In the energy market, there’s always a revolution going on somewhere.

For most of human history, light and heat were provided by wood and candles. Then we discovered whale oil, and in the early 1800s lamps replaced candles.

Later in that century, kerosene, a petroleum derivative, became the lamp oil of choice, and the whaling industry (thankfully) collapsed. A few decades later, electricity from coal replaced kerosene.

Now the regime is changing again, as ever-cheaper solar power leads analysts to predict that it will “kill” coal and nuclear.

Wind and solar kill coal and nuclear on costs, says latest Lazard report

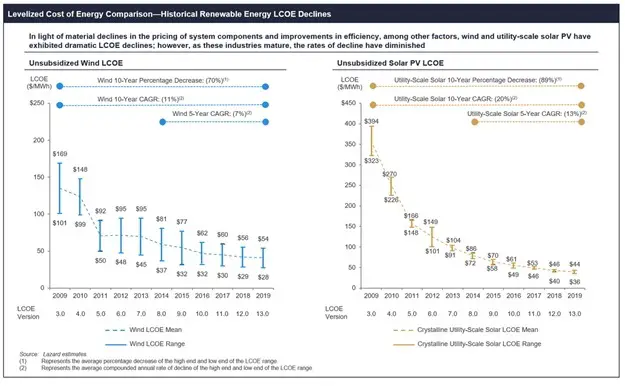

The cost of wind and solar continue to decline and are now at the point where they beat, or at least match, even the marginal costs of coal-fired generation and nuclear power, according to the 13th and latest edition of Lazard’s Levelized Cost of Energy Analysis, one of the most highly regarded assessments in the world.

The new Lazard report puts the unsubsidised levellised cost of energy (LCOE) of large scale wind and solar at a fraction of the cost of new coal or nuclear generators, even if the cost of decommissioning or the ongoing maintenance for nuclear is excluded.

Wind is priced at a global average of $US28-$US54/MWh ($A40-$A78/MWh), while solar is put at a range of $US32-$US42/MWh ($A46-$A60/MWh) depending on whether single axis tracking is used.

This compares to coal’s global range of $US66-$US152/MWh ($A96-$A220/MWh) and nuclear’s estimate of $US118-$US192/MWh ($A171-$A278/MWh).

Wind and solar have been beating coal and nuclear on costs for a few years now, but Lazard points out that both wind and solar are now matching both coal and nuclear on even the “marginal” cost of generation, which excludes, for instance, the huge capital cost of nuclear plants. For coal this “marginal” is put at $US33/MWh, and for nuclear $US29/MWh.

The cost of solar, Lazard notes, has fallen 89 per cent over the past decade, and is still falling at an average rate of 13 per cent a year. The more mature wind technology has fallen 70 per cent over the same period of time, and is still falling at around 7 per cent.

Solar’s take-down of traditional energy sources is interesting for at least three reasons:

First, it’s one of many current examples of capitalist creative destruction, the process by which an old industry is replaced by something better and/or cheaper. This is usually ultimately a positive thing but is emphatically not good for people on the wrong side of the technological divide.

Second, it’s a great example of what happens when exponential change hits a static industry. Coal and oil cost more or less the same amount from one decade to the next while solar falls by 10% per year. No static industry can survive against competition that grows continuously stronger. This also means that analysis based on a snapshot of current relationships will quickly become obsolete as one technology keeps improving while the other stands still.

Third, and most applicable for this gloom-and-doom website, solar killing fossil fuels impacts the “financial assets vs real assets” debate by making oil wells and coal plants – typically seen as “real” in the sense that the government can’t make more of them with a mouse click – less certain to preserve purchasing power during financial crises. It’s now possible that fossil fuel-related assets will lose value even faster than banks and auto makers in the next big downturn.

The energy assets likely to fit the definition of “real” in the future will be solar and wind farms, along with utility grade battery storage facilities. Sound money investors should adjust their portfolios accordingly.