BY JOHN RUBINO

It is generally, if grudgingly, accepted that the “paper gold” markets – that is, the people trading futures contracts and options – are able to dictate the metal’s price and have used this power to suppress and delay gold’s inevitable trip to the moon.

It’s also generally believed (at least by gold bugs) that demand for physical gold will someday overwhelm these paper games, sending the metal to its intrinsic value somewhere north of $10,000/oz.

The timing of this shift in market dynamics is impossible to predict, of course, but when it comes its early stage will look a lot like what’s happening right now.

This month’s sudden jump from $1,200 to $1,400 was at least in part driven by trend following speculators adding to their long bets. Since those speculators are almost always wrong at big turning points, the result is a very bearish signal for the next few months.

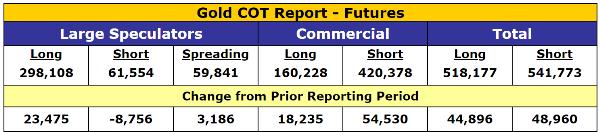

The following chart shows yet another week of increases in speculator net longs and commercial net shorts, with speculator long positions now a historically extreme five times their shorts.

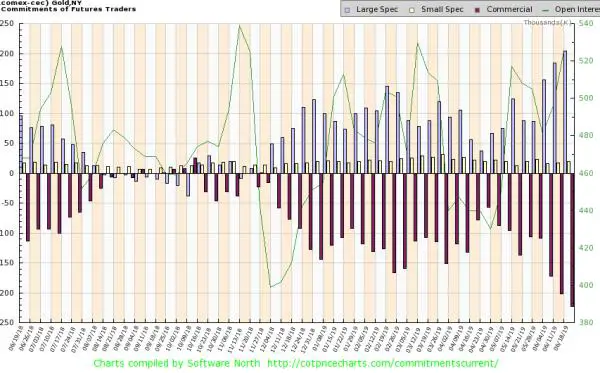

The next chart shows the same data graphically, illustrating how unusual this setup is compared to the previous couple. Anyone who’s been watching futures drive the price action over the past decade has to be a little worried right now.

And yet … the fundamentals are screaming “buy gold!”, making it at least possible that global demand for physical precious metals is finally strong enough to steamroll the futures markets, setting off the long-awaited generational bull run.

Among those fundamentals are a new round of central bank easing…

Is the Federal Reserve about to cave to Trump’s demand to cut interest rates?

(LA Times) – President Trump has been hectoring the Federal Reserve to lower interest rates, and financial markets are screaming for a cut. This even though rates are historically low and the economy is sailing along, albeit with some recent gray clouds.

What’s a central bank to do?

Fed policymakers stood pat on rates after their two-day meeting last Wednesday. But it looks as if they already may have backed themselves into a corner.

In recent weeks the Fed and its chairman, Jerome Powell, have signaled they’re prepared to lower rates if the outlook worsens. Just three months ago, they were favoring a rate hike or no action.

… continued strong buying by Russia and China…

Russia Bought Another 200K Ounces Of Gold Right Before The Rally

(Kitco) – Russia continues to add gold to its reserves, buying another 200,000 ounces or 6 tonnes of gold in May, according to the country’s central bank.

The latest purchase was made right before the latest gold rally shook the markets and the yellow metal surged to six-year highs and breaching the $1,400 an ounce level last week.

Moscow has been actively buying up gold this year, adding more than 77 tonnes since the beginning of 2019, with around 40% of that bought in February.

In April, Russia purchased 550,000 ounces, preceded by 600,000 ounces in March, one million ounces in February, and 200,000 ounces in January.

During the last decade, Russia’s gold reserves have gone from 2% of total reserves to 19% as of the end of 2018 Q4, according to the World Gold Council’s data.

… and surging silver imports by India…

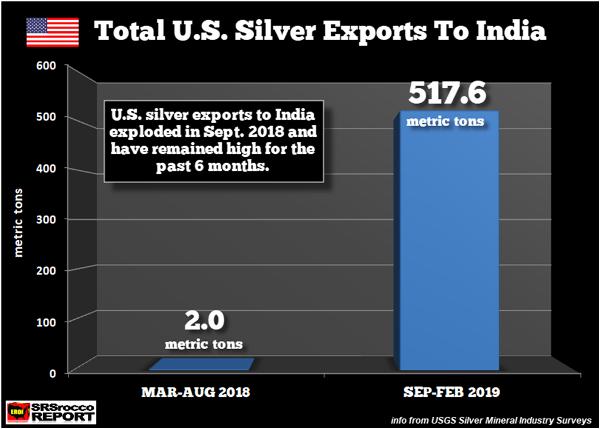

U.S. Silver Exports To India Explode Past Six Months

(SRS Rocco) – While silver investment demand in the West continues to remain weak, Indians are purchasing the white shiny metal hand over fist. In just the past six months, U.S. silver exports to India have exploded to record highs. Yes, there is no better way of putting it if we compare how little silver India imported from the United States during the previous six month period.

Furthermore, according to the Metals Focus Consultancy, they forecast even stronger Indian silver demand in 2019 due to rural Indians spending their “Cash Handouts” from the government to assist local economies ahead of the President’s election. How interesting. When Americans receive a government check in the mail, they use it to buy more throw-away crap they don’t need. However, many Indians use it to purchase silver as an investment.

Regardless, the chart below shows just how much silver the U.S. has exported to India over the past six months;

Add in unsettled geopolitics, including trade war with China, possible shooting war with Iran, and the very real prospect of a far-left government taking power in the US next year, and you get a world of massive deficits, rising taxes, zero-to-negative interest rates and volatile oil markets. This is horrible for most people, but great for gold.

Another way of viewing the above is as a generational shift from the old practice of governments, banks and hedge funds manipulating precious metals for their own benefit, and towards buyers seeking safe haven assets that they won’t sell for years or decades. The latter’s appetite is growing while supply is not. The inevitable result will be a rising price.

Markets, unfortunately, never give straight answers to questions like “is this the long-awaited regime change or just another head fake?” So betting big on either scenario is speculation rather than investing. The best strategy remains dollar cost averaging into precious metals and out of bonds and other financial assets while watching the world unravel from the safest possible distance.