via 13D Research:

In an article on America’s declining birthrate (WILTW July 19, 2018), we cited an unnerving finding from a recent Federal Reserve Bank of St. Louis study: “the average net worth of a family headed by someone born in the 1980s — the bulk of millennials — remains 34% below what past trends would predict for their age group — the worst off, by far, of any generation.” It is not just a diagnosis of the present, but a warning for the future. As the study concludes, millennials born in the 1980s are at risk of becoming “a lost generation”, held back for a lifetime by unprecedented debt loads, wage stagnation, and the lingering scars of the Global Financial Crisis (GFC).

Sometime in the next year, millennials — those born between 1981 and 1996, as defined by the Pew Research Center — are projected to overtake baby boomers as the largest generation in America, comprising roughly 36% of the U.S. population. It is a generation that will define American culture and politics, and set the course of the economy for decades to come.

And if the media stereotype is accurate, they will squander that power on frivolity. Millennials have been cast as snowflakes — entitled, irresponsible, emotionally wounded and weak. To sum up the absurdity of the media’s clickbait millennial bashing, just consider a segment headline the Today Show ran last week: “Bachelor, bachelorette parties are why millennials can’t afford houses.”

The reality is far less vacuous, and far more troubling. By many metrics, no American generation since WWII has had a more distressed start to their professional years than millennials. The implications for the U.S. could be dire, from the dramatic escalation of already-severe inequality to perpetually-low growth and a popular revolt against the fundamentals of American capitalism (a tide already rising, as we’ve explored time and again in WILTW).

Millennials will fight this fate. They are the most educated generation in American history. They work hard. And they remain optimistic — still expressing the same faith in the American Dream as the generations that came before. However, to salvage the millennial future, it is essential to see past stereotype and understand the reality of the millennial present.

The essential equation underlying the millennial struggle is as much about systemic inequities as bad timing. They graduated college carrying unprecedented debt burdens due to the skyrocketing cost of college. In 1975, college tuition for public, four-year colleges (in 2017 dollars) was $2,450. In 2017, that number reached $10,000, according to CollegeBoard. Student loans now make up roughly 74% of total debt owed by 25- to 34-year-olds, up more than sevenfold since 1989 when that number was just 10%.

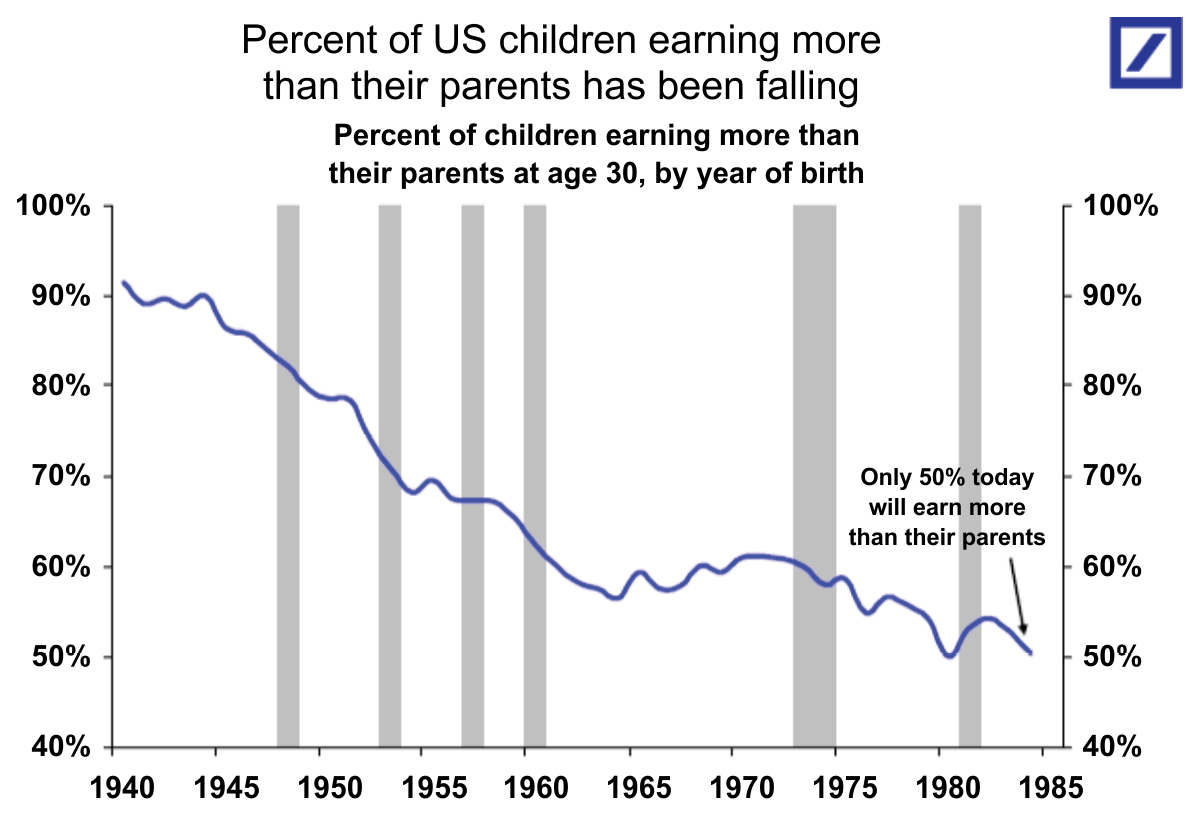

That added debt burden may have been manageable if more education had equalled higher wages. In 1977, only 24% of Americans ages 25 to 34 had attended college. In 2016, that number was 37%. Yet, over that same period, inflation-adjusted median income remained roughly stagnant at $34,000 for that same age group. Last week, Deutsche Bank’s Torsten Slok sent around a chart showing the staggering long-term decline in earning power for 30-year-old Americans:

The GFC no doubt exacerbated the systemic challenges millennials already faced. It is impossible to quantify the cumulative effect, but as Michael S. Derby wrote for The Wall Street Journal after reviewing the St. Louis Fed’s findings about millennials:

“Most people start out with little wealth, build it through their working life, achieve a peak around retirement age, and then burn that wealth off as they continue to age. The late 2000s recession threw up an obstacle in that dynamic for younger workers. People of the 1980s generation started their working lives in a time of troubled investment markets, high unemployment and persistently-weak wage gains.”

Compounding the problem, the toll of the GFC and student debt — not to mention the additional debt accrued in order to cover basic needs — deprived millennials of participation in the recovery since 2009. Homeownership rates have plummeted amongst the young — at roughly 39%, home ownership for millennials aged 25 to 34 is 8% lower than baby boomers at the same age, and 8.4% lower than Generation X, according to the Urban Institute. Moreover, three in five millennials lack stock market exposure. As the St. Louis Fed wrote in their May report:

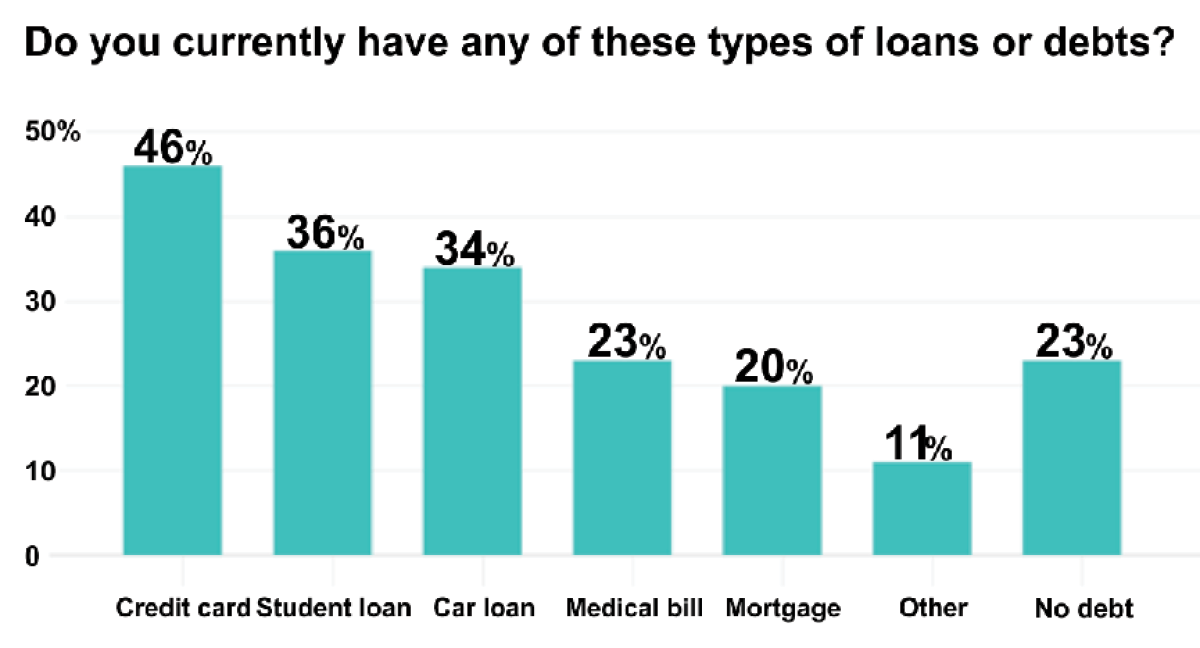

“The predominant type of debt [1980s families] owe is non-mortgage debt, including student loans, auto loans, and credit card debt. Because none of these types of debt finance assets that have appreciated rapidly during the last few years — such as stocks and real estate — they have received no leveraged wealth boost like that enjoyed by older cohorts.”

The cost of these setbacks on millennials becomes more apparent and grave as time passes. According to a NBC News/GenForward survey released in April, 39% of millennials without kids and 48% with kids say they would have “a lot of trouble” covering an unexpected expense of $1,000. Roughly three out of four millennials have some form of debt (see chart below). An overwhelming majority of millenials — 62% — now hold more debt than money saved. This debt has crippled their credit. According to 2016 data from TransUnion, 43% of millennials have poor credit, which compares to 20% for boomers and 9% for the silent generation.

The consequences of millennial financial struggles could prove crippling for the U.S. economy. It will wreak havoc on the nation’s dependency ratio: millennials are living with their parents longer, delaying marriage and parenthood, thus plummeting the nation’s birthrate to a record low of 1.77 lifetime births per woman, well below the developed world “replacement rate” of 2.1. Meanwhile, a lower home ownership rate has meant higher rental costs for millennials, threatening their ability to ever save for a downpayment. According to the Urban Institute, “almost half of 18- to 34-year-olds spend more than 30% of their income on rent.”

In addition, few have had the ability to save for the future — roughly two-thirds of millennials have nothing saved for retirement. Finally, the debt trauma of their early professional years may create a long-term aversion to debt, thus suppressing consumer spending. From real estate values and consumption spending to the nation’s overall growth rate and ability to support future social costs, the struggle of millennials is a short- and long-term threat to the vitality and sustainability of the American economy.

There is reason for hope, however. Millennials have been forced to work as hard as any generation — according to a recent Bankrate survey, more than 50% of millennials currently report having more than one job. They also save when able: since 2016, millennials have shaved 8% off their average debt. Plus, as their incomes are increasing with age, they are beginning to invest in housing: according to the National Association of Realtors, people age 37 and younger made up the largest share of homebuyers in 2017 at 36%.

Lastly, as maligned as millennials have been for being fragile, the travails of their early careers may solidify an invaluable culture of fortitude. For one early indicator, despite their struggles, they remain hopeful about the future: according to a recent Bank of the West study,60% of millennial respondents said the American Dream was still achievable, roughly the same rate as Gen X and baby boomers.

This article was originally published in “What I Learned This Week” on August 2, 2018. To subscribe to our weekly newsletter, visit 13D.com or find us on Twitter @WhatILearnedTW.