by Martin Armstrong

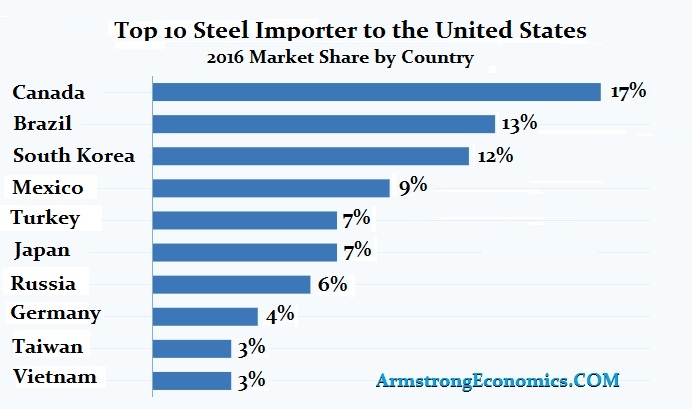

Canada is the largest exporter of steel to the United States. The decline in the Canadian dollar has helped this trend in particular. Trump is clueless when it comes to the impact of currency on foreign trade. If he wants to do tariffs, they MUST be indexed to the currency. Failure to do that will cause serious consequences as the dollar rises on the world financial markets in the years ahead. He will create a trade war globally and politicians on both sides remain ignorant of foreign exchange and its impact upon trade numbers.

I have stated many times that the entire system of trade is in a state of confusion. Following Bretton Woods, currencies were fixed to the dollar which in turn was fixed to $35 per troy ounce of gold. Therefore, the accounting system ONLY measured the amount of currencies moving back and forth. It was assumed that you imported more goods if the amount of outflow of dollars increased. Consequently, the way we measure trade today has NOTHING to do with the actual amount of product moving internationally. If you spent more dollars but the dollar declines in value by 20%, then even an increase in imports measured in dollars by 20% was not an indication that you purchased more goods – it was simply net currency movement.

I have stated many times that the entire system of trade is in a state of confusion. Following Bretton Woods, currencies were fixed to the dollar which in turn was fixed to $35 per troy ounce of gold. Therefore, the accounting system ONLY measured the amount of currencies moving back and forth. It was assumed that you imported more goods if the amount of outflow of dollars increased. Consequently, the way we measure trade today has NOTHING to do with the actual amount of product moving internationally. If you spent more dollars but the dollar declines in value by 20%, then even an increase in imports measured in dollars by 20% was not an indication that you purchased more goods – it was simply net currency movement.

Clearly the Trudeau government should have seen this coming as one of the signers of the NAFTA and should have developed markets abroad for their resource products rather than relying on exports to the U.S. for Canada’s GNP. It is imperative now that Canada expand its trade window to the far east including Eurasia the states and drop sections against Russia. If the U.S wants to play hard lets take our game somewhere else.