www.sifma.org/resources/research/us-abs-issuance-and-outstanding/

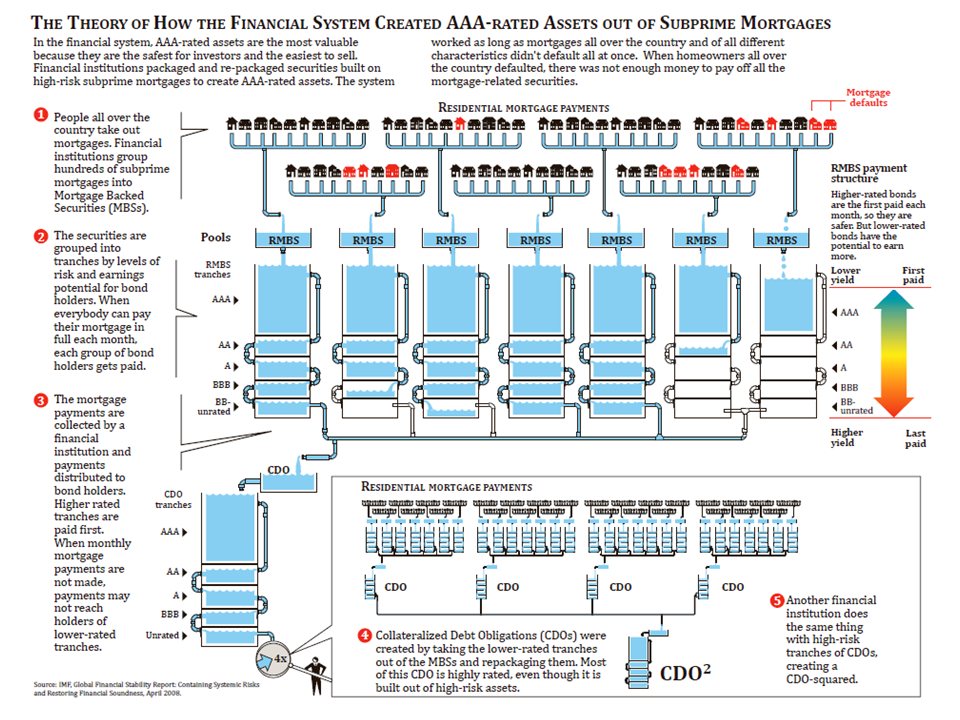

If you can understand this diagram, you will understand CDO impacts on markets. This one has housing as the anchor. The next one will be debt in general: en.wikipedia.org/wiki/Financial_crisis_of_2007%E2%80%932008#/media/File:CDO_-_FCIC_and_IMF_Diagram.png

CDOS are very complex. If you are interested in the minutia (Like I’ve been for 10 years), you need to do some homework. All you need to know is that bets on CDOs were a huge factor in the last financial crisis.

That combined with the fact the inflation yield curve inverted today means that this bull market will be over sometime 2020 (projection). Hedge against a recession if you are invested in the market now.

h/t Rudoprophet