by Alexander Trigaux, Editor, GoldSilver

It’s easy to show that the stock market is extremely overvalued right now. And we have, many times, many ways.

What is also true is that attempting to call the top of a wildly overvalued market is guesswork. Once any market has come completely unglued from its underlying fundamentals, you’re attempting to use logic to predict illogical behavior. It simply doesn’t work.

So instead of belaboring the obvious – that current stock market valuations are crazy – I’ll provide two basic points of reference that put into stark relief just how ridiculous things have gotten.

First, the number of Russell 3000 companies that are currently trading for 10x revenues or higher is the highest since the very peak of the dotcom bubble:

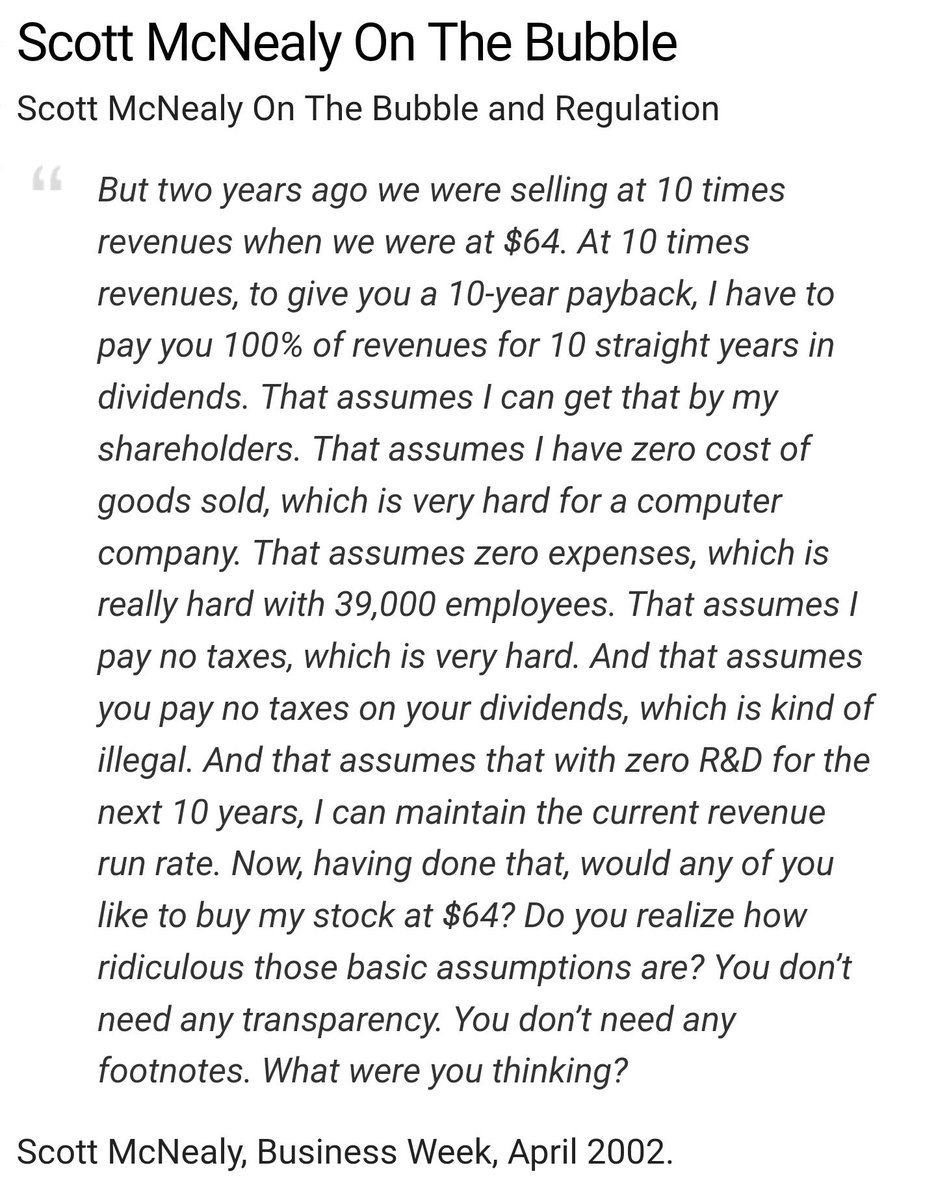

And sure, “10x revenues” sounds like a lofty valuation. But when you realize what that valuation actually means, it’s downright surreal. Take it from Scott McNealy, CEO of Sun Microsystems, whose company was valued at 10x revenues in 2000:

Of course, it wasn’t “thinking” that led to people buying the stock at $64. It was irrational exuberance. Greed run wild. Period.

So right now provides stock market investors with an incredible opportunity to ask themselves this very pointed question in the present tense…”What am I thinking?” And when they discover there’s no defensible rationale for sanity-based stock market investment at this point, they can get out, with a huge chunk of inflated, can’t-last, bubble-valuation profits.

And funds from this cash-out might wisely seek the opposite end of the greed/fear spectrum. To look to invest in markets not at an all-time high valuation (and this includes stocks, bonds, and real estate), but two that are, astonishingly, at 50-year inflation-adjusted undervalued lows:

That’s right. Gold and silver. To sell an all-time overvalued market and swap into an all-time undervalued market? Rarely does such a simple and drastic opportunity exist. But it exists right now.

It’s so difficult to have the discipline to sell into mania, to do something that feels bad today even though you know it’s the right long-term decision. It’s so much easier, emotionally, to just ignore all reason and logic and let yourself be carried along with the euphoric crowd.

History proves, time and time and time again, that greed-based decision making only ends one way. With one rhetorical question.

“What was I thinking?”