It is an acknowledged fact within the circle of Austrian Economists that the Central Banks have to continuously rely on and actively indulge in the propaganda of Voodoo Economics to hide the extreme imbalances that they have created in the world economy.

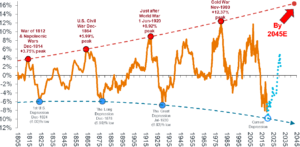

What lies in the decade ahead for much of the Western economies and most parts of the world is a prolonged period of high inflation combined with an economic depression. I should add that if one were to account for inflation correctly, even today, we are probably in stagflation (inflation + recession) already in most parts of the world. But the sleight of hand of Central Banks in the way they underreport consumer price inflation (CPI) will allow them to hide the reality for a few more months. If we draw a comparison between the stagflationary seventies (1970’s in which gold went from $35 to $850/oz, Oil from $3 to $40/barrel, etc.) and what lies ahead. In that, it’s a given that inflation is going to be substantially higher than what we had in the 1970s and the economic recessions much deeper.

Before I proceed further, it would be useful to clarify the term “Depression” used above. Most Economists confound Depression with Deflation. These are two different economic phenomenon – the former refers to the condition of GDP growth, and the latter refers to a monetary phenomenon. Depression denotes a prolonged period of rapid economic declines and a steep fall in the living standards of most people. It relates primarily to negative GDP growth by a substantial degree over at least a few years. On the other hand, deflation is a monetary phenomenon that refers to a condition of falling prices of consumer goods.

Depressions can be either deflationary or inflationary – in fact, more often than not, most depressions are inflationary. The 1930’s “The Great Depression” was deflationary, and the one we are living in the early stages of is going to be inflationary.

Does deflation lead to Depressions?

Most Economists think that deflation caused the 1930’s Great Depression, and this is a myth that the US Fed has entirely propagated. As Murray Rothbard explains in his book “America’s Great Depression,” Deflation (or falling prices) made the depression a lot more tolerable than would otherwise have been the case. The entire century before the formation of the US Fed (from 1815 to 1914), when the US was on the classical gold standard, was deflationary. This was the period in which the US economy transitioned from a primitive agrarian society to the world’s leading economic powerhouse with an estimated CAGR of more than 4% (with real growth being even higher due to falling prices) for a century.

If deflations result in a depression, the US ought to have been a basket-case with a century of deflation leading up to 1914. Ironically, with more than a century of inflation since then, courtesy, the US Fed, the US Economy is indeed a basket-case today, and the unraveling of the currency and the economy when it happens in the years ahead will be swift and decisive.

Now that a fundamental but important distinction has been made, we can expand on the theme of the Inflationary Depression ahead.

So how did we reach this precipice…?

Well, for the world to have reached such a precarious situation as I have painted above, the problems have to be deep-rooted, fundamental, and long-standing. That is the case, and as Mises said during 1951, the origins can predictably be traced to the Central Banks.

“There is nowadays a very reprehensible, even dangerous, semantic confusion that makes it extremely difficult for the non-expert to grasp the true state of affairs. Inflation, as this term was always used everywhere and especially in this country [the United States], means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check. But people today use the term “inflation” to refer to the phenomenon that is an inevitable consequence of inflation: the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages. There is no longer any word available to signify the phenomenon that has been, up to now, called inflation. It follows that nobody cares about inflation in the traditional sense of the term. As you cannot talk about something that has no name, you cannot fight it. Those who pretend to fight inflation are, in fact, only fighting what is the inevitable consequence of inflation, rising prices. Their ventures are doomed to failure because they do not attack the root of the evil.”

What Mises rued above is commonly referred to as “Inflation is too much money chasing too few goods.” Or, as Milton Friedman said, “Inflation is and everywhere a Monetary Phenomenon.” What Mises spoke of in 1951 today is ubiquitous. It would be almost impossible to spot a single economic commentator (other than the handful of Austrian Economists) who would distinguish the cause from the effects when talking about inflation. To add insult to injury, most mainstream economic commentators believe that consumer price inflation is caused by growth and that “some” inflation is indeed good/desirable / required for economic progress.

The above US Fed propaganda of the witchcraft Keynesian economics has indeed been extraordinarily successful – so much so that after a century, even they seem to believe in it themselves. The last US Fed Chairman who understood the distinction between propaganda and the truth was Alan Greenspan. His essay “Gold and Economic Freedom” remains one of the best expositions written to date on this topic. The subsequent ones have been thoroughbred Keynesians, who pretty much subscribe to the above ridiculous notion as gospel truth.

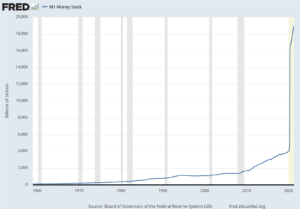

So under the garb of promoting economic growth, we have just allowed the central banks around the world to print money with impunity. This has long been the case since 1971 when the last vestiges to Gold and Currency were removed. After Richard Nixon closed the Gold Window “temporarily” in 1971, the Central Banks have had little reason to restraint themselves. But they have indeed gone berserk after 2008, and even more so in the last year or two. Each transgression makes the erstwhile felony look like a misdemeanor.

Where has all the inflation, since 2008 – Gone?

Going forward, we will use the phrase “monetary inflation” to denote the cause and “consumer price inflation” to denote the effects.

During the 1970s, the link between rising monetary inflation and increasing consumer prices was extremely well understood. The money supply growth figures that the US Fed used to publish weekly was one of the most keenly watched numbers. Any abnormal increase in the Fed Balance Sheet would invite a strong rebuke from the Bond Vigilantes who sent the stocks and the bonds lower.

It is astonishing to see how basic finance and economics have been reshaped diabolically in just a few decades. Very few commentators and even economists understand the correlation these days. Even more ironical is the belief that a negative GDP growth/unemployment report is seen as good for stocks and bonds as the Fed would then expand its balance sheet via QE to suppress yields. This thinking is almost as perverse as the “Tulipmania.” Though it has survived a lot longer than the average asset bubble, the days of such Voodoo Economics are numbered, and we are now in the early stages of the unraveling of the epic “Fed Bubble.”

Returning to the question posed above – Where has all this “monetary inflation” gone, especially since the trend of massive monetary inflation since 2008?

As readers can see, there has been a significant divergence between monetary inflation and consumer price inflation since the Great Recession of 2008. How do we explain this?

The CPI number reported is a process of self-appraisal by Central Banks, so they have a strong motive to underreport the actual numbers. There is no conspiracy theory in this, but the way CPI calculations have evolved since the 1970s using substitution, hedonic adjustments, owner’s equivalent rent, etc., ensures an in-built bias towards the under-reporting of numbers.

A number of economists calculate CPI using the same methodology as was done during the 1970s (John William of Shadow Statistics, for example). Those numbers show inflation in high single-digits / low double-digits, which would be consistent with the monetary inflation that we have observed.

But there is a far more important reason – Austrian Economists refer to as the Cantillon Effect. This essentially means that while the Money Supply growth will cause the price of different assets to go up in different proportions. Indeed it is even possible during times of even relatively high money supply growth for one category of assets to go up while the others go down, not only in relative terms but in nominal terms as well.

This Cantillon Effect implies that all monetary inflation has gone into financial assets – Stocks, Bonds, Real Estate, Bitcoin, Nasdaq 2.0, etc. – that do not show up in the CPI numbers. Any rational investor who understands the basics can observe a sea of hyper bubbles in these asset classes that artificially low-interest rates have propped.

The 10-year treasury that underlines the valuations of the above classes has been suppressed by the US Fed that there is no basis for rationally valuing these assets any longer. Courtesy, the US Fed, nominal interest rates are at a 5000-year low, and it is the inevitable increase in rates that will cause these bubbles to unwind.

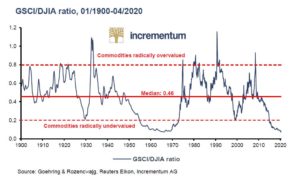

The only asset class that remains undervalued, almost by definition, is commodities. Commodities in a relative sense, have never been cheaper in 100 years than what it is today. So virtually all the money printed has ended up driving the prices of all other asset classes to valuation hitherto unheard of.

What Gives?

So what has accompanied the high M2 growth since 2008 is the price of stocks, bonds, and real estate? And what has gone down in relative terms are the commodities. This largely explains why the CPI has stayed muted over the last decade. So why can’t this situation continue for a few more years or another decade…?

In this epic battle between US Fed and Sound Money (gold and silver), we crossed the rubicon when the CRB indexed bottomed out in Apr 2020. Gold has always been a leading indicator and has been on an uptrend since early 2016. Since the Index bottomed more than a year ago, it is up more than 50%, albeit from historically very low levels.

Source: Stifel Report June 2020. Note: Shown as 10yr rolling compound growth rate with polynomial trend at tops and bottoms. Blue dotted line illustrates a forecast estimation. Source: Warren & Pearson Commodity Index (1795-1912), WPI Commodities (1913-1925), equal-weighted (1/3rd ea.) PPI Energy, PPI Farm Products and PPI Metals (Ferrous and Non-Ferrous) ex-precious metals (1926-1956), Refinitiv Equal Weight (CCI) Index (1956-1994), and Refinitiv Core Commodity CRB Index (1994 to present).

All commodities – lumber, steel, zinc, soybeans, corn, etc.-are up significantly over the last year. While this is attributed to the covid induced supply reductions, the cause for all inflation is the same every time – an excess supply of money. This increase in commodity prices is causing the CPI in the US to levels of 5%+. An interesting observation would be that Richard Nixon, who closed the gold window, introduced wage and price controls when CPI crossed 4%, never bothering to consider inflation’s possible “transitory nature.”

Forget the future monetary inflation, which I am sure will make the monetary expansions since 2019 look like another misdemeanor, but we have already created sufficient monetary inflation that guarantees a commodity uptrend for the next several years. This will ensure that the dream of the US Fed that these CPI increases are transitory remains just that – a dream. I would not in the least be surprised if CPI doubles from the current 5%+ to reach a double-digit number within a 12-18 month timeline.

Does the Fed believe that CPI is Transitory?

I don’t in the least believe that to be the case.

What should the appropriate actions of the US Fed be if CPI is 5%+ and showing an increasing trend on an m-o-m basis..? In the normal scenario, the interest rate should be such that real interest rates are positive, implying an interest rate of at least 5%. Where is the interest rate today?

ZERO. Or very close to that. After more than eight years at near zero, when the US Fed under Jerome Powell tried to reverse course and increased it to 2.5% over a three-year period (between 2016 and 2019), the junk bond pretty much froze and threatened to unravel the entire US financial system. Predictably, in very short order, Powell took it back to its original levels.

If the US Fed could not raise rates when the National debt was less than $20 Trillion, what chances are there for a similar action when the debt is expected to cross $30T in the next few months? The threat of a market collapse that happened at a 2.5% rate in 2019 will probably occur even at a 1 to 1.25% rate today. The leverage in the system is so much higher than the probability of having positive real interest rates in the US for the foreseeable future is ZERO. There can be no two ways about it.

So given that the US Fed cannot have interest rates at a level that will curtail the monetary inflation, what can they do? The only option for them is to pretend that the current Consumer Price Inflation (which is the result of decades of monetary inflation) is transitory. They need not embark on a course of action guaranteed to collapse the US stocks, bond, and real estate market.

The End Game

As said, we are at the early stages of an Inflationary Depression in the US and something that will run for a decade if not longer. Given this, the dual mandate of the US FED, i.e., maximum employment and price stability, cannot be pursued any longer. They will have to choose between controlling consumer price inflation with markedly higher interest rates and persisting with the illusion of a stable economy for a few more months with this artificially low-interest rate regime.

Decades of artificially low-interest rates have led to tremendous malinvestments in the US with excessive debt-fueled consumption and very little savings-led production. The only solution is to put interest rates at a high enough level to dramatically shrink the growth in the money supply and reduce the national debt. That, of course, will immediately plunge the US economy into a massive recession.

Readers should remember that Paul Volcker did not put the US interest rates at 20%+ in the early 1980s for amusement or because he wanted the US to suffer a recession. That was the only choice in front of him at the stage, i.e., saving the US Dollar or prolonging the malinvestments. The choice is, even more stark today. If the US Fed tries to prolong the bubble economy by maintaining these deeply negative real interest rates, it will destroy the US Dollar.

That, unfortunately, is the most likely course of action for the US Fed as well. Predicting the exact timing of the US Dollar crisis is fraught with danger. But given the imbalances, the size of the bubbles in the US Economy, and the relatively early stages of the Commodities bull market, I think we will witness the collapse before Biden completes his term. That unfortunately is the most likely course of action for the US Fed as well. Predicting the exact timing of the US Dollar crisis is fraught with danger. But given the imbalances, the size of the bubbles in the US Economy and the rather early stages of the Commodities bull market, I think we will witness the collapse before Biden completes his term.

Editor’s Note: It’s clear the Fed’s money printing is about to go into overdrive. The Fed has already pumped enormous distortions into the economy and inflated an “everything bubble.” The next round of money printing is likely to bring the situation to a breaking point.

We’re on the cusp of a global economic crisis that could eclipse anything we’ve seen before. That’s precisely why bestselling author and legendary speculator Doug Casey just released this urgent video. Click here to watch it now.