It’s the stock buybacks. Companies are expected to buy back 10% of their market cap this year. They are borrowing money to do it. Likely be a huge credit crisis and crash in the future from it, but enjoy the ride while it lasts.

What Is Driving The Stock Bull Market Higher?

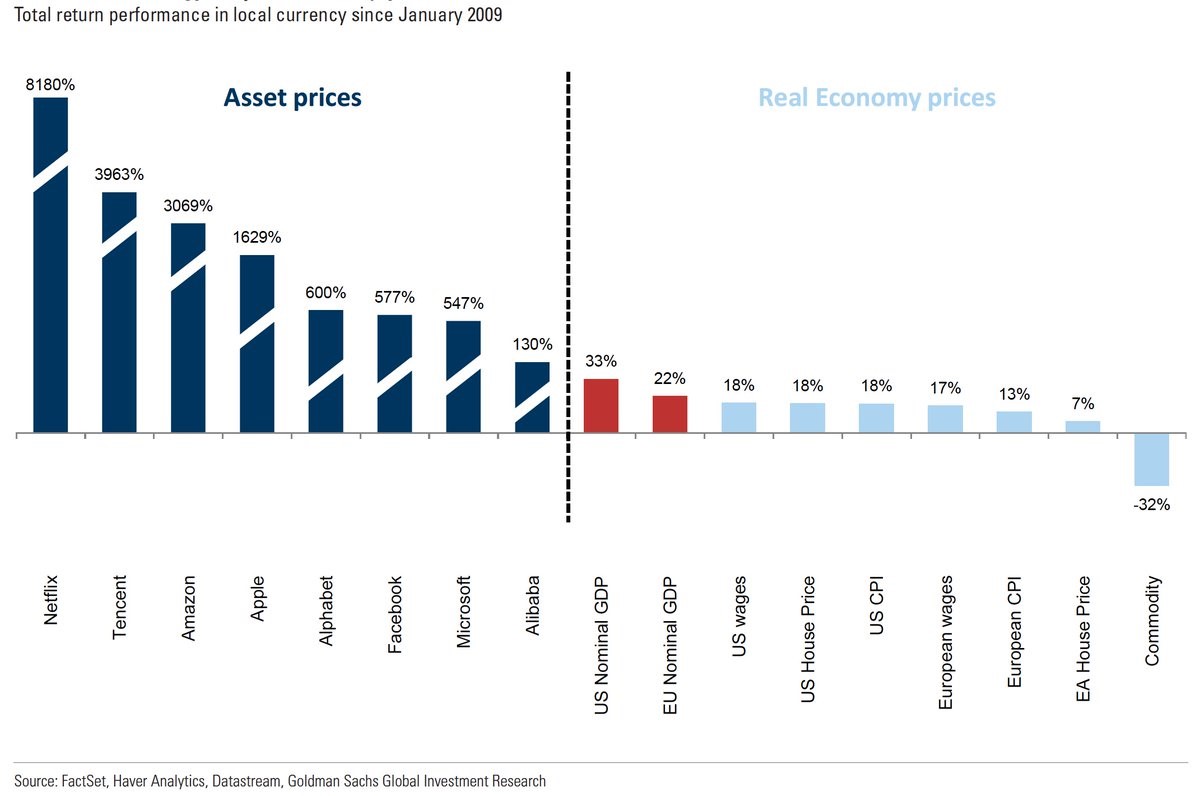

The performance of the internet stocks is very important to the current bull market. They are the market leaders. The chart below from Goldman Sachs compares the total returns of the top internet stocks with GDP growth, wages, inflation, housing prices, and commodities since January 2009.

Source: Goldman Sachs

Bubble-Like Stock Valuations Miss $3.4 Trillion in Hidden Assets

On paper, Autodesk Inc. is a bit of a mess. It’s been losing money for almost three years, and its book value — what’s left if you sell off the assets and repay debt — is negative. Yet over the past year, the stock has gained 23 percent, almost double the S&P 500.

With its sky-high valuation, the software maker would appear to be a poster child for froth amid a nine-year bull run. But to some, it should be seen in a very different light — as a company whose fundamentals are made to look a lot worse than they are by old, and increasingly useless, accounting rules.

“You get numbers which are highly inflated for some companies, and are understated for other companies,” says Baruch Lev, the New York University finance professor whose 2017 paper on the topic ignited a debate about valuation. “It doesn’t make any sense.”

That talk rankles the old school, which hears it as an apologia for stock prices that seem to be bubbling over. But lumping it with dot-com-era gimmicks like price-to-eyeballs misses a larger point tied to the growing role of services in developed countries. As the economy changes, proponents say, accounting standards that made sense for shipbuilders and oil drillers are bound to lose relevance.

Tech Stocks Sorted By Market Implied Odds of a 10% Correction

NFLX and SNAP on top

Volatility may hit Wall Street as Alphabet, Facebook leave tech sector group

Facebook and Alphabet will move from information technology and sit alongside AT&T Inc and Verizon Communications in a broadened telecommunication services sector that will be renamed communications services.

The one chart the middle class is not allowed to see. pic.twitter.com/zKz3khgmaN

— Alastair Williamson (@StockBoardAsset) June 7, 2018

Remember when #Bitcoin & $SPX were coupled? Now they are decoupled. Could that be an ominous sign that stock rally is shortlived? pic.twitter.com/m5COoZo1WI

— Alastair Williamson (@StockBoardAsset) June 6, 2018

— Alastair Williamson (@StockBoardAsset) June 6, 2018

Jordan Roy-Byrne Interview: Similarities to 1999-2001, Stocks, Commodities & Precious Metals

Palisade Radio, Released on 6/6/18

Jordan Roy-Byrne shares his thoughts on the similarities we are seeing in the financial markets currently compared to 1999-2001. We discuss the current trend in interest rates, US markets (particularly tech stocks) and overall commodities.

h/t AlexPitti