Authored by Ted Dabrowski and John Klingner via Wirepoints.org,

Chicago Mayor Lori Lightfoot has presented her plan to cover an $838 million budget shortfall for fiscal year 2020. Like her predecessors, she’s chosen to focus on plugging a one-year budget deficit largely with a one-off deal and a number of tax hikes. And also like her predecessors, she’s failed to attack the real sources of Chicago’s slide toward insolvency.

To close the city’s deficit, Lightfoot expects $200 million to come from up-fronting 20 years of savings from a bond refinancing deal that will partially securitize $1.3 billion of debt. The savings will be a one-time event – even though the mayor originally promised not to use one-time sources – leaving a $200 million hole in budgets after 2020.

The mayor proposes to save another $337 million through various efficiencies, including the implementation of zero-based budgeting, department mergers, better debt and tax collection, and various other financial improvements.

Lightfoot wants the remaining $350 million deficit to be paid through new taxes. Her plan calls for higher taxes on ridesharing and restaurant food and drink, all which will put even more pressure on consumers. She’s also called for other revenues, including a progressive real estate transfer tax and a Chicago casino, that need the authorization of Springfield. If the mayor doesn’t get those items, she’s threatened to close the remaining deficit with a property tax hike.

Those property tax increases would follow Emanuels’ tax hikes of $860 million, which included a record-breaking $543 million property tax hike and numerous increases on garbage collection, ride sharing, online entertainment, e-cigarettes, utilities, permits and more.

What’s missing

Missing from the mayor’s speech was a call for a pension amendment and collective bargaining reforms – the reforms needed to help her cut the city’s massive pension debts and to bring tax relief to city residents. Instead, her only request of Springfield was permission to hike taxes even more.

Without structural changes, Lightfoot will face budget challenges year after year and the city will deteriorate more rapidly. Additional pension costs alone – Chicago will need another $600 million annually by 2023 – will force her to hike taxes by hundreds of millions more over the next few years. And if a recession hits during her term, the city’s financial crisis will deepen.

Even if Lightfoot succeeds in implementing her plan, the budget won’t be balanced. Official numbers consistently fail to properly account for the city’s true costs, including those of pensions. That’s why the city runs up massive debts every year despite City Hall’s claims of “balanced” budgets. Fitch Ratings agrees. The firm “will not consider the city’s budget to be structurally balanced until recurring revenues match recurring expenses (including actuarial funding of pension contributions).”

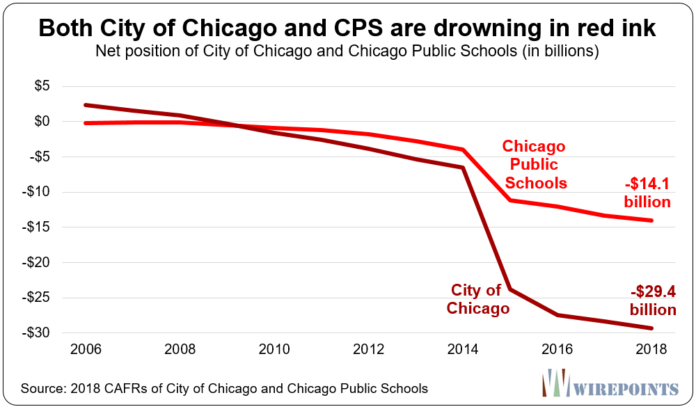

That failure to structurally balance the city’s finances is why the city’s net position has worsened by billions. Chicago’s net position now stands nearly $30 billion in the red, while the CPS sits at negative $14 billion.

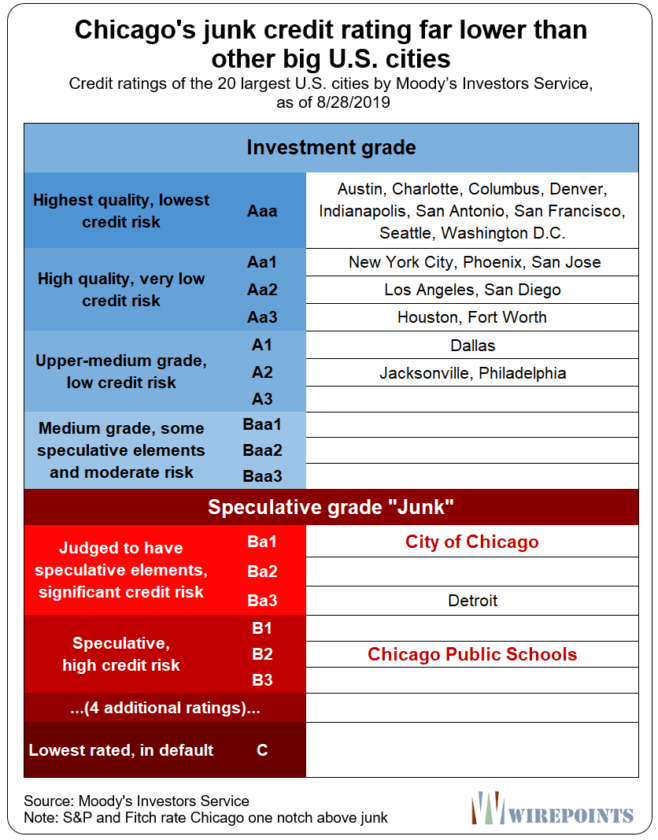

The reality is this: Chicago is trapped in a vicious spiral. The city and school district are already junk rated by Moody’s [2].

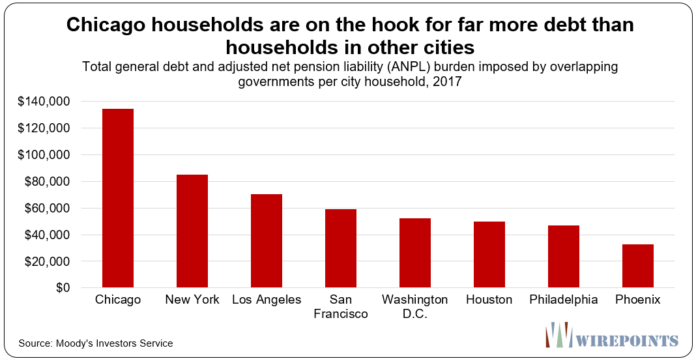

Chicagoans are on the hook for more public sector debts than any other major city in the country.

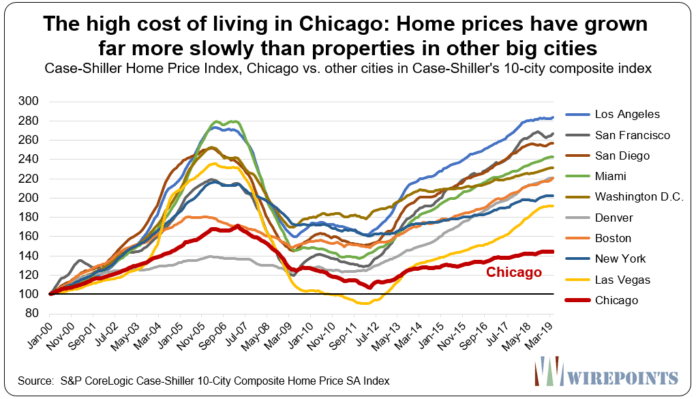

Taxes already rose by record amounts under Mayor Rahm Emanuel. And real home values are falling, bucking the upward trend in the biggest cities across the country.

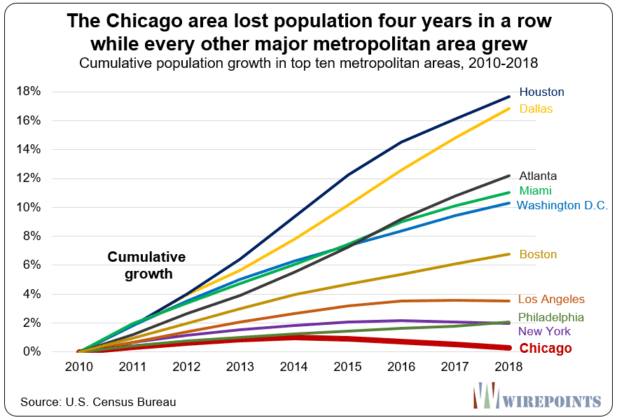

All those problems are contributing to Chicagoans’ flight. And as the city’s population shrinks, the burden will only get bigger on those who remain.

The mayor’s budget plan doesn’t change the negative trajectory of the city. In fact, it keeps in place every structural problem that’s brought the city to this point. Expect things to only get worse.

A historical burden to address

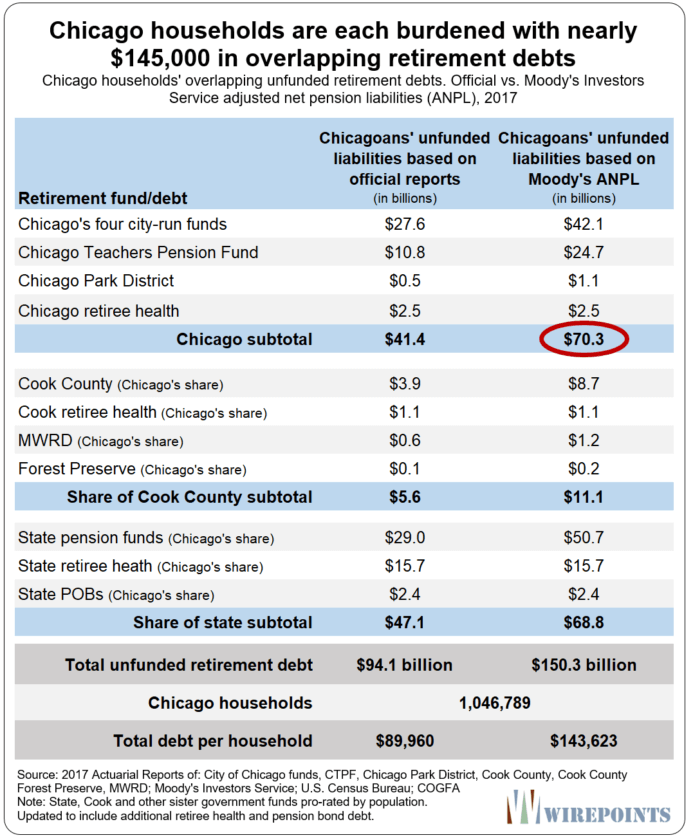

Lightfoot is focused on closing the $838 million gap, but the real problem she should focus on is the massive overlapping retirement debts Chicago households are on the hook for.

Chicagoans face some $90 billion in official overlapping city, county and state retirement debts. But under Moody’s more realistic pension assumptions, those overlapping debts total nearly $150 billion.

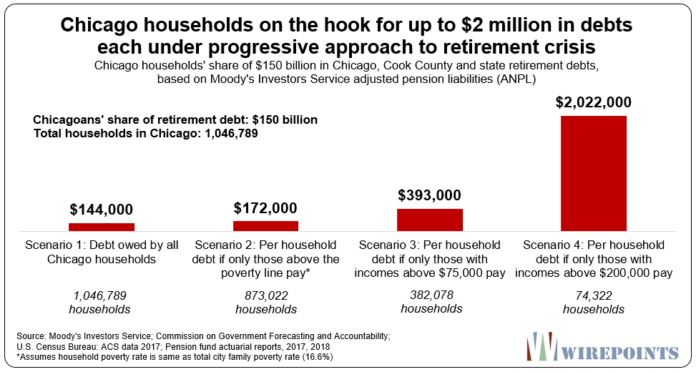

Spread that debt over the Chicago households with the means to pay – say those making more than $75,000 a year – and it’s nearly $400,000 per household, a hidden mortgage that will eventually chase many families out of Chicago.

Unfortunately, Lightfoot has already moved in the wrong direction. She’s made the household burden worse by offering Chicago teachers what she calls “the most lucrative CTU package in its history.”

If Lightfoot really wants to be historical and address the problems that her predecessors have ignored for decades, she’ll need to change her approach. She needs a workout plan – a restructuring of sorts – that reduces overlapping pension debts, aligns the city’s public sector infrastructure with what its residents can afford and reforms collective bargaining laws to give taxpayers a stronger voice.

She’ll need to be the champion of those reforms in Springfield. All of them are needed to make Chicago – and cities across the state – competitive again in tax burdens, public services and economic confidence.