by Frank Holmes, CEO, U.S. Global Investors

For the past decade, citizens of Latin American countries have grown bolder in protesting their governments’ failed socialist policies. We’ve seen unrest in, among other states, Venezuela, Chile and Colombia, but until recently, we hadn’t heard a peep from Cuba, which has been under communist rule since Fidel Castro’s revolution in 1959.

It’s hard to exaggerate the significance of Cubans taking to the streets to air their grievances against the government. Protests of this scale are unprecedented in the Caribbean island-state’s history.

But living conditions are deteriorating fast, due to President Miguel Díaz-Canel’s mishandling of the economy during the pandemic. Echoing dismal scenes from past failed socialist-communist regimes, Cubans must stand in line for hours to buy food. Power outages can last for hours at a time.

As many others have pointed out, the protests offer hope that change may be right around the corner for Cuba. Its young people—for whom the Castro revolution is fading in relevance—are well educated, active on social media and not shy about taking risks, even in the face of police violence and persecution.

What have they got to lose anyway that socialism hasn’t already stolen from them and their families?

Venezuela to Redenominate Its Currency… Again

Indeed, if you want to see a once-prosperous country’s economy destroy itself, there are few more effective ways than to install a hardline socialist government. Before the revolution, Cuba’s economy was larger than Singapore’s. But whereas the former’s decayed, the latter’s thrived under the free market policies of Lee Kuan Yew, who came into power the same year as Castro. Today, Singapore has one of the world’s highest GDPs per capita and ranks number one on the Heritage Foundation’s Index of Economic Freedom.

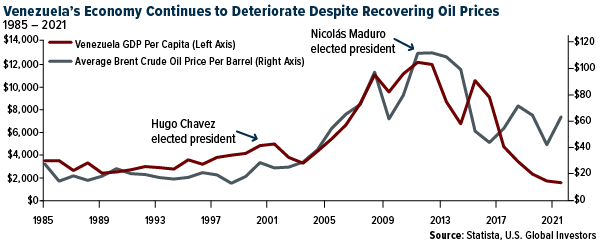

And then there’s Venezuela, once the wealthiest country in South America thanks to its fossil fuel reserves, the largest in the world. High oil prices may have helped keep Venezuela’s coffers well stocked during Hugo Chavez’s administration, but conditions tanked dramatically in 2014 when the bottom fell out of the oil market. Even when prices began to recover, the economy continued its downward spiral, fueled by unchecked government spending and rampant money-printing. GDP per capita is lower today than it was in 1985.

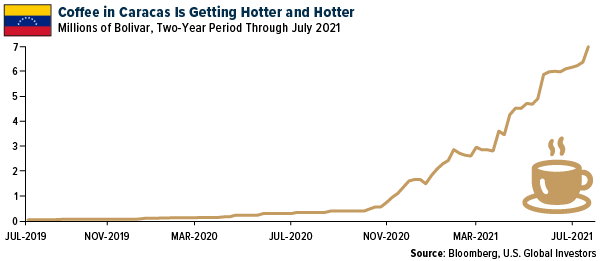

I’ve written extensively about hyperinflation in Venezuela, which continues to pummel people’s pocketbooks and savings. You think cash is trash? The Venezuelan bolivar is effectively worthless, a point well illustrated at this year’s Bitcoin 2021 conference in Miami when someone hauled in a dumpster full of 50-bolivar notes, which went ignored by attendees and passersby. According to Bloomberg’s Venezuela Café con Leche Index, a cup of hot coffee in the capital of Caracas now costs a little under 7 million bolivars, a 2,289% increase from just a year ago.

Besides destroying the value of the local currency, inflation has made making simple purchases absurdly complex. Calculator screens often cannot display entire figures, and credit cards must be swiped multiple times to complete a transaction.

That’s why, to simplify things, Venezuela announced it will be lopping off as many as six zeros from the bolivar’s value. So instead of one American dollar converting to 3,219,000 bolivars at present, it will convert to 3.2 bolivars.

This isn’t the first time the country has had to redenominate its currency. In 2018, Venezuela began printing a 1 million-bolivar note, the largest in country history, which isn’t even enough to buy you a single cup of coffee in 2021.

Gold and Bitcoin Could Be the Solution

Both Cuba and Venezuela are cautionary tales of hardline socialism, an ideology that, at its core, has no respect for civil liberties or private property. Citizens of these countries are tragically denied ownership over their own livelihoods, largely as a result of being locked into using disastrously mismanaged currencies.

Gold and Bitcoin could be the solution. These assets transfer ownership directly from governments and central banks to individual holders. When you buy a gold coin or a Bitcoin, you are granted access to real money that transcends borders, jurisdictions and regimes. This is what’s known as self-custody.

Historically, gold has literally saved people’s lives. Consider the Vietnamese “boat people” in the 1970s and 80s, who were forced to flee the country after the communists took control. Had it not been for gold, which became the de facto currency with the collapse of South Vietnam, many families wouldn’t have been able to make their escape past the Vietcong, Cambodian soldiers and even Thai pirates.

Today, Bitcoin is likewise extending a lifeline to desperate people in desperate circumstances.

Many allies of the Cuban protestors have been able to show their support by sending them Bitcoin. As I’ve pointed out before, Bitcoin adoption in Venezuela has been remarkably fast. Because there’s no third-party risk, the crypto “has become a tool to send remittances, protect wages from inflation and help businesses manage cash flow in a quickly depreciating currency,” according to reporting by Reuters.

Gold Continues to Look Undervalued

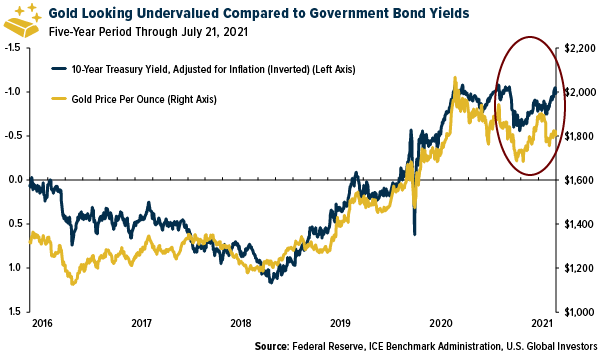

As for gold, it traded down last week, marking the first loss in five weeks, but support held at around $1,800 an ounce. I see this as an attractive entry point as the metal looks undervalued compared not only to equities but bonds as well. Ordinarily gold has traded inversely to bond yields, but as you can see below, it’s been underperforming. I’ve inverted the Treasury yield line so you can see the relationship more clearly.

On a final note, I’ll be participating in a webcast on gold and Bitcoin, and I will be joined by none other than Bitcoin evangelist Michael Saylor, founder and CEO of MicroStrategy. To get the link to book your spot for this exclusive conservation, email me at info@usfunds.com with subject line “Michael Saylor webcast.” Demand has been higher than even I anticipated, so don’t hesitate to register!