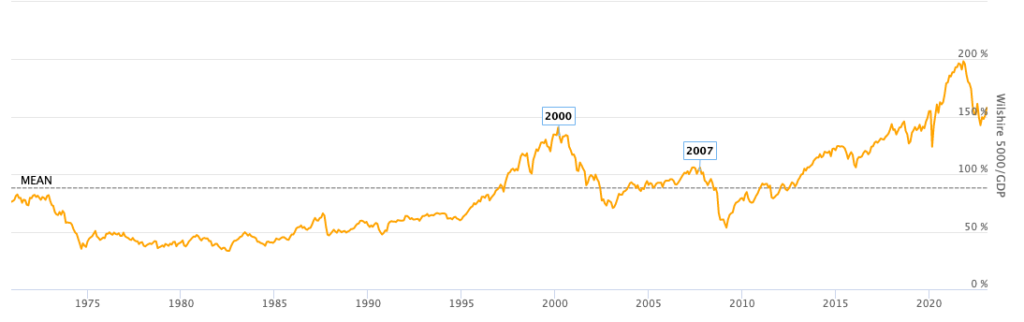

Today, I’d like to share a chart that illustrates this situation to perfection. It’s alleged to be Warren Buffett’s favorite means of valuing the stock market. In fact, Buffett used this indicator to avoid going anywhere near stocks during the Tech Bubble in the late 1990s.

I’m talking about the total stock market’s capitalization as a percentage of the U.S.’s Gross Domestic Product.

The single most important aspect of this chart is the fact that in spite of stocks collapsing 20% last year… this indicator is STILL HIGHER than it was at the PEAK of the Tech Bubble.

Anyone who claims this bear market is over and that the Fed’s work is done is out of their minds. The stock market is now MORE overvalued relative to the economy than it was at the absolute peak of the Tech Bubble.

I fully believe the stock market is going to crash. My proprietary Crash Trigger is on a confirmed “SELL” for the first time since 2007. The only other time it has signaled in the last 25 years was in 2000, right before the Tech Crash.