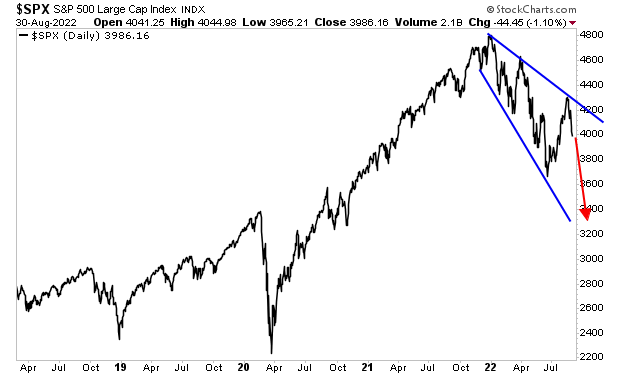

As I warned yesterday, the next crisis is just around the corner.

By quick way of review…

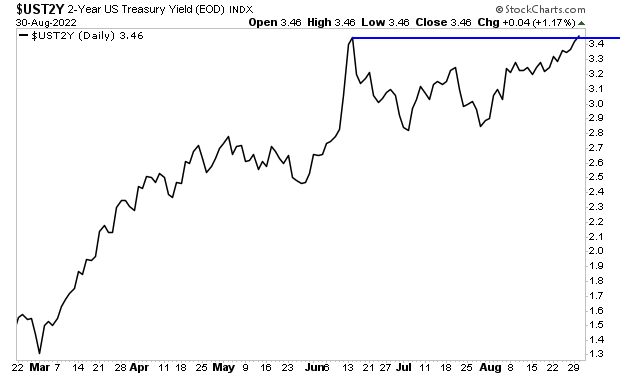

1) The Fed takes its cues on where rates need to be from the yield on the 2-Year U.S. Treasury.

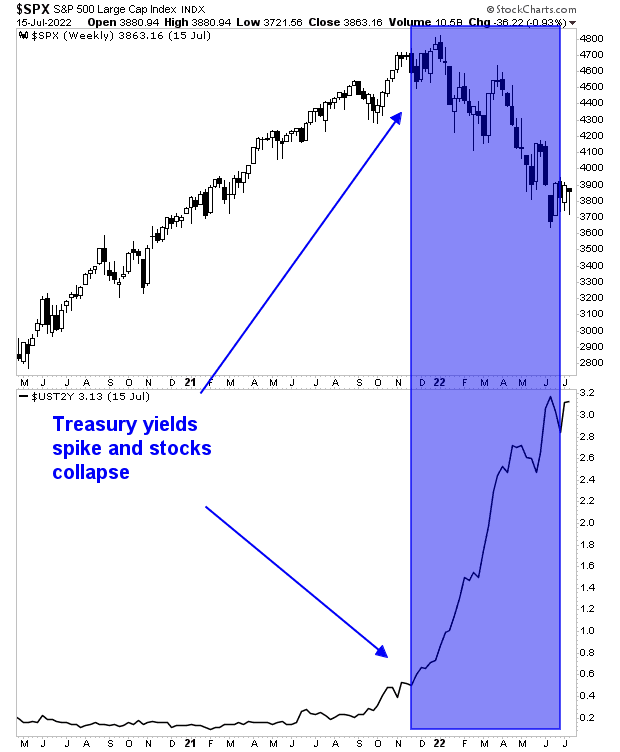

2) Throughout the first half of 2022, the yield on the 2-Year U.S. Treasury has spiked, resulting in the Fed being WAAAAAY behind the curve in terms of inflation.

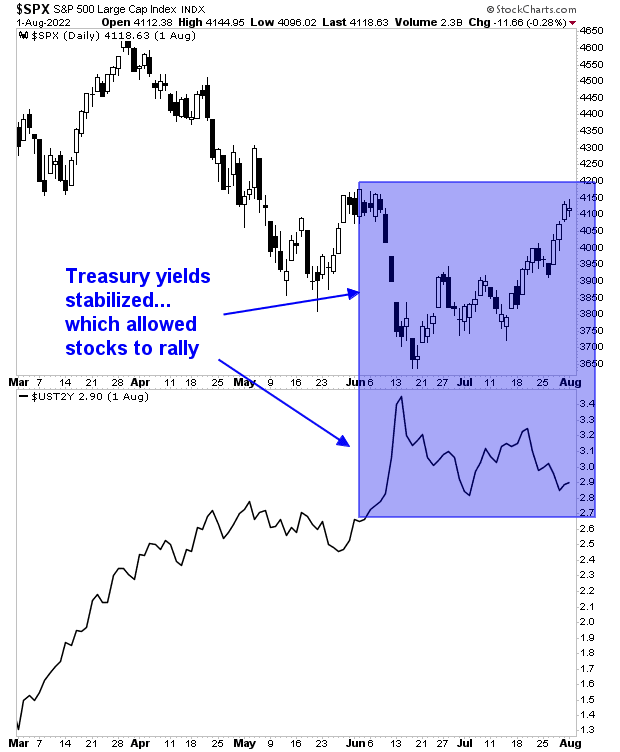

3) Only once the Fed began raising rates by 0.75% did the yield on the 2-Year U.S. Treasury begin to stabilize.

Why does all of this matter?

Because stocks are priced based on Treasury yields. So, when the yield on the 2-Year U.S. Treasury spiked earlier this year, the stock market took it on the chin.

Indeed, it was the fact that the yield on the 2-Year U.S. Treasury had stabilized that allowed the stock market to rally this summer.

Then came the Fed’s monster screw up.

In July, Fed Chair Jerome Powell claimed the Fed is “in the range of neutral” as far as monetary policy is concerned. This is akin to him stating, “we’re done tightening monetary policy.”

It was arguably the stupidest thing a Fed Chair has said since Ben Bernanke stated that “subprime is contained” in 2007. And the bond market just called the Fed’s bluff.

The yield on the 2-Year U.S. Treasury has just broken to new highs. This represents the bond market telling us that it no longer believes that the Fed is serious about tackling inflation. The Fed either needs to get WAY more aggressive with monetary policy (bad for stocks) or inflation is going to collapse the economy (even worse for stocks).

Put simply… stocks are on borrowed time. And the markets know it!