via slopeofhope:

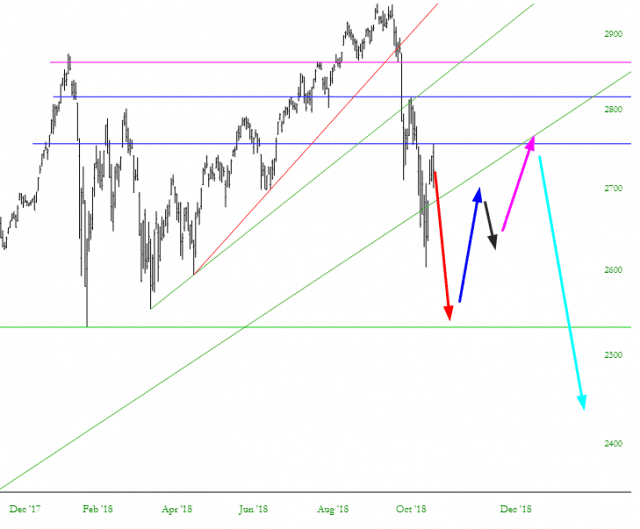

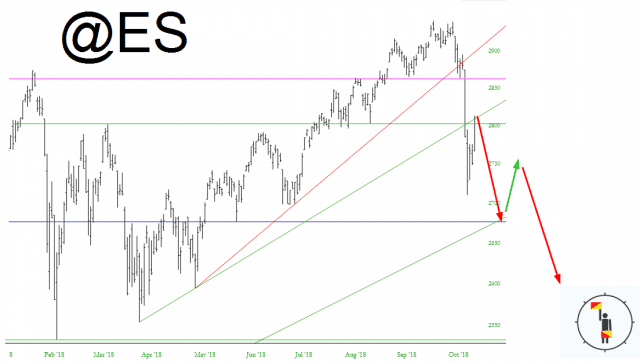

In the middle of last month, I offered up the post Whiskey Tango Foxtrot in an effort to lay out what I thought were some possible paths for the market. Out of an infinity of possibilities, I described fourpossible pathways, and the most bearish of them all, “Delta“, unfolded beautifully. Here was the prediction at the time.

When the market started falling, I was tormented by the prospect that it was just another January 29-February 9 blip. That is, a tease for the bears which would simply result in bitter disappointment. Almost the entire world felt this way, and with good reason: the bears have been cheated for nine solid years, and the BTFD crowd has been winning, so why should it be any different this time? Why not sustain such a thing until, oh, the year 2397?

Even now, though, I can see that the late January/early February selloff was nothing……..NOTHING!….. compared to what has happened over the past month. The kind of damage that October caused was absolutely core to my stratagem. What happened early this year was exciting, yes, but truly was nothing more than a cruel tease.

Having had such a dynamite month (+27.7% in October with a simple equity account, nothing fancy) I naturally want to pad those gains. Two Fridays ago, the 26th of October, I pulled in my bear horns (as it were) and wrote at length about the ensuing bounce. That bounce, having take place with a furious quadruple-point gain on the Dow has, God willing, passed.

Therefore, after my satisfactory performance with the aforementioned WTF post, I’d like to throw caution utterly to the wind and do the insane: lay out ONE scenario for the rest of the year. Now at this point, all of you “the future is impossible to predict” crowd should probably leave, since there’s not much point in reading this, but for the rest of you, allow me the opportunity to describe a pathway which we can at least agree is possible. And, should these prediction turn out to be a total joke, I pledge to my non-premium users a 300% refund on the fees they give me, which would turn out to be $0.

I’ll lay this out in five steps. The direction and size of the direction is what I’m predicting more than the timetable. So here is the Omega prediction:

- The resumption: the selling will resume, and with strength, swiftly re-igniting fears that this is something more than what we’ve seen before. How the midterms plays into this is a mystery. Perhaps we’ll sell off really hard for Monday and Tuesday, and the elections will go hugely in Trump’s favor and end the selloff. Or perhaps the election will be a shocker and cause the market to plunge. It doesn’t much matter. As I said earlier, Omega is about the direction and sequence, NOT specific dates and events. So don’t you dare hold me to any election prediction, because I’m not offering any.

- The relief: Something substantive will come along that gives the market relief. As I just said, perhaps the election will go in such a way as is considered bullish. Or perhaps there really will be a meaningful US/China trade deal. Whatever it is, it’ll cause committed buying again.

- The doubt: There will be a brief pause in the strength, since there’s been so much selling, and weaker hands will worry that the bounce is already over.

- The assurance: However, this will soon stabilize, and buying will resume, pushing the market even higher than it did the first week of November. “The worst is over” crowd will begin to seem truly credible, and people will look forward to a resumption of a confident bull market in 2019.

- The plunge: Just when things seem calm and the VIX is back in the teens, all holy hell will break loose. Maybe there will be a severe political crisis. Maybe the debt choking the planet will finally start to matter. Whatever it is, an honest-to-God vicious selloff will begin, dwarfing what was seen in the autumn.

This is laid out in the overly-simplistic chart below, with each of the five arrows representing the five steps above.

And I shall leave with you that.