The Fed is now cornered courtesy of the coming inflationary recession.

Let’s start with the economy first.

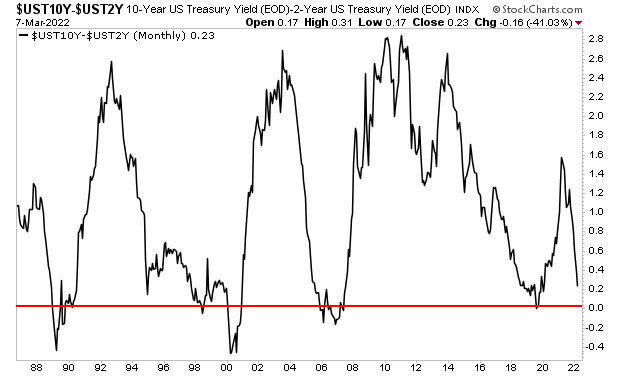

The 2s-10s yield curve is just a 19.4 basis points away from inversion. The last FOUR times this yield curve inverted the U.S. experienced a recession soon after. I’ve identified that line on the chart below:

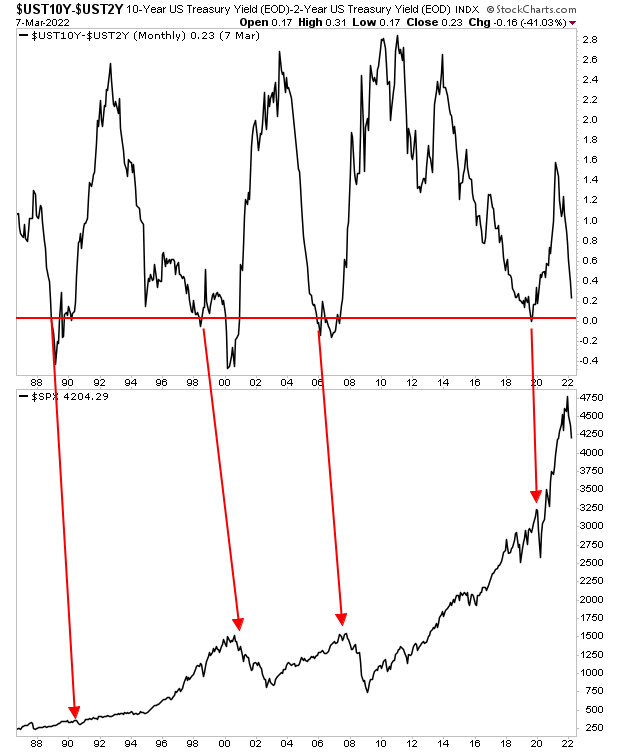

A recession is bad enough news because it means a bear market in stocks and most likely a crash. Here’s that same chart with the S&P 500 below it. Note what happened to stocks soon after the yield curve inversion hit (note that the 1990 market saw a 17% drop, but the chart doesn’t show it well).

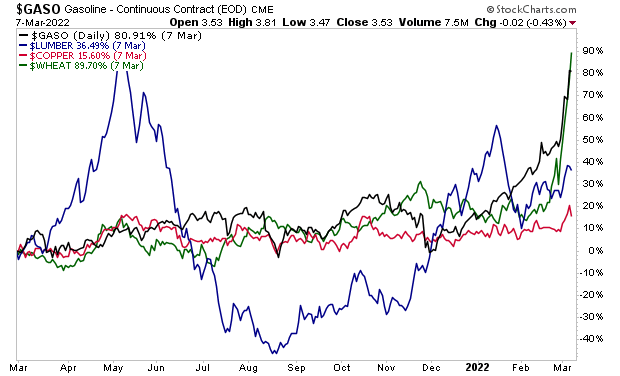

On top of this, inflation is roaring in the financial system. Gasoline is up 80% in the last 12 months. Lumber is up 36%. Copper is up 15%. And wheat has exploded 90% higher!

Remember, the consumer accounts for 75% of GDP in the U.S. What do you think happens to consumer spending when inflation eats into incomes? There is a reason Presidential ratings are highly correlated to gasoline prices!

And all of this is happening when the Fed only just ended QE and still has rates at zero.

Yes, we are rapidly heading into an inflationary recession, and the Fed hasn’t even begun tightening yet. If the Fed tightens to rapidly to kill inflation, the economy collapses. And if the Fed takes its time raising rates, inflation rages, and the economy again collapses.

The Fed is officially cornered. There is no possible way to navigate this mess without disaster. Remember the last four recessions involved a stock market crash. This one will likely prove no different.