by Jeff Clark, Senior Analyst, GoldSilver

Dear Main Street and Wall Street Investor,

I’m a pretty nice guy. But you may not think so if what I outline below comes to pass.

You see, over the next few years, I’m going to steal cash right out of your brokerage account.

It’ll go from your portfolio to mine.

It’s not trickery.

It’s not even actual “stealing,” of course.

That’s because, well, you’re going to give it to me. Willingly. Many of you will even be excited to do so.

Here’s how…

Gold and Stocks: Teammates, Not Competitors

Since it’s baseball season, here’s a good analogy of why gold and stocks should be on the same “team” in your portfolio. Pitchers are among the worst hitters in baseball. The best batters are usually not very good at pitching. But together, each doing what they do best, they make a well-rounded team.

It’s the same with gold and stocks. You may not be aware, but they are, for the most part, inversely correlated. That means when one is going up, the other is usually going down. Stocks tend to rise in periods of economic growth while gold tends to rise in recessions.

In fact, the gold price has risen in most stock market crashes. We’ve even shown that gold would’ve hedged Warren Buffet’s stock every time it crashed.

So let’s assume this axiom remains true going forward, and history will repeat itself…

And that human nature isn’t going to change…

That means, gold is once again very likely to rise in the next bear market in stocks.

And that when ordinary investors finally decide to dump their stocks and buy gold, they’ll be handing me money hand over fist.

Let me explain…

Value Proposition: Gold vs. S&P 500

One of the most common ways to value gold — despite it producing no earnings or cash flow — is to compare it to the S&P 500 stock index. It can tell you if gold is expensive relative to stocks, cheap, or fairly valued.

This updated chart shows that the gold price, relative to the S&P 500, is near all-time lows.

At 0.48, gold is deeply undervalued compared to the S&P 500.

But look at the highs the ratio has hit over the past 40 years. It reached 1.53 in August 2011. It rose to 2.01 in December 1987. And it soared to 5.89 in January 1980.

Consider what those figures mean: in every case, the gold price was higher than the S&P 500. And importantly, those figures are three to 12 times higher than the ratio right now.

Again, if history repeats and this ratio returns to any of those levels in the next bear market for stocks/bull market for gold, that means stocks will be worth a whole lot less and gold a whole lot more.

And since most investors don’t jump into big bull markets until the end, many of you will sell your stocks for a loss and buy gold — right when I am about to sell my gold for a huge profit and buy stocks at a major discount.

To show you exactly what this could look like, let’s imagine that the gold/S&P 500 ratio returned to those levels…

Chills for Stock Owners, Thrills for Gold Owners

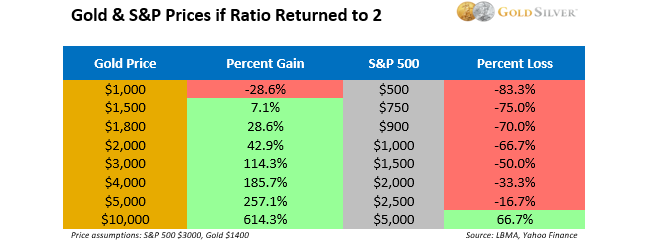

The following tables show what would happen to the price of the S&P 500, at various gold prices, if the three ratios above were matched from current levels.

To keep it simple, the tables are calculated from 3,000 for the S&P and $1,400 for gold.

First, here’s what the gains would be in gold vs. the losses in the S&P, if the ratio returned to its 2011 high of 1.5.

In most scenarios where gold logs a gain, the S&P 500 would experience significant losses.

Imagine gold more than doubling to $3,000 while the S&P 500 loses a third of its value. That’s entirely possible. And, to the point of this article, it would probably push a lot of investors to sell stocks and buy some gold.

Even if gold fell to $1,000, the S&P at this ratio would lose almost three times as much. Only if gold rose to $5,000 or higher would stock owners show a gain at this ratio reading. Even so, the difference between the two assets couldn’t be more stark. Clearly you win with gold and lose with stocks.

While this scenario is pretty sobering, it only gets worse for stock investors. Here’s what gold and S&P prices would look like if the ratio matched its 1987 high of two.

In all scenarios but one, S&P holders would see their stock portfolios fall substantially. While watching the gold price climb.

At this ratio, if gold hit $3,000, the S&P would fall by 50%. An entirely possible scenario, since this ratio has occurred before.

At a $10,000 gold price, S&P investors would see a 66.7% gain, but it would pale in comparison to the 614.3% gain in gold.

If this scenario played out, how many investors wouldn’t sell at least some of their stock holdings and shift to gold? History shows that the average investor crowds in near the end.

And here’s the biggie, a rematch of early 1980s ratio of 5.9.

This is a pretty ugly table for any diehard stock investor. And as with the other ones, an exciting scenario for those who own gold, or at least those who buy it now.

Remember, these are not pretend prices, model projections, or wishful thinking on the part of gold investors. All these ratios have occurred before.

And given where the ratio currently sits, the odds of it moving significantly higher are indeed very high.

- When the gold/S&P 500 ratio climbs, it will be almost all good for gold investors, and almost all bad for stock investors.

So stock investors, the question you have to ask yourself is actually a famous movie line: do you feel lucky? If you stay in stocks and have no exposure to gold, I hope you’re not one of those that end up selling your losing stock positions near their bottom and buying gold near its top, indirectly helping me become richer.

Or instead, given that stocks don’t stay in bull markets forever, and that gold is deeply undervalued relative to stocks and is highly likely to rise when they reverse, might it be wise to allocate a portion of your portfolio to gold now?

Just don’t wait too long, as the price appears to have broken out of a long-term trading range.

I encourage you to buy some gold now. At the current ratio, your risk is very low.

And if you don’t buy gold now?

Well, unfortunately some of the cash in your brokerage account will leave it and enter mine. It will be, as the French say, fatalité.