by allthenine

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_ibuy.htm

Why would I not max this out? I understand that I-bonds exist to simply keep up with inflation and if the S&P moons I have missed out, but this kind of no risk return is not something I have come across in my short time investing. The other side of the coin is the S&P could continue to struggle.

Someone explain to me why I shouldn’t throw my money at this.

8.37% comes from 7.12% from the first 6 months and the calculated 9.62% for the second 6.

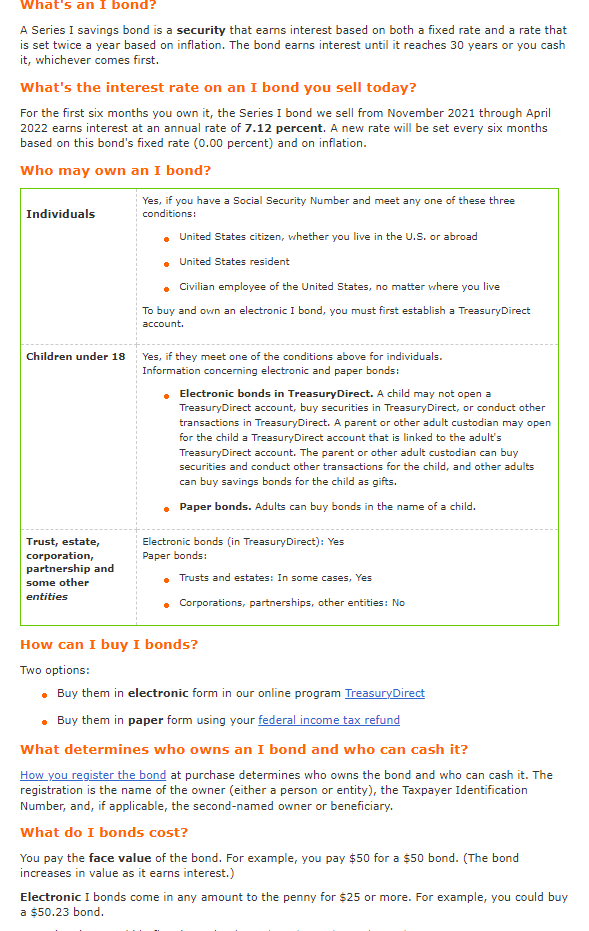

Up to $15,000 per person.

$10,000 through Treasury direct (digital bond) and $5,000 in paper bonds

I Bonds’s new variable rate will rise to 9.62% with the May reset

Since inflation might be peaking, this might be the highest variable rate for I bonds that we’ll see for a while! And probably best to lock in the current 7.12% in April while you can, so that it can have both high rates in the year long minimum holding period.

https://tipswatch.com/2022/04/12/i-bondss-new-variable-rate-will-rise-to-9-62-with-the-may-reset/